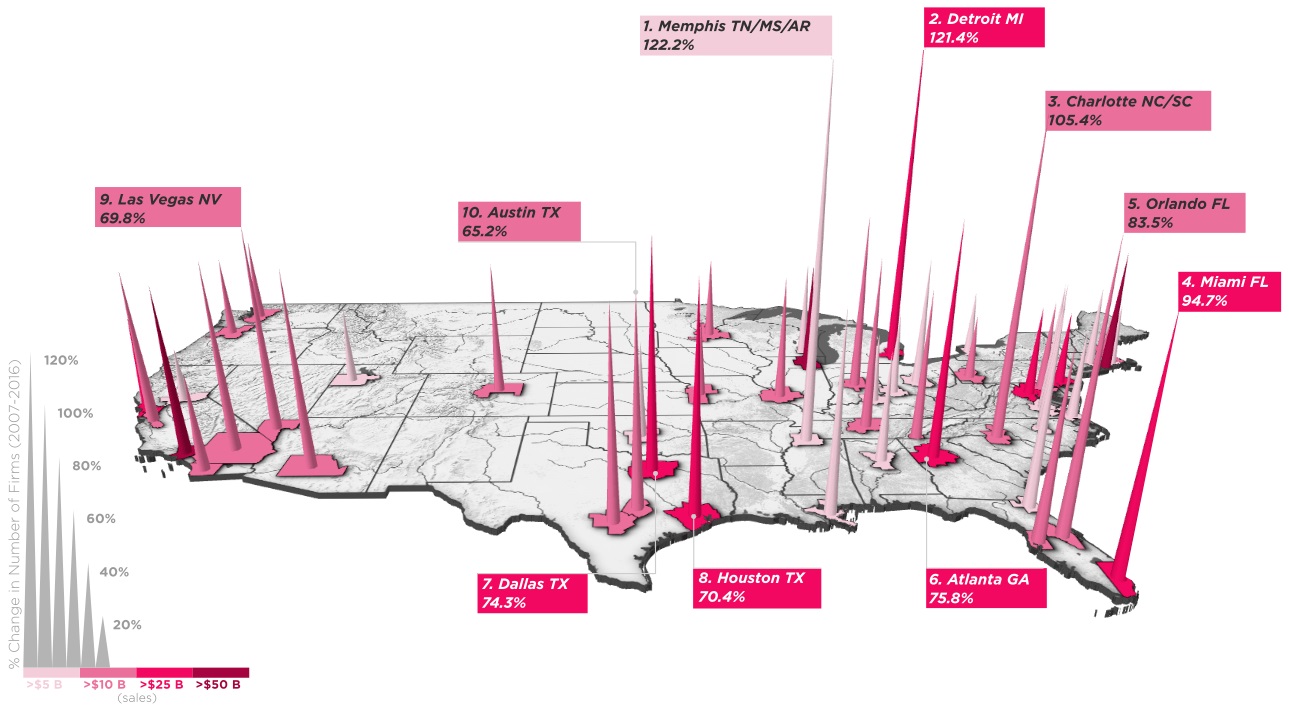

The proof? In the last decade, the number of women-owned firms nationwide has grown by over 3.5 million, now representing 38% of all businesses in the United States. Today’s map from HowMuch.net shows the top American cities where business is booming for women entrepreneurs.

Where are Women-Owned Businesses Growing Fastest?

Looking at the percentage growth in women-owned businesses tells us a lot about the way local economies have developed in the past decade. Though women-owned firms in larger cities may have more absolute growth and revenue, a high growth rate shows the rapid emergence of a business community where there may have not been one before. Memphis’ women are leading the charge in the development of their city’s relatively small economy. Though the city is ranked only 45th in terms of revenue generation by women-owned firms, it’s adding new women-owned businesses at a very rapid pace. The growth rate in Memphis of 122.2% between 2007-2016 leads the nation, making it one of only three cities (along with Charlotte and Detroit) where women-led business growth has more than doubled since 2007.

Absolute Growth Numbers

More metropolitan cities like New York or Los Angeles already have a bigger base of women entrepreneurs to start with, so their percentage growth is not high enough to show up on the aforementioned map. However, it is worth looking at where the most women-owned businesses are being added (in absolute terms) as well: Interestingly enough, certain cities appear on both lists, showing impressive growth both in relative and absolute terms. Detroit and Miami are fairly unique in that they make the top five on both lists. Detroit grew its women-owned businesses by 121.4%, or 140,000 in absolute terms. Meanwhile, Miami grew at 94.7% to add 220,000 businesses since 2007. Houston and Atlanta are two other cities that fare very well on both lists.

