The March of the Zombie Miners Continues [Chart]

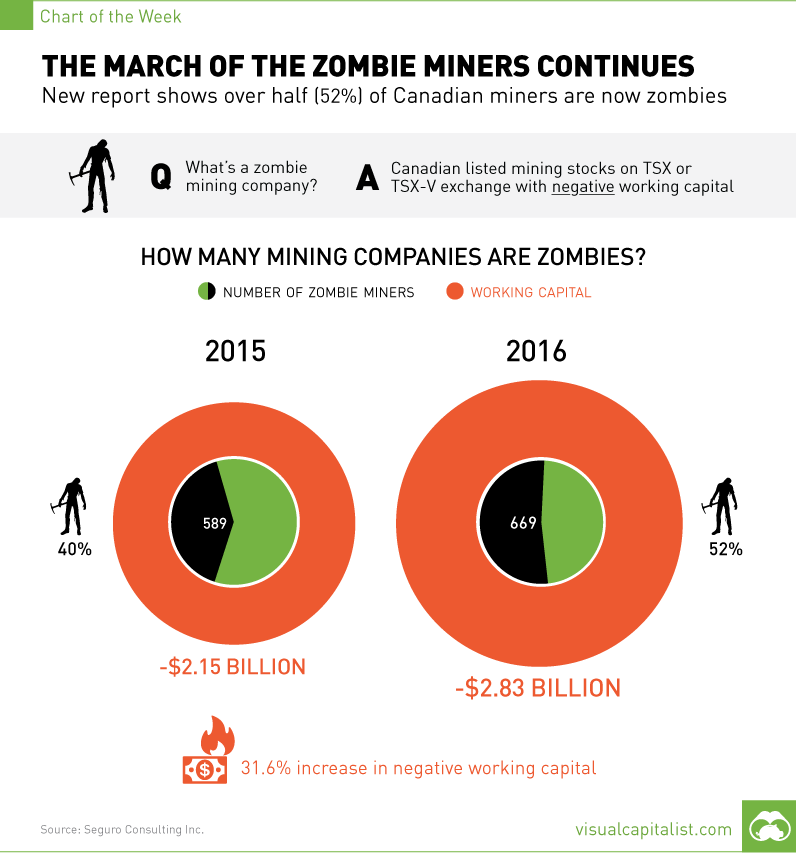

New report shows that over half (52%) of all Canadian-listed mining companies are zombies

The Chart of the Week is a weekly Visual Capitalist feature on Fridays. Canada has a reputation worldwide as the epicenter for mining exploration, and over the years the country’s junior-listed companies have created billions of dollars in wealth through new mineral discoveries. However, these days, Canada is home to a horror story that seems to haunt investors more each year: 52% of all Canadian mining stocks are now “zombies”, and together the walking dead combine for a total of -$2.8 billion in negative working capital.

The “Zombie” Backstory

It was just over a year ago that Tony Simon, President of Seguro Consulting, brought to our attention the initial problem of the zombie miners. In this case, his “zombie” definition referred to mining exploration companies that had negative working capital and therefore did not meet the Continuous Listing Requirements (CLR) for the TSX and TSX-V stock exchanges. Our chart from last year called “A Miner Problem” detailed these requirements, while also showing the ugly state of the 589 listed companies’ balance sheets. Many of these companies have negative working capital because they have no real assets that can be monetized, while being saddled with mounting costs or unsustainable debt.

