On one hand, all this data can be harnessed to make intelligent and timely investment decisions. However, with data growing at exponential rates, this also means that there is a lot of noise – and finding the right signal can be like looking for a needle in a haystack. Today’s infographic from Mergalim shows how the power of predictive data analytics is growing, and using tools like AI and Bayesian inference to anticipate the outcome of events before they happen is more feasible and applicable than ever.

The Big Data Landscape

Before we get into predictive analytics, let’s look at what investors are up against in the first place. Volume: The rate of data creation is accelerating so fast, that in 2017 there will be more data created than the previous 5,000 years combined. To put this in perspective: in the U.S. alone, approximately 2,657,000 GB of data is created every minute. Variety: Data is not uniform, and there are many types of data. With data coming from many sources simultaneously, useful analysis can be very difficult. Velocity: Especially in the markets, data needs to be monitored in real-time to be useful. Getting information too late could mean zero liquidity for a portfolio in some sort of crisis. In other words, one missed data signal can cause irreparable harm to a portfolio in a situation where things go awry. Therefore, along with having a smart allocation of assets, it can be advantageous to also be one step ahead of the game to know what’s coming.

The Power of Predictive Data

Predictive analytics is defined as: “The branch of advanced analytics used to make predictions about unknown future events. It uses techniques from data mining, statistics, modelling, machine learning, and artificial intelligence to make predictions about the future.” Not surprisingly, Wall Street has jumped on this bandwagon too.

Goldman Sachs famously employs more engineers than Facebook, Twitter, or LinkedIn. Citadel, a secretive hedge fund, calculates the outcomes of more than 500 “doomsday scenarios” per day to assess potential risk for the firm from geopolitical and other potential crises Quantitative traders use streams of data and complex algorithms to create models of the market to find predictable patterns, and create machine-derived forecasts

But there is one possible limitation with these approaches. Markets are complex systems and need to be analyzed as such. After all, human decision makers can be irrational, events can be “triggered” by seemingly random factors, and traditional mathematical models can fall apart when markets get volatile.

A Multi-Disciplinary Approach?

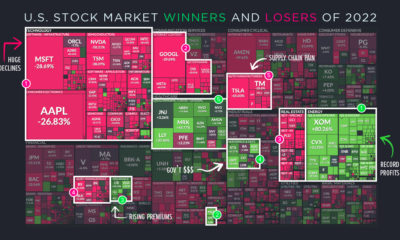

One solution to this limitation may be to borrow ideas from the intelligence industry, which must anticipate irrational or “random” human actions before they happen. As an example of this, intelligence agencies like the CIA have already been working to apply other disciplines to the techniques already widely used in predictive data: Bayesian Inference: A formula in which the probability for the hypothesis is updated based on new data. Behavioral Psychology: The science behind how responses to environmental stimuli shape people’s actions. Complexity Theory: Born in the 1960s, the science around how complex systems work is now well established. Fuzzy Cognitive Maps: A way of representing social scientific knowledge and modelling decision making in systems. Historical Perspective: Applying knowledge of past events and subject matter experts to these other disciplinary fields. Artificial Intelligence: Today’s deep learning now allows AI to instantly recognize and process all types of previously impenetrable data. If predictive data analytics becomes the norm and its potential is fully realized, having data only in real-time may not be enough for many active market participants. In turn, this could set up a very different landscape than exists today. on Last year, stock and bond returns tumbled after the Federal Reserve hiked interest rates at the fastest speed in 40 years. It was the first time in decades that both asset classes posted negative annual investment returns in tandem. Over four decades, this has happened 2.4% of the time across any 12-month rolling period. To look at how various stock and bond asset allocations have performed over history—and their broader correlations—the above graphic charts their best, worst, and average returns, using data from Vanguard.

How Has Asset Allocation Impacted Returns?

Based on data between 1926 and 2019, the table below looks at the spectrum of market returns of different asset allocations:

We can see that a portfolio made entirely of stocks returned 10.3% on average, the highest across all asset allocations. Of course, this came with wider return variance, hitting an annual low of -43% and a high of 54%.

A traditional 60/40 portfolio—which has lost its luster in recent years as low interest rates have led to lower bond returns—saw an average historical return of 8.8%. As interest rates have climbed in recent years, this may widen its appeal once again as bond returns may rise.

Meanwhile, a 100% bond portfolio averaged 5.3% in annual returns over the period. Bonds typically serve as a hedge against portfolio losses thanks to their typically negative historical correlation to stocks.

A Closer Look at Historical Correlations

To understand how 2022 was an outlier in terms of asset correlations we can look at the graphic below:

The last time stocks and bonds moved together in a negative direction was in 1969. At the time, inflation was accelerating and the Fed was hiking interest rates to cool rising costs. In fact, historically, when inflation surges, stocks and bonds have often moved in similar directions. Underscoring this divergence is real interest rate volatility. When real interest rates are a driving force in the market, as we have seen in the last year, it hurts both stock and bond returns. This is because higher interest rates can reduce the future cash flows of these investments. Adding another layer is the level of risk appetite among investors. When the economic outlook is uncertain and interest rate volatility is high, investors are more likely to take risk off their portfolios and demand higher returns for taking on higher risk. This can push down equity and bond prices. On the other hand, if the economic outlook is positive, investors may be willing to take on more risk, in turn potentially boosting equity prices.

Current Investment Returns in Context

Today, financial markets are seeing sharp swings as the ripple effects of higher interest rates are sinking in. For investors, historical data provides insight on long-term asset allocation trends. Over the last century, cycles of high interest rates have come and gone. Both equity and bond investment returns have been resilient for investors who stay the course.