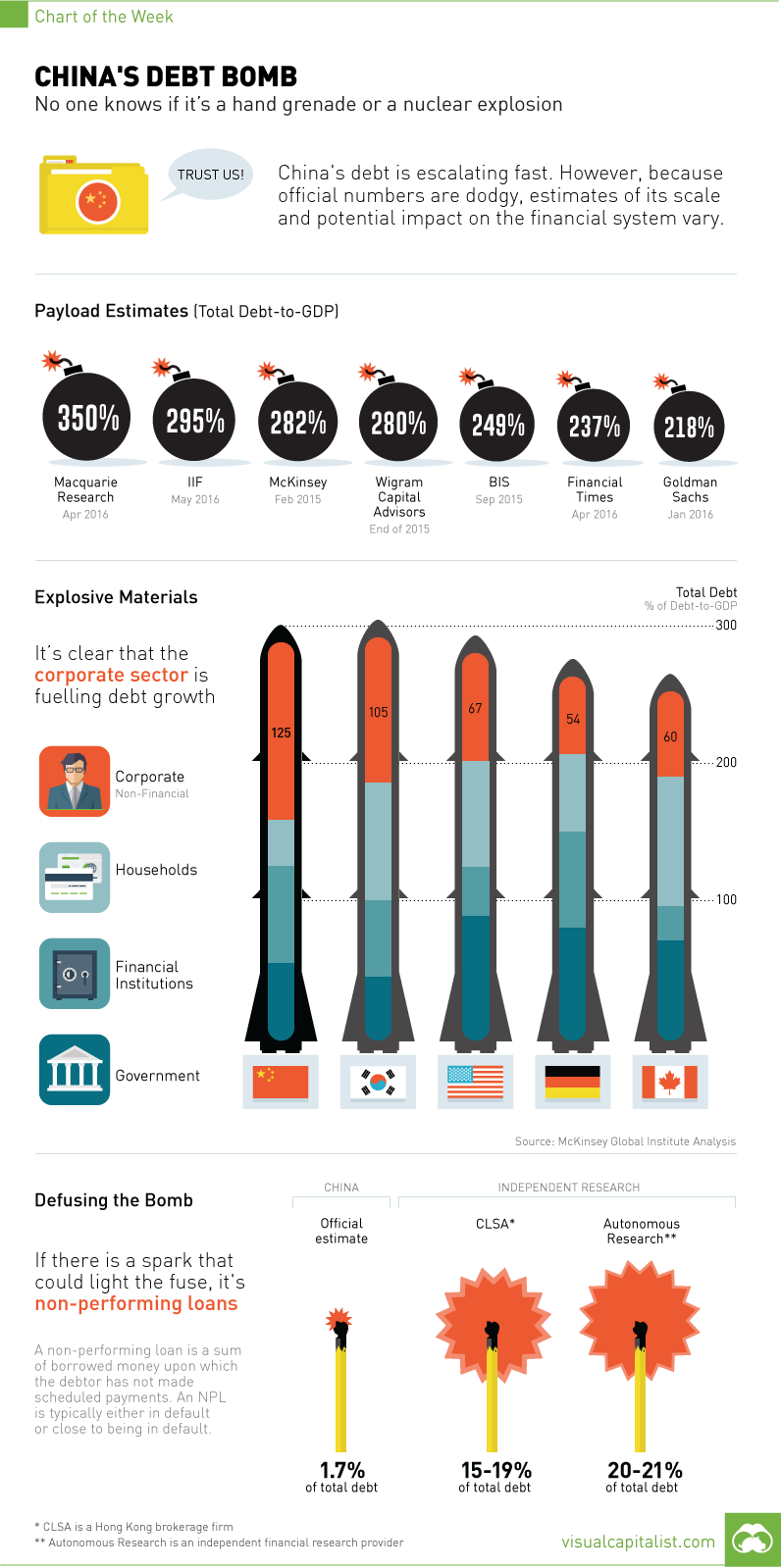

China’s Debt Bomb [Chart]

No One Knows if its a Hand Grenade or a Nuclear Explosion

The Chart of the Week is a weekly Visual Capitalist feature on Fridays. The ramp up in Chinese debt accumulation has been a leading concern of investors for years. The average total debt of emerging market economies is 175% of GDP, and skyrocketing corporate non-financial debt has launched China far beyond that number. The real question is: by how far? The answer is disconcerting, because nobody really knows. If the Chinese debt bomb is detonated, the impact on markets is anybody’s guess. Kyle Bass says the losses would be 5x that of the subprime mortgage crisis, while Moody’s says the bomb will be safely disarmed by authorities far before it goes off. In today’s chart, we look at various estimates to the size of China’s debt bomb, its payload, and what might spark the fuse.

