Over time, advice for living longer has become more practical: eat well, get regular exercise, seek medical advice. However, as life expectancies increase, many individuals will struggle to save enough for their lengthy retirement years. Today’s infographic comes from New York Life Investments, and it uncovers how holding a stronger equity weighting in your portfolio may help you save enough funds for your lifespan.

Longer Life Expectancies

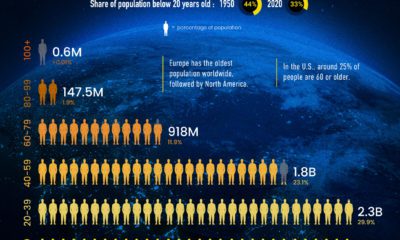

Around the world, more people are living longer. Despite this, many people underestimate how long they’ll live. Why?

They compare to older relatives. Approximately 25% of variation in lifespan is a product of ancestry, but it’s not the only factor that matters. Gender, lifestyle, exercise, diet, and even socioeconomic status also have a large impact. Even more importantly, breakthroughs in healthcare and technology have contributed to longer life expectancies over the last century. They refer to life expectancy at birth. This is the most commonly quoted statistic. However, life expectancies rise as individuals age. This is because they have survived many potential causes of untimely death — including higher mortality risks often associated with childhood.

Longevity Risk

Amid the longer lifespans and inaccurate predictions, a problem is brewing. Currently, 35% of U.S. households do not participate in any retirement savings plan. Among those who do, the median household only has $1,100 in its retirement account. Enter longevity risk: many investors are facing the possibility that they will outlive their retirement savings. So, what’s the solution? One strategy lies in the composition of an investor’s portfolio.

The Case for a Stronger Equity Weighting

One of the most important decisions an investor will make is their asset allocation. As a guide, many individuals have referred to the “100-age” rule. For example, a 40-year-old would hold 60% in stocks while an 80-year-old would hold 20% in stocks. As life expectancies rise and time horizons lengthen, a more aggressive portfolio has become increasingly important. Today, professionals suggest a rule closer to 110-age or 120-age. There are many reasons why investors should consider holding a strong equity weighting.

Higher Risk, Higher Potential Reward

Holding equities can be an exercise in psychological discipline. An investor must be able to ride out the ups and downs in the stock market. If they can, there’s a good chance they will be rewarded. By allocating more of their portfolio to equities, investors greatly increase the odds of retiring whenever they want — with funds that will last their entire lifetime. on Last year, stock and bond returns tumbled after the Federal Reserve hiked interest rates at the fastest speed in 40 years. It was the first time in decades that both asset classes posted negative annual investment returns in tandem. Over four decades, this has happened 2.4% of the time across any 12-month rolling period. To look at how various stock and bond asset allocations have performed over history—and their broader correlations—the above graphic charts their best, worst, and average returns, using data from Vanguard.

How Has Asset Allocation Impacted Returns?

Based on data between 1926 and 2019, the table below looks at the spectrum of market returns of different asset allocations:

We can see that a portfolio made entirely of stocks returned 10.3% on average, the highest across all asset allocations. Of course, this came with wider return variance, hitting an annual low of -43% and a high of 54%.

A traditional 60/40 portfolio—which has lost its luster in recent years as low interest rates have led to lower bond returns—saw an average historical return of 8.8%. As interest rates have climbed in recent years, this may widen its appeal once again as bond returns may rise.

Meanwhile, a 100% bond portfolio averaged 5.3% in annual returns over the period. Bonds typically serve as a hedge against portfolio losses thanks to their typically negative historical correlation to stocks.

A Closer Look at Historical Correlations

To understand how 2022 was an outlier in terms of asset correlations we can look at the graphic below:

The last time stocks and bonds moved together in a negative direction was in 1969. At the time, inflation was accelerating and the Fed was hiking interest rates to cool rising costs. In fact, historically, when inflation surges, stocks and bonds have often moved in similar directions. Underscoring this divergence is real interest rate volatility. When real interest rates are a driving force in the market, as we have seen in the last year, it hurts both stock and bond returns. This is because higher interest rates can reduce the future cash flows of these investments. Adding another layer is the level of risk appetite among investors. When the economic outlook is uncertain and interest rate volatility is high, investors are more likely to take risk off their portfolios and demand higher returns for taking on higher risk. This can push down equity and bond prices. On the other hand, if the economic outlook is positive, investors may be willing to take on more risk, in turn potentially boosting equity prices.

Current Investment Returns in Context

Today, financial markets are seeing sharp swings as the ripple effects of higher interest rates are sinking in. For investors, historical data provides insight on long-term asset allocation trends. Over the last century, cycles of high interest rates have come and gone. Both equity and bond investment returns have been resilient for investors who stay the course.