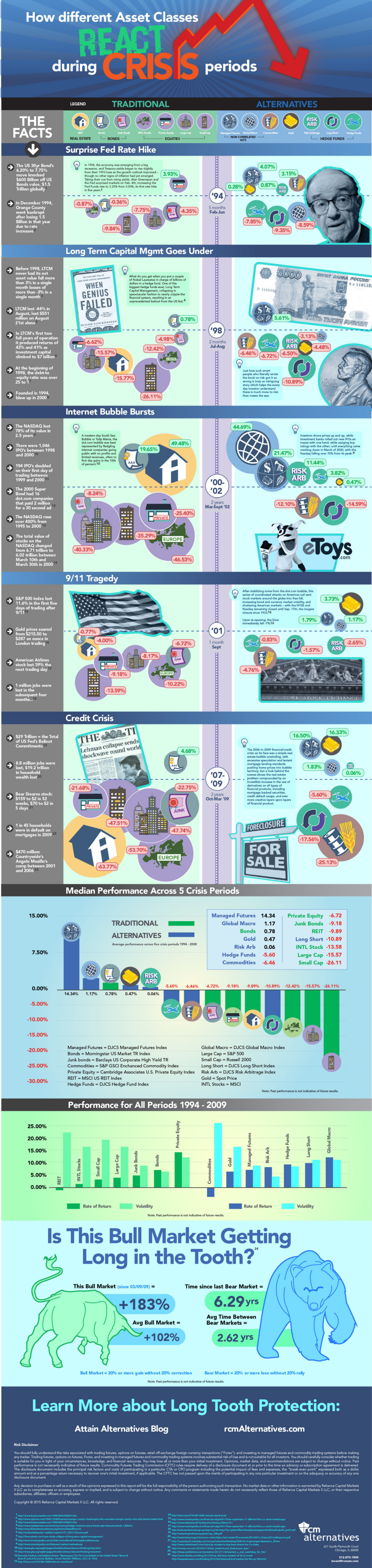

Crisis Investing: How 14 Different Asset Classes Performed in Times of Distress

Note: to see the bigger version of this infographic, click here. History does not repeat itself, but it often rhymes. This could not be truer for crisis investing. Between China’s stock market and the debt troubles of Greece and Puerto Rico, it is clear that we could be entering a time of potential financial crisis. Every situation is unique, but generally the types of asset classes that protect investors in times of crisis are not necessarily the same as those during a bull run. Therefore, it’s worth taking a look at five previous periods of distress to see the returns of conventional and alternative asset classes.

1994: Surprise Rate Hike

In 1994, the economy was recovering from a significant recession and treasury yields started to rise from the lows of the previous year. The Fed and Alan Greenspan surprised markets by tightening monetary policy with the first rate hike in five years. Returns: Large cap (-7.75%) and small cap stocks (-9.84%) got crushed. Managed futures (4.07%), commodities (3.15%), and gold (0.28%) did okay.

1998: LTCM Goes Under

Long-Term Capital Management started off with promise as it brought in annualized returns (after fees) of 21%, 43%, and 41% in its first three years with high leverage and normal macroeconomic conditions. LTCM directors Myron Scholes and Robert Merton would share the Nobel Prize in Economic Sciences in 1997. Promptly after, the hedge fund would lose $4.6 billion in four months in the aftermath of the Asian financial crisis, requiring a bailout from the Federal Reserve and various banks. Returns: Stocks and REITs get crushed. Bonds (0.78%) and managed futures (5.61%) survive.

2000: Dotcom Bubble Bursts

Fledgling internet companies with no profits and limited revenues went public, reaping huge gains on IPOs. Prices went up and up, but eventually came crashing down in March of 2000 with the Nasdaq losing up to 70% of its peak value. Returns: Large cap stocks (-40.33%), small cap stocks (-35.29%), private equity (-25.40%), and international stocks (-46.53%) get hammered. REITs (49.48%), bonds (19.65%), global macro (44.69%) all did well. Gold (0.47%) remained virtually unchanged.

2001: 9/11 Tragedy

Coordinated attacks on the United States shock markets, and the NYSE and Nasdaq remain closed until September 17th. Upon re-opening, the Dow drops 7%. Returns: Almost all asset classes struggle, but gold (3.73%) got the highest return.

2008: Global Financial Crisis

Lehman Brothers goes under and the Greenspan real estate bubble crashes and burns. Excessive speculation, lenient mortgage lending, and the proliferation of derivative financial products such as credit default swaps contribute to the problem. The Fed has $29 trillion in bailout commitments while 8.8 million jobs and $19.2 trillion in household wealth are lost. Returns: Again, most assets get crushed. It is no surprise that worst off are REITs (-63.77%). Gold continues to shine, gaining double digits (16.33%). Original graphic by: Attain Capital

on Did you know that nearly one-fifth of all the gold ever mined is held by central banks? Besides investors and jewelry consumers, central banks are a major source of gold demand. In fact, in 2022, central banks snapped up gold at the fastest pace since 1967. However, the record gold purchases of 2022 are in stark contrast to the 1990s and early 2000s, when central banks were net sellers of gold. The above infographic uses data from the World Gold Council to show 30 years of central bank gold demand, highlighting how official attitudes toward gold have changed in the last 30 years.

Why Do Central Banks Buy Gold?

