Warren Buffett’s investment style exemplifies the fundamental approach: “Which companies offer the best returns?” On the other hand, hedge fund manager James Simons of Renaissance Technologies is a notable example of the quantitative approach: “What is the best way to predict returns?” Both techniques have one thing in common—they seek excess return from the marketplace, or what is known as “Alpha”.

Quantamental: Combining Quantitative & Fundamental

Today’s infographic from GoldSpot Discoveries outlines quantamental investing as the blending of these two styles, human insight with computer power. Despite both methods seeking excess returns in the market, there are some key differences: The arrival of advanced sensor technology and computer processing power is creating huge opportunities for capturing the complexity of human activity on a larger scale. Could these two distinct methods be fused together?

A New Frontier for Data: Combining Man and Machine

On a larger scale, tracking and storing data can reveal economic patterns over long periods of time. For example, satellite images of a mall’s parking lot can determine the mall’s sales volume. In the finance world, software can track sentiment in earnings call transcripts, and detect word patterns of executives. The applications of sensor technology stretch across various cases, and could improve overall performance in different industries.

Case #1: Sabermetrics

Picking a winning baseball team is a lot like investing: with limited capital, one needs to optimize player selection and performance to beat the competition. That is why the Major League Baseball Association installed StatScan in 30 ballparks for 3 seasons (2015-2017).

These radar and camera systems captured the raw skills of players in ways that were previously available to or only understood by the baseball scouts.

Scouts are the stock pickers of the baseball. They know the ins and outs of a potential major league player, and consider health, family history, body mechanics and even personalities.

Team managers can use a scout’s insight, against the vast amounts of data collected during a baseball season, to uncover the exact metrics to predict the success of the next great home run or strike-out king.

Case #2: Mineral Exploration

Resource companies spend huge amounts of money on exploration to collect data. However, the volume of data generated is too much for one geologist, or even a team to sift through in a reasonable time. Machine learning in mineral exploration can take in training data to help identify prospective land for a mineral deposit.

Computer Power with a Human Touch

Quantamental investing seeks to understand the depth and the breadth of the investment world. The goal is to produce superior returns in the marketplace by answering two questions.

Quantamental investing harnesses the raw power and scale of data, coupled with human insight — increasing market returns by finding the next great investment.

on

Brand value in this context is a measure of the “value of the trade mark and associated marketing IP within the branded business”. In other words, it measures the value of intangible marketing assets, and not the overall worth of the business itself.

In this infographic, we’ve visualized the Banking 500’s top 10 brands since 2019 to show you how the ranking has evolved (or stayed the same).

Top Bank Brands of 2023

The 10 most valuable bank brands of 2023 are evenly split between China and the United States. In terms of combined brand value, China leads with $262 billion to America’s $165 billion. Chinese banks have a massive market to serve, which helps to lift the perceived value of their brands. For example, Industrial and Commercial Bank of China (ICBC) serves over 500 million individuals as well as several million business clients. It’s worth noting that ICBC is the world’s largest bank in terms of assets under management ($5.5 trillion as of Dec 2021), and in terms of annual revenues ($143 billion as of Dec 2022). The bank was founded just 39 years ago in 1984. After ICBC, the next three spots are occupied by the rest of China’s “big four” banks, all of which are state-owned. The fifth to ninth spots on this ranking are occupied by an assortment of America’s largest banks. Despite a string of controversies in recent years, Wells Fargo rose from eighth in 2022 to sixth in 2023. This goes to show that large corporations can often recover from a scandal in a relatively short period of time (e.g. Volkswagen’s Dieselgate). Coming in tenth is China Merchants Bank, which is China’s first “joint-stock commercial bank wholly owned by corporate legal entities”.

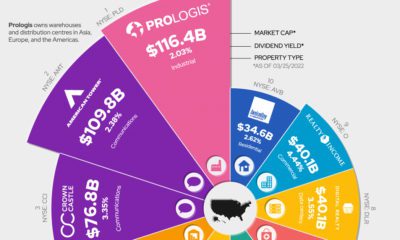

Top Asset Management Brands

Brand Finance’s 2023 ranking also includes a separate category for asset managers. Given America’s leadership in financial markets, it’s no surprise to see eight out of the 10 firms listed here as being based in the United States. The number one spot, however, is held by Canada’s Brookfield. The Canadian alternative asset manager is building a strong brand through its investments in renewable energy and other high-value infrastructure.