But like any other area of personal finance expertise, real estate investing boils down to some simple basics. With the right strategies, patience, and a willingness to learn, it’s a discipline that can help you make strides on the path to financial independence.

Strategies For Real Estate Investing

Today’s infographic comes to us from Offer Climb and it dives into four timeless real estate investing strategies worth knowing. Whether you aim to do a quick “lipstick” flip or you’d prefer to generate passive income over time, here are the details and resources needed to execute on each strategy.

Although buying and holding is the most common and traditional strategy used for real estate investing, there is actually a variety of different strategies used. Some of these are simple and can be executed in just days, while others can be used on an ongoing basis to create long-term value.

How Does Each Strategy Work?

The appropriateness of each strategy below depends on your goals, risk tolerance, and local housing market. For the average investor, it is obvious that some of these strategies would also not likely be suited for booming markets like San Francisco, New York City, Vancouver, or Toronto, where multi-million dollar prices are the norm, and bubble risk is higher.

- The “Lipstick” Flip The first impression of a house is incredibly important. The “Lipstick” flip involves buying a house that can be easily improved, and then making minimal cosmetic improvements and repairs to sell for a better price. For the right property, taking the time to fix small issues with flooring, walls, landscaping, and paint can pay off almost immediately.

- Buy and Hold This is one of the oldest strategies in the book, and it’s designed for long-term passive income. By purchasing a property and leasing it to tenants, it creates a stream of monthly cash flows, and even offers potential tax benefits for the owner.

- Wholesale This has similarities to flipping, but involves finding a buyer for a seller and taking a percentage off the sale. If done right, this can be done quickly and with minimal risk.

- Buy, Renovate, Rent, Refinance, and Repeat Likely the most complex strategy in real estate investing for beginners to follow, this can ultimately be used to provide benefits in both the short and long term. It involves four steps: buying a property, renovating it, renting the property out to tenants, and then refinancing the mortgage later on. Then the process repeats itself. Of course, this strategy works best in places where property values are rising fast.