China’s Debt Bomb: The Payload

Mckinsey came out with a widely-publicized estimate of China’s debt at the beginning of 2015. Using figures up to Q2 2014, they estimated that total Chinese debt was 282% of GDP, an increase from 158% in 2007. Since then, various trusted organizations have come up with follow-up estimates. On the low end, Goldman Sachs came out with an estimate in January 2016 of 216% total debt-to-GDP for 2015. (A few months later, they put out a separate report saying that total debt-to-GDP was estimated to be closer to 270% for 2016.) On the high end, Macquarie analyst Viktor Shvets said that China’s debt was $35 trillion, or “nearly 350%” of GDP. The truth is that it’s anybody’s guess. China’s official estimates are fairly useless, and the country has a massive and quickly evolving shadow banking sector that complicates these projections significantly.

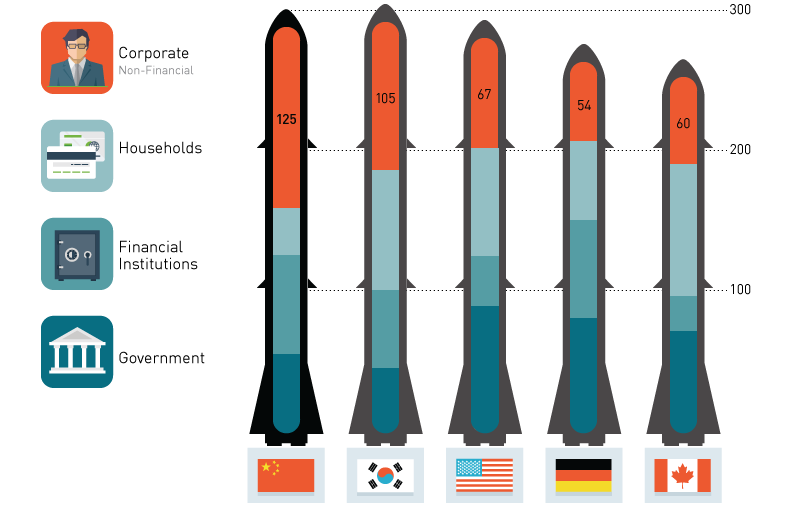

Explosive Materials

Total debt is made up of various components, including government, corporate, banking, and household debts. In the case of China, it is corporate debt that is particularly explosive. According to Mckinsey, the country’s corporate sector already has a higher debt-to-GDP than the United States, Canada, South Korea, or Germany, even while still being considered an “emerging market”. S&P Global Ratings now figures that Chinese corporate debt is in the 160% range, up from 98% in 2008. The current number in the United States is a less ominous 70%. China’s central bank is just as concerned as anyone else. Here’s what the Governor of the People’s Bank of China, Zhou Xiaochuan, had to say about a month ago: Xiaochuan also noted that a high leverage ratio is more prone to macroeconomic risk.

Defusing the Bomb

If there’s something that can ignite the fuse of China’s debt bomb, it’s non-performing loans (NPLs). An NPL is a sum of money borrowed upon which the debtor has not made scheduled payments. They are essentially loans that are either close to defaulting, or already in default territory. China has an official estimate for this number, and it is a benign 1.7% of debt. Unfortunately, independent researchers peg it much higher. Bullish analysts have the number pegged in the high single-digits, while bearish analysts put the range anywhere between 15% and 21%. Even the IMF says that loans “potentially at risk” would be equal to 15.5% of total commercial lending. If there’s a place to start defusing the bomb, this is it. on A statement that is as profound as it is banal. In other words, when we do history, we’re a bit like tourists. If we really want to understand the past, we have to think like a local. The infographic above, Aspects of Principal Exports of Chinese Goods to Foreign Countries, is the first in a series that we’re calling Vintage Viz, which presents a historical visualization along with the background and analytical tools to make sense of it. Today, the People’s Republic of China is the second largest economy in the world, a permanent member of the UN Security Council, and a growing military power. But at the dawn of the 20th century, things were much, much different.

