As these factors play out, the oil production landscape can dramatically change. Countries can secure energy independence and global influence by rising up the rankings – or they can fall off the map completely, becoming a footnote on the global stage.

Animation: The Changing Oil Landscape

Today’s animation shows you how the oil landscape has changed, in terms of production by country, in less than a minute of time. Data here comes from the BP Statistical Review of World Energy, 2018, which chronicles oil production by country all the way from 1965-2017.

The animation starts in 1965 during the height of the Cold War – a time when it was becoming incredibly evident that the ability to produce oil self-sufficiently would be a crucial advantage for any type of global superpower. During this stretch of time, the United States was the undeniable leader in oil production, producing an average of 9.0 million barrels per day. Put another way, U.S. oil production nearly double that of the entire USSR, or four times as much as the largest Arab producer (Kuwait), making this period a heyday of U.S. energy dominance.

Modern Production Figures

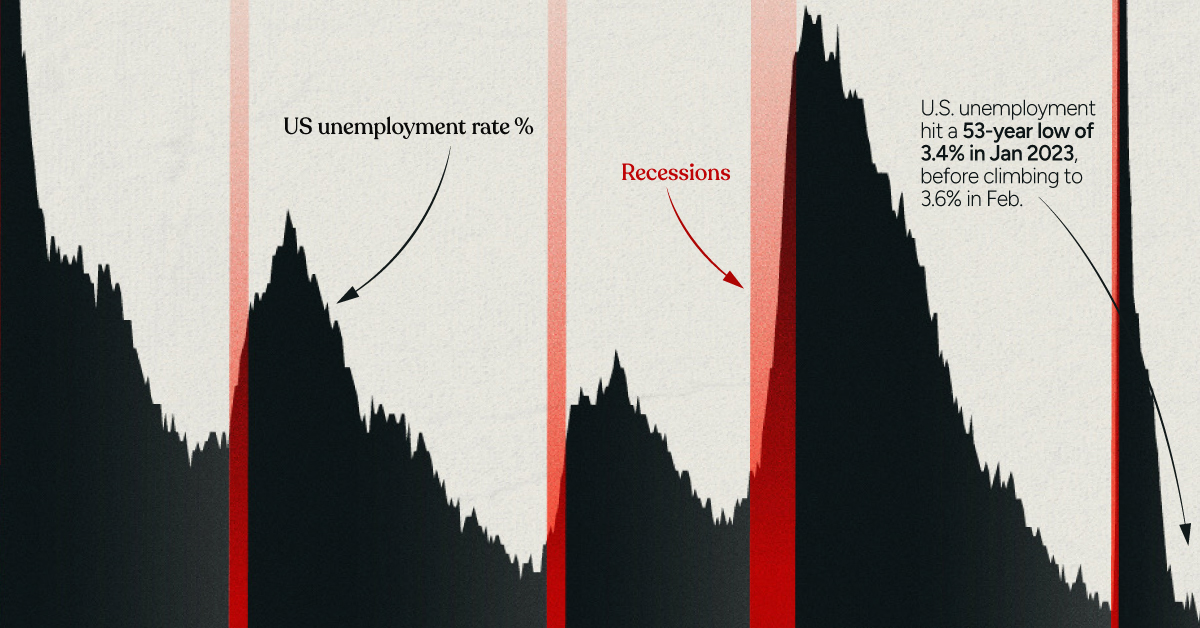

According to the BP Statistical Review of World Energy 2018, here is how oil production has shaped up based on more recent data. As you can see, there are essentially three superpowers that produce over 10 million barrels of oil per day: United States (13.1 million), Saudi Arabia (12.0 million), and Russia (11.3 million). Together, these three countries combine for 39.1% of global oil production, and about 24.9% of the world’s proven oil reserves. After this group, there is a significant dropoff: Iran (5.0 million bpd), Canada (4.8 million bpd) and Iraq (4.5 million bpd) each have a 5% share of global production, while the U.A.E. and China are next on the list. In total, the top 10 producers of crude oil combine for roughly 70% of the global total – meaning the world’s other 183 countries added together produce just 30% of the world’s total crude. on Both figures surpassed analyst expectations by a wide margin, and in January, the unemployment rate hit a 53-year low of 3.4%. With the recent release of February’s numbers, unemployment is now reported at a slightly higher 3.6%. A low unemployment rate is a classic sign of a strong economy. However, as this visualization shows, unemployment often reaches a cyclical low point right before a recession materializes.

Reasons for the Trend

In an interview regarding the January jobs data, U.S. Treasury Secretary Janet Yellen made a bold statement: While there’s nothing wrong with this assessment, the trend we’ve highlighted suggests that Yellen may need to backtrack in the near future. So why do recessions tend to begin after unemployment bottoms out?

The Economic Cycle

The economic cycle refers to the economy’s natural tendency to fluctuate between periods of growth and recession. This can be thought of similarly to the four seasons in a year. An economy expands (spring), reaches a peak (summer), begins to contract (fall), then hits a trough (winter). With this in mind, it’s reasonable to assume that a cyclical low in the unemployment rate (peak employment) is simply a sign that the economy has reached a high point.

Monetary Policy

During periods of low unemployment, employers may have a harder time finding workers. This forces them to offer higher wages, which can contribute to inflation. For context, consider the labor shortage that emerged following the COVID-19 pandemic. We can see that U.S. wage growth (represented by a three-month moving average) has climbed substantially, and has held above 6% since March 2022. The Federal Reserve, whose mandate is to ensure price stability, will take measures to prevent inflation from climbing too far. In practice, this involves raising interest rates, which makes borrowing more expensive and dampens economic activity. Companies are less likely to expand, reducing investment and cutting jobs. Consumers, on the other hand, reduce the amount of large purchases they make. Because of these reactions, some believe that aggressive rate hikes by the Fed can either cause a recession, or make them worse. This is supported by recent research, which found that since 1950, central banks have been unable to slow inflation without a recession occurring shortly after.

Politicians Clash With Economists

The Fed has raised interest rates at an unprecedented pace since March 2022 to combat high inflation. More recently, Fed Chairman Jerome Powell warned that interest rates could be raised even higher than originally expected if inflation continues above target. Senator Elizabeth Warren expressed concern that this would cost Americans their jobs, and ultimately, cause a recession. Powell remains committed to bringing down inflation, but with the recent failures of Silicon Valley Bank and Signature Bank, some analysts believe there could be a pause coming in interest rate hikes. Editor’s note: just after publication of this article, it was confirmed that U.S. interest rates were hiked by 25 basis points (bps) by the Federal Reserve.