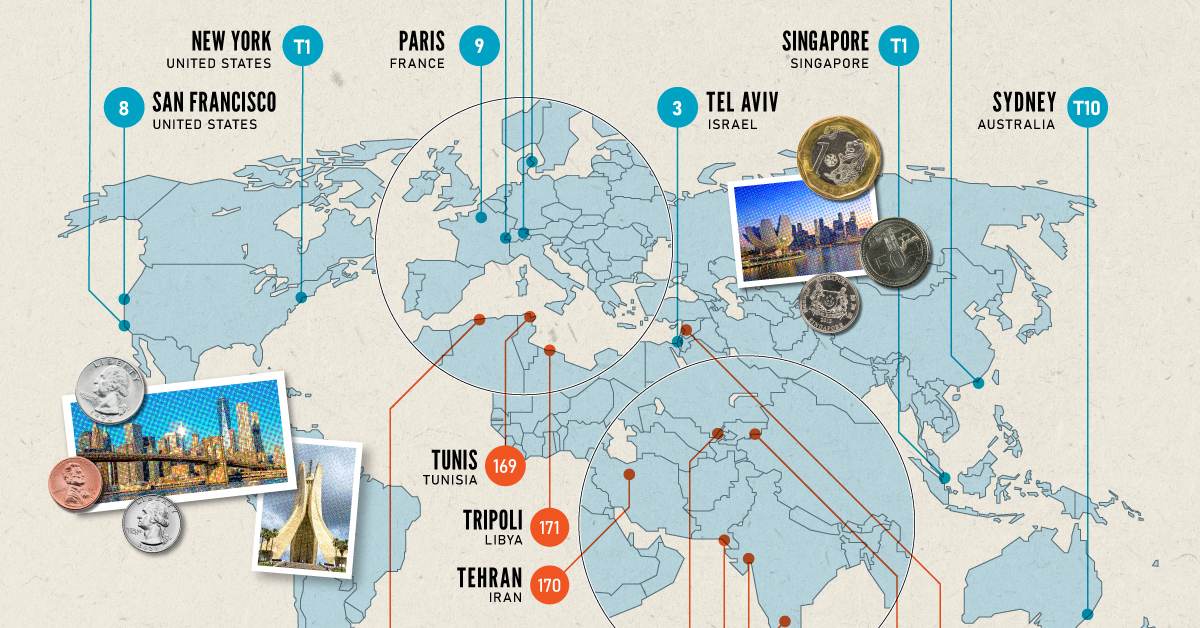

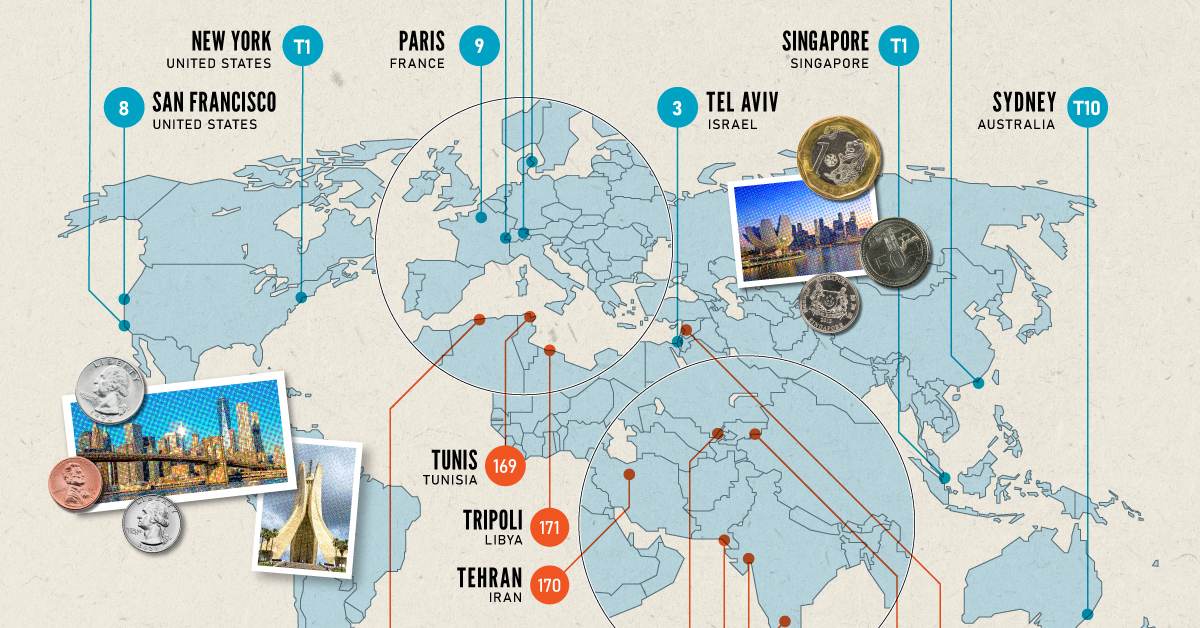

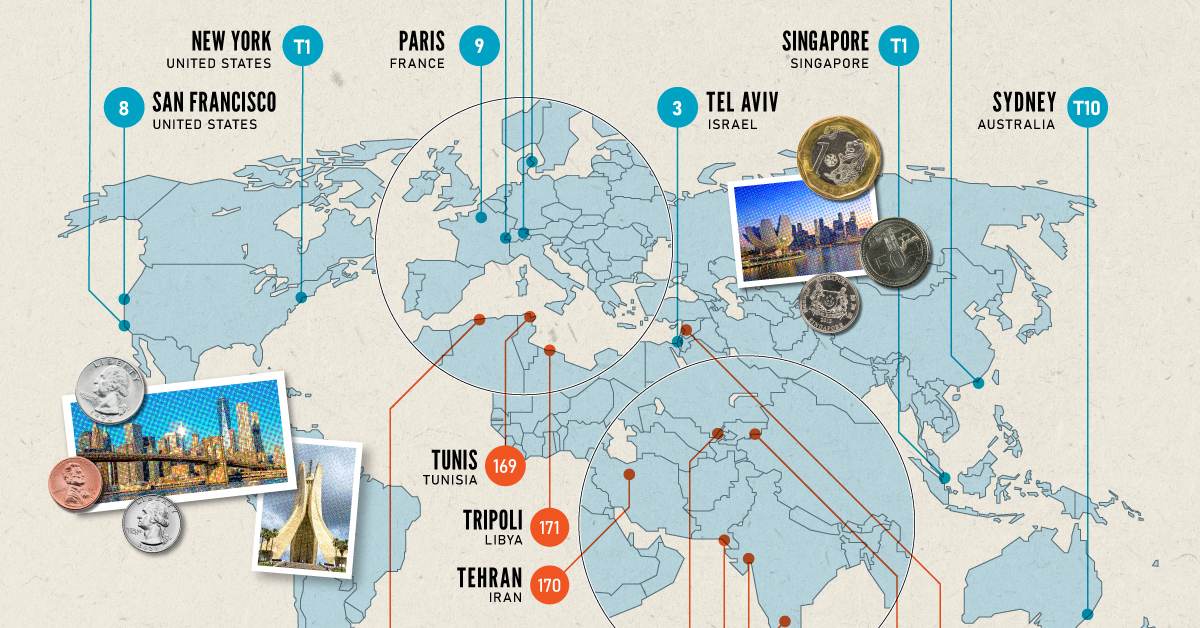

on Cities become “expensive” due to a variety of factors such as high demand for housing, a concentration of high-paying businesses and industries, and a high standard of living. Additionally, factors such as taxes, transportation costs, and availability of goods and services can also contribute to the overall cost of living in global cities. The infographic above uses data from EIU to rank the world most and least expensive cities to live in. To make the list, the EIU examines 400+ prices for over 200 products and services in 172 cities, surveying a variety of businesses to track price fluctuations over the last year.

Inflation + Strong Currency = Expensive Cities

If you live in a city where many residents find it challenging to put a roof over their heads, food on their plates, and make ends meet, you live in an expensive city. But if this inflation is compounded with a strong national currency, you may live in one of the world’s most expensive cities. Singapore and New York City tied for the first rank amongst the world’s most expensive cities in 2022, pushing Israel’s Tel Aviv from the first place in 2021 to the third place in 2022. Both these cities had high inflation and a strong currency. Surprisingly, this is the Big Apple’s first time atop the ranking. The city with one of the most expensive real estate markets worldwide, Hong Kong ranked fourth in this list, followed by Los Angeles, which moved up from its ninth rank in 2021.

Poor Economies = Cheaper Cities

Asia continues to dominate the list of the world’s least expensive cities, followed by parts of North Africa and the Middle East. Though affordability sounds good at face value, sitting at the bottom of the ranking isn’t necessarily a coveted position. While the cost of living in some of the cities in these nations is low, it comes at the price of a weak currency, poor economy, and, in many cases, political and economic turmoil. The decade-long conflict in Syria weakened the Syrian pound, led to a spiraling inflation and fuel shortages, and further collapsed its economy. It’s no surprise that its capital city of Damascus has maintained its position as the world’s cheapest city. Tripoli and Tehran, the capitals of Libya and Iran, respectively, follow next on this list, reflecting their weakened economies. Meanwhile, seven cities in Asia with the common denominator of high-income inequality and low wages dominate the list of the world’s cheapest cities. These include three Indian cities, Tashkent in Uzbekistan, Almaty in Kazakhstan, Pakistan’s most populous city of Karachi, and Sri Lankan capital–Colombo.