Opium and the Opening of China to the West

Early Sino-Western trade was restricted by the Qing emperors to three ports, and after 1757, just one, in what became known as the Canton System. This name came from the one remaining port city of the same name, present-day Guangzhou. Foreign trade was tightly monitored and subject to stiff tariffs, and Western traders chafed under these restrictions. So when in 1839, Chinese authorities moved to shut down opium smuggling—an important source of profit for foreign merchants—Western powers saw their chance and used the pretext to revise the terms of trade by force. In what became known as the Opium Wars, 1839-1842 and 1856-1860, first Great Britain and then an Anglo-French alliance defeated imperial China and imposed punitive treaties that included indemnities and lowered tariffs, but also expanded the number of ports open to foreign traders, first to five and by 1911, to more than 50.

Westerners were exempted from local laws, Christian missionaries were allowed to proselytize freely, and the opium trade was legalized. Hong Kong was also ceded to Great Britain at this time. The Treaty Port Era, also known as the Century of Humiliation, was perhaps too much for the country to bear. The weakened central government was beset by popular unrest, including the Taiping Rebellion (1850–64), which killed 20 million people, and the Boxer Rebellion (1899-1901), so-named for the secret society that led the movement, the Righteous and Harmonious Fists. Eventually, the last Chinese emperor was deposed and a republic declared in 1911. Nevertheless, the government was too weak to impose its will, and was repeatedly challenged by warlords. So as we approach the outbreak of the First World War in 1914, and the period covered by our visualization, we find China weakened internally by civil strife, and externally by Western powers.