Gold plays an important role in the financial reserves of numerous nations. Here are three of the reasons why central banks hold gold:

Balancing foreign exchange reserves Central banks have long held gold as part of their reserves to manage risk from currency holdings and to promote stability during economic turmoil. Hedging against fiat currencies Gold offers a hedge against the eroding purchasing power of currencies (mainly the U.S. dollar) due to inflation. Diversifying portfolios Gold has an inverse correlation with the U.S. dollar. When the dollar falls in value, gold prices tend to rise, protecting central banks from volatility. The Switch from Selling to Buying In the 1990s and early 2000s, central banks were net sellers of gold. There were several reasons behind the selling, including good macroeconomic conditions and a downward trend in gold prices. Due to strong economic growth, gold’s safe-haven properties were less valuable, and low returns made it unattractive as an investment. Central bank attitudes toward gold started changing following the 1997 Asian financial crisis and then later, the 2007–08 financial crisis. Since 2010, central banks have been net buyers of gold on an annual basis. Here’s a look at the 10 largest official buyers of gold from the end of 1999 to end of 2021: Rank CountryAmount of Gold Bought (tonnes)% of All Buying #1🇷🇺 Russia 1,88828% #2🇨🇳 China 1,55223% #3🇹🇷 Türkiye 5418% #4🇮🇳 India 3956% #5🇰🇿 Kazakhstan 3455% #6🇺🇿 Uzbekistan 3115% #7🇸🇦 Saudi Arabia 1803% #8🇹🇭 Thailand 1682% #9🇵🇱 Poland1282% #10🇲🇽 Mexico 1152% Total5,62384% Source: IMF The top 10 official buyers of gold between end-1999 and end-2021 represent 84% of all the gold bought by central banks during this period. Russia and China—arguably the United States’ top geopolitical rivals—have been the largest gold buyers over the last two decades. Russia, in particular, accelerated its gold purchases after being hit by Western sanctions following its annexation of Crimea in 2014. Interestingly, the majority of nations on the above list are emerging economies. These countries have likely been stockpiling gold to hedge against financial and geopolitical risks affecting currencies, primarily the U.S. dollar. Meanwhile, European nations including Switzerland, France, Netherlands, and the UK were the largest sellers of gold between 1999 and 2021, under the Central Bank Gold Agreement (CBGA) framework. Which Central Banks Bought Gold in 2022? In 2022, central banks bought a record 1,136 tonnes of gold, worth around $70 billion. Country2022 Gold Purchases (tonnes)% of Total 🇹🇷 Türkiye14813% 🇨🇳 China 625% 🇪🇬 Egypt 474% 🇶🇦 Qatar333% 🇮🇶 Iraq 343% 🇮🇳 India 333% 🇦🇪 UAE 252% 🇰🇬 Kyrgyzstan 61% 🇹🇯 Tajikistan 40.4% 🇪🇨 Ecuador 30.3% 🌍 Unreported 74165% Total1,136100% Türkiye, experiencing 86% year-over-year inflation as of October 2022, was the largest buyer, adding 148 tonnes to its reserves. China continued its gold-buying spree with 62 tonnes added in the months of November and December, amid rising geopolitical tensions with the United States. Overall, emerging markets continued the trend that started in the 2000s, accounting for the bulk of gold purchases. Meanwhile, a significant two-thirds, or 741 tonnes of official gold purchases were unreported in 2022. According to analysts, unreported gold purchases are likely to have come from countries like China and Russia, who are looking to de-dollarize global trade to circumvent Western sanctions.

There were several reasons behind the selling, including good macroeconomic conditions and a downward trend in gold prices. Due to strong economic growth, gold’s safe-haven properties were less valuable, and low returns made it unattractive as an investment.

Central bank attitudes toward gold started changing following the 1997 Asian financial crisis and then later, the 2007–08 financial crisis. Since 2010, central banks have been net buyers of gold on an annual basis.

Here’s a look at the 10 largest official buyers of gold from the end of 1999 to end of 2021:

Source: IMF

The top 10 official buyers of gold between end-1999 and end-2021 represent 84% of all the gold bought by central banks during this period.

Russia and China—arguably the United States’ top geopolitical rivals—have been the largest gold buyers over the last two decades. Russia, in particular, accelerated its gold purchases after being hit by Western sanctions following its annexation of Crimea in 2014.

Interestingly, the majority of nations on the above list are emerging economies. These countries have likely been stockpiling gold to hedge against financial and geopolitical risks affecting currencies, primarily the U.S. dollar.

Meanwhile, European nations including Switzerland, France, Netherlands, and the UK were the largest sellers of gold between 1999 and 2021, under the Central Bank Gold Agreement (CBGA) framework.

Which Central Banks Bought Gold in 2022?

In 2022, central banks bought a record 1,136 tonnes of gold, worth around $70 billion. Türkiye, experiencing 86% year-over-year inflation as of October 2022, was the largest buyer, adding 148 tonnes to its reserves. China continued its gold-buying spree with 62 tonnes added in the months of November and December, amid rising geopolitical tensions with the United States. Overall, emerging markets continued the trend that started in the 2000s, accounting for the bulk of gold purchases. Meanwhile, a significant two-thirds, or 741 tonnes of official gold purchases were unreported in 2022. According to analysts, unreported gold purchases are likely to have come from countries like China and Russia, who are looking to de-dollarize global trade to circumvent Western sanctions.