Sponsored Infographics

The Money Project

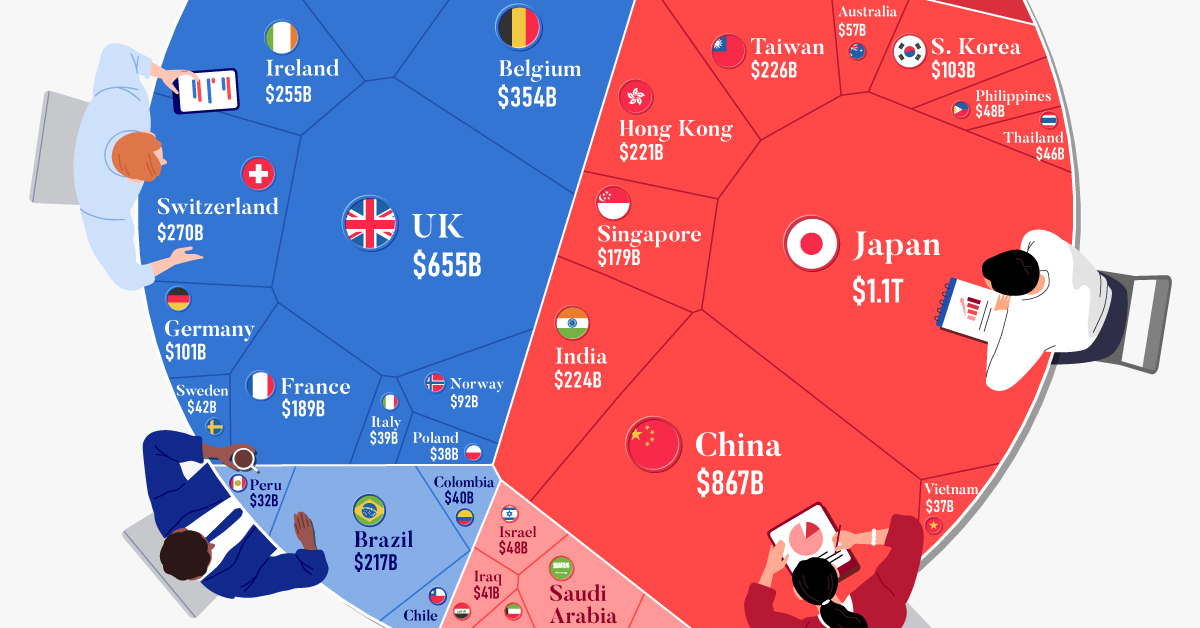

on These are in the form of Treasury securities, some of the most liquid assets worldwide. Central banks use them for foreign exchange reserves and private investors flock to them during flights to safety thanks to their perceived low default risk. Beyond these reasons, foreign investors may buy Treasuries as a store of value. They are often used as collateral during certain international trade transactions, or countries can use them to help manage exchange rate policy. For example, countries may buy Treasuries to protect their currency’s exchange rate from speculation. In the above graphic, we show the foreign holders of the U.S. national debt using data from the U.S. Department of the Treasury.

Top Foreign Holders of U.S. Debt

With $1.1 trillion in Treasury holdings, Japan is the largest foreign holder of U.S. debt. Japan surpassed China as the top holder in 2019 as China shed over $250 billion, or 30% of its holdings in four years. This bond offloading by China is the one way the country can manage the yuan’s exchange rate. This is because if it sells dollars, it can buy the yuan when the currency falls. At the same time, China doesn’t solely use the dollar to manage its currency—it now uses a basket of currencies. Here are the countries that hold the most U.S. debt: As the above table shows, the United Kingdom is the third highest holder, at over $655 billion in Treasuries. Across Europe, 13 countries are notable holders of these securities, the highest in any region, followed by Asia-Pacific at 11 different holders. A handful of small nations own a surprising amount of U.S. debt. With a population of 70,000, the Cayman Islands own a towering amount of Treasury bonds to the tune of $284 billion. There are more hedge funds domiciled in the Cayman Islands per capita than any other nation worldwide. In fact, the four smallest nations in the visualization above—Cayman Islands, Bermuda, Bahamas, and Luxembourg—have a combined population of just 1.2 million people, but own a staggering $741 billion in Treasuries.

Interest Rates and Treasury Market Dynamics

Over 2022, foreign demand for Treasuries sank 6% as higher interest rates and a strong U.S. dollar made owning these bonds less profitable. This is because rising interest rates on U.S. debt makes the present value of their future income payments lower. Meanwhile, their prices also fall. As the chart below shows, this drop in demand is a sharp reversal from 2018-2020, when demand jumped as interest rates hovered at historic lows. A similar trend took place in the decade after the 2008-09 financial crisis when U.S. debt holdings effectively tripled from $2 to $6 trillion.

Driving this trend was China’s rapid purchase of Treasuries, which ballooned from $100 billion in 2002 to a peak of $1.3 trillion in 2013. As the country’s exports and output expanded, it sold yuan and bought dollars to help alleviate exchange rate pressure on its currency. Fast-forward to today, and global interest-rate uncertainty—which in turn can impact national currency valuations and therefore demand for Treasuries—continues to be a factor impacting the future direction of foreign U.S. debt holdings.