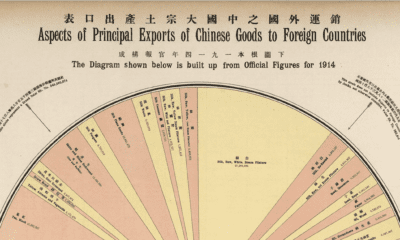

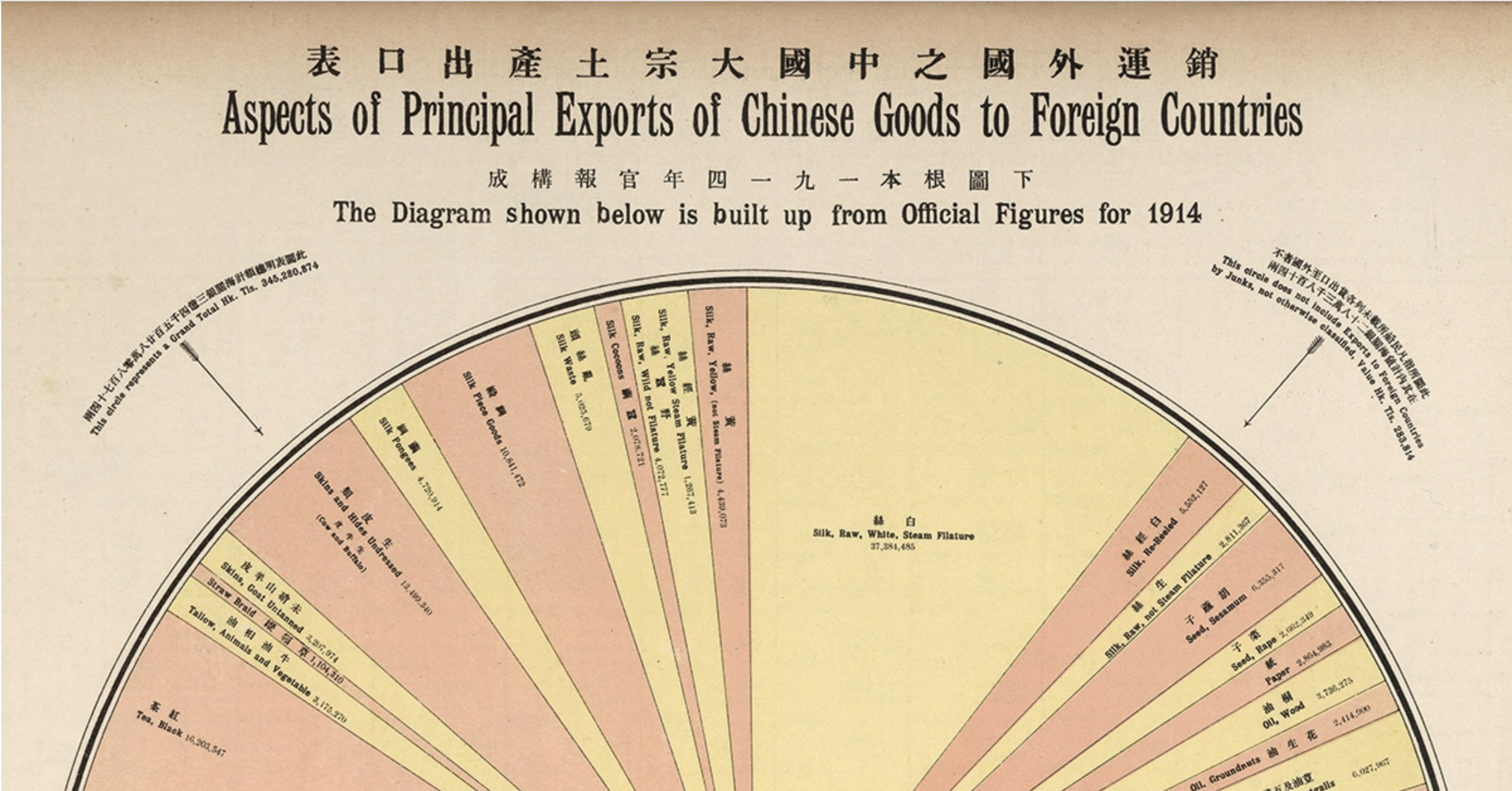

The History of this Century-Old Pie Chart

Aspects of Principal Exports of Chinese Goods to Foreign Countries captures Chinese exports for 1914, and comes from The New Atlas and Commercial Gazetteer of China: A Work Devoted to Its Geography & Resources and Economic & Commercial Development. Originally published in 1917 and edited by Edwin J. Dingle for the Far Eastern Geographical Establishment, the volume contains a wealth of data for the period. According to the book’s Preface, it “seeks to give all the information that is essential to the business-man in regard to a country… about which less is known than in regard to any similar area in the world.” The visualization breaks down total Chinese exports for 1914 in haikwan taels (hk. tls.), a unit of silver currency used to collect tariffs. In 1907, one haikwan tael was worth $0.79 U.S. dollars. Official figures come from the Chinese Maritime Customs Service. This was set up by foreign consuls after the First Opium War to collect tariffs to guarantee the payment of treaty indemnities. Exports in 1914 represented 345 million hk. tls., a 14.4% decrease from 1913, likely owing to the outbreak of the First World War that same year. Apart from “Other Metals and Minerals, Sundries, etc,” which served as a catch-all category, the largest categories were silks and teas of various types, representing 22.6% and 10.4% of total exports respectively. Below are some more details that emerge from this visualization.

All the Tea in China

The Chinese tea trade was the subject of another visualization in the Atlas. It shows that China had been steadily losing ground to British India. Between 1888-1892 Chinese exports to Great Britain were 242 million pounds against India’s 105 million pounds. By 1912-1913, India had surpassed China to export 279 million pounds against 198 million pounds. In 1914, the majority of Chinese exports went to Russia, 902,716 piculs in all. A picul is equal to “as much as a man can carry on a shoulder-pole” or about 133 pounds.