Zombie Survival Tactics

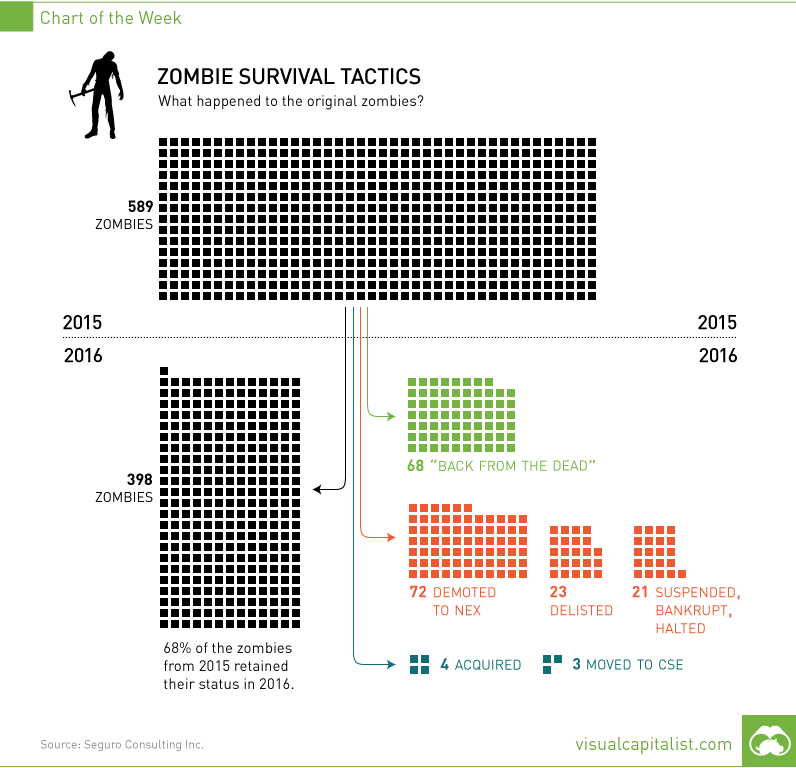

Break out your Zombie Survival Kit, because we now have another year’s worth of information from Mr. Simon, who is a CPA by designation. Here are the stats that caught our eye, most of which are also included in this week’s chart:

The number of zombie miners increased from 589 to 669. Zombies now make up 52% (up from 40%) of all mining companies in Canada listed on TSX and TSX-V exchanges. The average zombie has had negative working capital for 44 months. Negative working capital of all zombie companies increased by 31.6% from -$2.15 billion (2015) to -$2.83 billion (2016).

Of the original 589 zombies, 398 (68%) stayed as zombies the following year, and were counted towards 2016’s total. Mr. Simon provided us with some additional stats on the companies carried forward:

51% of the zombies have share prices of $0.025 or less. Only 13 zombies had $1,000,000 or more of liquidity in the last quarter. Meanwhile, an astonishing 68% of zombies traded with less than $50,000 of liquidity last quarter. 55% of zombies have market capitalizations of less than $1 million.

In other words, these zombies don’t eat brains for breakfast. Instead, they munch on capital from private placements until no one is willing to feed them. So why do they continue to exist?

More Zombies, More Problems

From the perspective of the zombie management teams, it makes sense why they still roam the streets in search of capital or a stroke of luck. Just read this post by an anonymous CEO of a zombie company. To sum up: they continue to exist because of fiduciary duty to their shareholders. However, it gets tougher to explain their existence from other angles. How does the exchange justify keeping them around? Mr. Simon has been poking at this with a stick to try and get an answer. After all, retail investors have a tough enough time as it is, even without 52% of the total selection of companies being extreme long shots. Here’s hoping that normalizing commodity prices in gold, silver, zinc, and other metals will help spur mergers and acquisitions in the sector. Perhaps today’s zombies can have their assets “brought to life” on the balance sheets of healthier companies. Looking for sources?

Update on the 2015 zombies New zombies in 2016 Average time with negative working capital

on Did you know that nearly one-fifth of all the gold ever mined is held by central banks? Besides investors and jewelry consumers, central banks are a major source of gold demand. In fact, in 2022, central banks snapped up gold at the fastest pace since 1967. However, the record gold purchases of 2022 are in stark contrast to the 1990s and early 2000s, when central banks were net sellers of gold. The above infographic uses data from the World Gold Council to show 30 years of central bank gold demand, highlighting how official attitudes toward gold have changed in the last 30 years.

Why Do Central Banks Buy Gold?

Gold plays an important role in the financial reserves of numerous nations. Here are three of the reasons why central banks hold gold:

