Ultimately what most people really want is freedom – the freedom to do more of what they want, whenever they want, and with whomever they want. Sadly, many people never achieve this long-desired freedom for themselves or their families. That’s because there is a silent investment killer that picks away at many investors’ portfolios, and it’s all part of Wall Street’s plan to line their pockets.

Becoming Unshakeable

Today’s infographic is from Tony Robbins, and it uses data and talking points from his #1 Best Selling book Unshakeable: Your Financial Freedom Playbook, which is now available on paperback. Specifically, the infographic dives deep into the rabbit hole of fees associated with the investing products sold to most people saving for retirement, while also showing that these same Wall Street products often can’t beat the performance of the market.

The Silent Portfolio Killer

Take a look at your investing statement, and it’s likely that your portfolio is in fact growing. Unfortunately, most people leave it at that, and they don’t question any further. But the stats are revealing:

71% of Americans believe they pay no fees at all to have a 401(k) plan 92% of Americans admit they have no idea how much they are paying

In other words, they are blindly trusting the financial industry to look out for their best interests. Meanwhile, the grim reality is that mutual funds, which are used in many 401(k) plans, have visible and hidden costs that can impact portfolio performance.

According to Forbes, the average total of all of these costs is 4.17% – though of course, costs usually vary widely from fund to fund. – Tony Robbins

Not All Fees are Bad

It is important to note that not all fees are bad. Working with the right financial advisor can help you make better decisions, and this expertise can be used to save you money in the long run. A recent Vanguard study helps quantify the value a good advisor can bring:

Rebalancing portfolio – 0.35% Lowering expense ratios – 0.45% Asset allocation – 0.75% Withdrawing the right investments for retirement – 0.70% Behavioral coaching – 1.50%

In aggregate, the right financial advisor can create 3.75% in value – that’s 3X more than a sophisticated advisor might charge, and doesn’t even include the added benefits of reducing taxes, estate planning, and other areas.

A Difference Maker

One percent here, two percent there – it’s barely anything in the long run, right? It turns out, however, that the power of compound interest is so great, that even 2% can be the difference between financial freedom and financial ruin. Put $1 in the stock market for 50 years at a 7% rate of return, and you’ll end up with nearly $30. Get charged a 2% fee to bring your returns to 5%, and your fortune is one-third the size! – Jack Bogle

Chasing Market Beating Returns

Investors often buy top performing mutual funds or try to time the market, because ultimately they are hoping to beat the market to achieve financial freedom. However, it’s not clear that either of these strategies work. Buying “Top-Performing” Funds Industry expert Robert Arnott studied all 203 actively managed mutual funds with at least $100 million in assets, tracking their returns for the 15 years from 1984 through 1998. And you know what he found? Only 8 of these 203 funds actually beat the S&P 500 index. That’s less than 4%! Trying to Time the Market Researchers Richard Bauer and Julie Dahlquist examined more than a million market-timing sequences from 1926 to 1999. Their conclusion: just holding the market outperformed more than 80% of market-timing strategies

The Moral of the Story

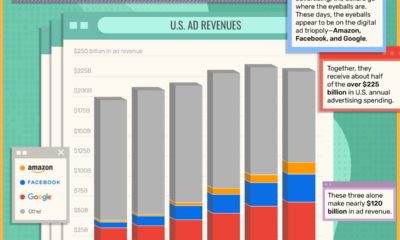

Wall Street tries to fool you into overpaying for underperformance. Overpaying: Fees and taxes can be silent portfolio killers. Even 1% or 2% makes a big difference over time. Underperformance: Only a small percentage of funds beat the market over time, and much of this can be attributed to randomness. Only being in the market, while minimizing costs, can empower you to getting the real financial freedom you deserve. on Last year, stock and bond returns tumbled after the Federal Reserve hiked interest rates at the fastest speed in 40 years. It was the first time in decades that both asset classes posted negative annual investment returns in tandem. Over four decades, this has happened 2.4% of the time across any 12-month rolling period. To look at how various stock and bond asset allocations have performed over history—and their broader correlations—the above graphic charts their best, worst, and average returns, using data from Vanguard.

How Has Asset Allocation Impacted Returns?

Based on data between 1926 and 2019, the table below looks at the spectrum of market returns of different asset allocations:

We can see that a portfolio made entirely of stocks returned 10.3% on average, the highest across all asset allocations. Of course, this came with wider return variance, hitting an annual low of -43% and a high of 54%.

A traditional 60/40 portfolio—which has lost its luster in recent years as low interest rates have led to lower bond returns—saw an average historical return of 8.8%. As interest rates have climbed in recent years, this may widen its appeal once again as bond returns may rise.

Meanwhile, a 100% bond portfolio averaged 5.3% in annual returns over the period. Bonds typically serve as a hedge against portfolio losses thanks to their typically negative historical correlation to stocks.

A Closer Look at Historical Correlations

To understand how 2022 was an outlier in terms of asset correlations we can look at the graphic below:

The last time stocks and bonds moved together in a negative direction was in 1969. At the time, inflation was accelerating and the Fed was hiking interest rates to cool rising costs. In fact, historically, when inflation surges, stocks and bonds have often moved in similar directions. Underscoring this divergence is real interest rate volatility. When real interest rates are a driving force in the market, as we have seen in the last year, it hurts both stock and bond returns. This is because higher interest rates can reduce the future cash flows of these investments. Adding another layer is the level of risk appetite among investors. When the economic outlook is uncertain and interest rate volatility is high, investors are more likely to take risk off their portfolios and demand higher returns for taking on higher risk. This can push down equity and bond prices. On the other hand, if the economic outlook is positive, investors may be willing to take on more risk, in turn potentially boosting equity prices.

Current Investment Returns in Context

Today, financial markets are seeing sharp swings as the ripple effects of higher interest rates are sinking in. For investors, historical data provides insight on long-term asset allocation trends. Over the last century, cycles of high interest rates have come and gone. Both equity and bond investment returns have been resilient for investors who stay the course.