The Silk Road to Profits

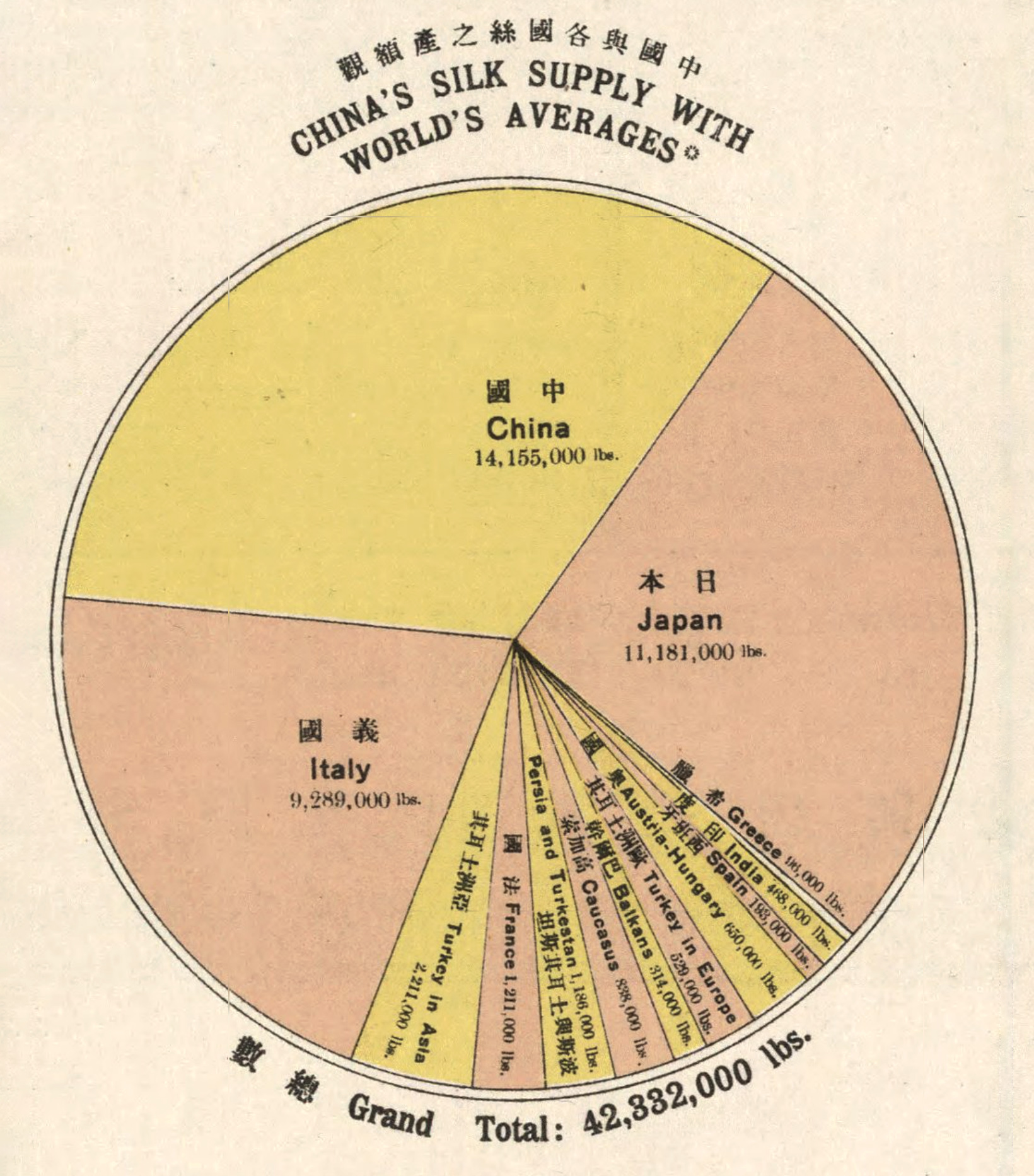

Silk has long been in demand in the West as a luxury good, giving its name to the overland trade route that connected East and West for centuries: the Silk Road. In 1914, China was the largest producer and exporter of silks in the world. On an annual basis, China averaged 14 million pounds, compared to the number two spot, Japan, at 11 million pounds, and number three, Italy, at 9 million pounds. Together, these three controlled 81.7% of the global silk trade.

The Opium of the Masses?