Balancing foreign exchange reserves Central banks have long held gold as part of their reserves to manage risk from currency holdings and to promote stability during economic turmoil. Hedging against fiat currencies Gold offers a hedge against the eroding purchasing power of currencies (mainly the U.S. dollar) due to inflation. Diversifying portfolios Gold has an inverse correlation with the U.S. dollar. When the dollar falls in value, gold prices tend to rise, protecting central banks from volatility. The Switch from Selling to Buying In the 1990s and early 2000s, central banks were net sellers of gold. There were several reasons behind the selling, including good macroeconomic conditions and a downward trend in gold prices. Due to strong economic growth, gold’s safe-haven properties were less valuable, and low returns made it unattractive as an investment. Central bank attitudes toward gold started changing following the 1997 Asian financial crisis and then later, the 2007–08 financial crisis. Since 2010, central banks have been net buyers of gold on an annual basis. Here’s a look at the 10 largest official buyers of gold from the end of 1999 to end of 2021: Rank CountryAmount of Gold Bought (tonnes)% of All Buying #1🇷🇺 Russia 1,88828% #2🇨🇳 China 1,55223% #3🇹🇷 Türkiye 5418% #4🇮🇳 India 3956% #5🇰🇿 Kazakhstan 3455% #6🇺🇿 Uzbekistan 3115% #7🇸🇦 Saudi Arabia 1803% #8🇹🇭 Thailand 1682% #9🇵🇱 Poland1282% #10🇲🇽 Mexico 1152% Total5,62384% Source: IMF The top 10 official buyers of gold between end-1999 and end-2021 represent 84% of all the gold bought by central banks during this period. Russia and China—arguably the United States’ top geopolitical rivals—have been the largest gold buyers over the last two decades. Russia, in particular, accelerated its gold purchases after being hit by Western sanctions following its annexation of Crimea in 2014. Interestingly, the majority of nations on the above list are emerging economies. These countries have likely been stockpiling gold to hedge against financial and geopolitical risks affecting currencies, primarily the U.S. dollar. Meanwhile, European nations including Switzerland, France, Netherlands, and the UK were the largest sellers of gold between 1999 and 2021, under the Central Bank Gold Agreement (CBGA) framework. Which Central Banks Bought Gold in 2022? In 2022, central banks bought a record 1,136 tonnes of gold, worth around $70 billion. Country2022 Gold Purchases (tonnes)% of Total 🇹🇷 Türkiye14813% 🇨🇳 China 625% 🇪🇬 Egypt 474% 🇶🇦 Qatar333% 🇮🇶 Iraq 343% 🇮🇳 India 333% 🇦🇪 UAE 252% 🇰🇬 Kyrgyzstan 61% 🇹🇯 Tajikistan 40.4% 🇪🇨 Ecuador 30.3% 🌍 Unreported 74165% Total1,136100% Türkiye, experiencing 86% year-over-year inflation as of October 2022, was the largest buyer, adding 148 tonnes to its reserves. China continued its gold-buying spree with 62 tonnes added in the months of November and December, amid rising geopolitical tensions with the United States. Overall, emerging markets continued the trend that started in the 2000s, accounting for the bulk of gold purchases. Meanwhile, a significant two-thirds, or 741 tonnes of official gold purchases were unreported in 2022. According to analysts, unreported gold purchases are likely to have come from countries like China and Russia, who are looking to de-dollarize global trade to circumvent Western sanctions.

There were several reasons behind the selling, including good macroeconomic conditions and a downward trend in gold prices. Due to strong economic growth, gold’s safe-haven properties were less valuable, and low returns made it unattractive as an investment.

Central bank attitudes toward gold started changing following the 1997 Asian financial crisis and then later, the 2007–08 financial crisis. Since 2010, central banks have been net buyers of gold on an annual basis.

Here’s a look at the 10 largest official buyers of gold from the end of 1999 to end of 2021:

Source: IMF

The top 10 official buyers of gold between end-1999 and end-2021 represent 84% of all the gold bought by central banks during this period.

Russia and China—arguably the United States’ top geopolitical rivals—have been the largest gold buyers over the last two decades. Russia, in particular, accelerated its gold purchases after being hit by Western sanctions following its annexation of Crimea in 2014.

Interestingly, the majority of nations on the above list are emerging economies. These countries have likely been stockpiling gold to hedge against financial and geopolitical risks affecting currencies, primarily the U.S. dollar.

Meanwhile, European nations including Switzerland, France, Netherlands, and the UK were the largest sellers of gold between 1999 and 2021, under the Central Bank Gold Agreement (CBGA) framework.

Which Central Banks Bought Gold in 2022?

In 2022, central banks bought a record 1,136 tonnes of gold, worth around $70 billion. Türkiye, experiencing 86% year-over-year inflation as of October 2022, was the largest buyer, adding 148 tonnes to its reserves. China continued its gold-buying spree with 62 tonnes added in the months of November and December, amid rising geopolitical tensions with the United States. Overall, emerging markets continued the trend that started in the 2000s, accounting for the bulk of gold purchases. Meanwhile, a significant two-thirds, or 741 tonnes of official gold purchases were unreported in 2022. According to analysts, unreported gold purchases are likely to have come from countries like China and Russia, who are looking to de-dollarize global trade to circumvent Western sanctions.