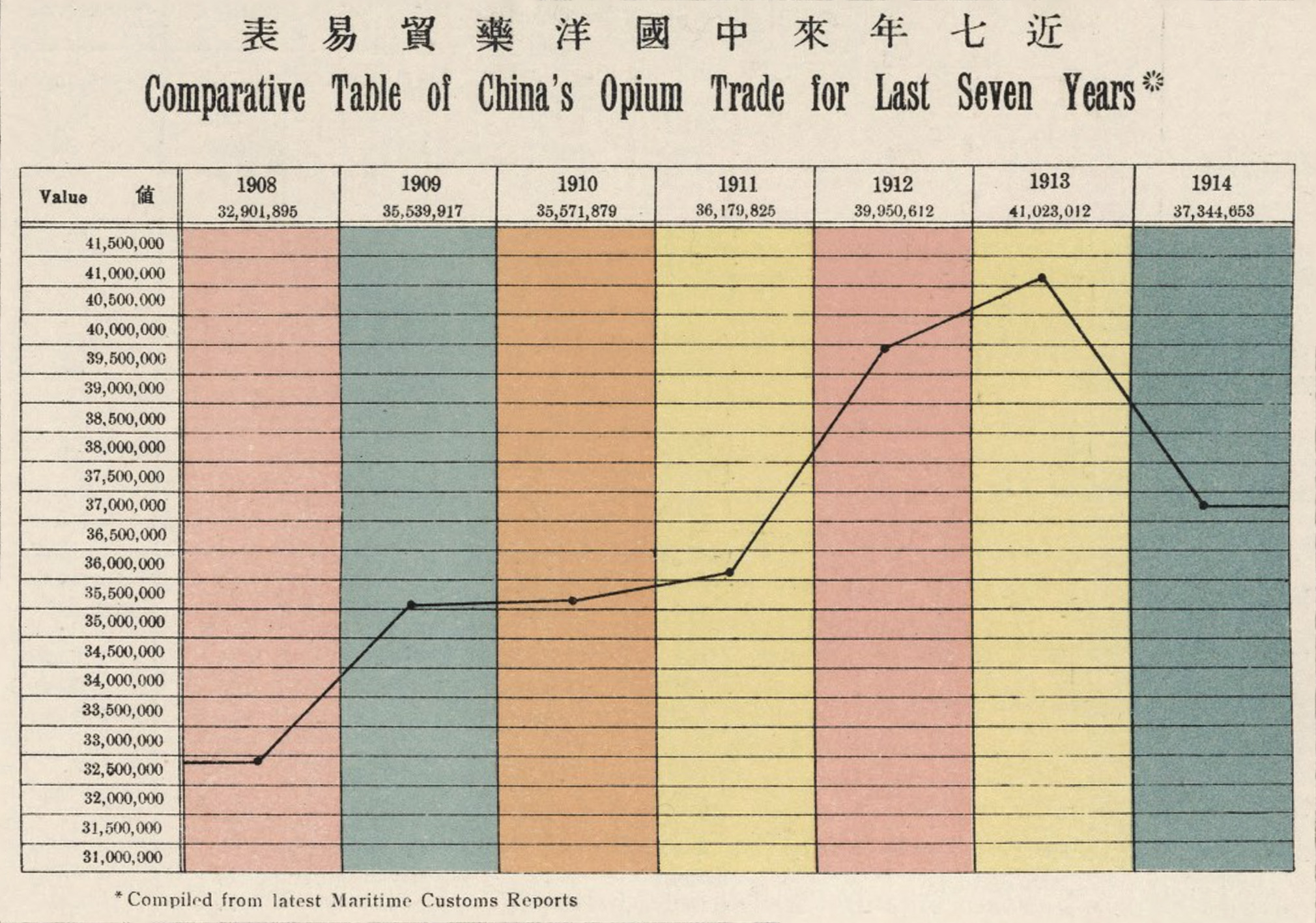

The opium trade, the pretext that opened China to foreign trade, was still big money in 1914. A total of 37 million hk. tls. were imported in 1914 from India, up 11.9% from 1908. This is actually down from a peak of 41 million hk. tls. in 1913.

In 1907, China signed the Ten Year Agreement with India, which ultimately phased out the opium trade. By 1917 the trade was all but extinguished.

Back to the Future

The Aspects of Principal Exports of Chinese Goods to Foreign Countries is a far cry from the contemporary trade picture. China’s top export in 2021 was in the category “telephones for cellular networks or other wireless networks,” and was worth $147.1 billion. But it’s worth noting that China today is a direct result of this period. The resentment created during the Century of Humiliation would eventually help lead to Mao Zedong, the Long March, and the establishment of the People’s Republic of China. And in 1979, the Chinese central government would set up the first of their own “treaty ports,” in the form of special economic zones, places where foreign companies could set up shop. But this time, it wasn’t foreign powers who were making the rules.