The World’s Most Famous Case of Deflation (Part 1 of 2)

The Money Project is an ongoing collaboration between Visual Capitalist and Texas Precious Metals that seeks to use intuitive visualizations to explore the origins, nature, and use of money. The Great Depression was the most severe economic depression ever experienced by the Western world. It was during this troubled time that the world’s most famous case of deflation also happened. The resulting aftermath was so bad that economic policy since has been chiefly designed to prevent deflation at all costs.

Setting the Stage

The transition from wartime to peacetime created a bumpy economic road after World War I.

Growth has hard to come by in the first years after the war, and by 1920-21 the economy fell into a brief deflationary depression. Prices dropped -18%, and unemployment jumped up to 11.7% in 1921.

However, the troubles wouldn’t last. During the “Roaring Twenties”, economic growth picked up as the new technologies like the automobile, household appliances, and other mass-produced products led to a vibrant consumer culture and growth in the economy.

More than half of the automobiles in the nation were sold on credit by the end of the 1920s. Consumer debt more than doubled during the decade.

While GDP growth during this period was extremely strong, the Roaring Twenties also had a dark side. Income inequality during this era was the highest in American history. By 1929, the income of the top 1% had increased by 75%. Income for the rest of people (99%) increased by only 9%.

The Roaring Twenties ended with a bang. On Black Thursday (Oct 24, 1929), the Dow Jones Industrial Average plunged 11% at the open in very heavy volume, precipitating the Wall Street crash of 1929 and the subsequent Great Depression of the 1930s.

The Cause of the Great Depression

Economists continue to debate to this day on the cause of the Great Depression. Here’s perspectives from three different economic schools: Keynesian: John Maynard Keynes saw the causes of the Great Depression hinge upon a lack of aggregate demand. This later became the subject of his most influential work, The General Theory of Employment, Interest, and Money, which was published in 1936. Keynes argued that the solution was to stimulate the economy through some combination of two approaches: 1. A reduction in interest rates (monetary policy), and 2. Government investment in infrastructure (fiscal policy). “The difficulty lies not so much in developing new ideas as in escaping from old ones.” – John Maynard Keynes Monetarist: Monetarists such as Milton Friedman viewed the cause of the Great Depression as a fall in the money supply. Friedman and Schwartz argue that people wanted to hold more money than the Federal Reserve was supplying. As a result, people hoarded money by consuming less. This caused a contraction in employment and production since prices were not flexible enough to immediately fall. “The Great Depression, like most other periods of severe unemployment, was produced by government mismanagement rather than by any inherent instability of the private economy.” ― Milton Friedman Austrian: Austrian economists argue that the Great Depression was the inevitable outcome of the monetary policies of the Federal Reserve during the 1920s. In their opinion, the central bank’s policy was an “easy credit policy” which led to an unsustainable credit-driven boom. “Any increase in the relative size of government in the economy, therefore, shifts the societal consumption-investment ratio in favor of consumption, and prolongs the depression.” – Murray Rothbard

The Great Depression and Deflation

Between 1929 and 1932, worldwide GDP fell by an estimated 15%. Deflation hit. Personal income, tax revenue, profits and prices plunged. International trade fell by more than 50%. Unemployment in the U.S. rose to 25% and in some countries rose as high as 33%. These statistics were only the tip of the iceberg. Learn about the full effects, the stories, and the recovery from the Great Depression in Part 2.

About the Money Project

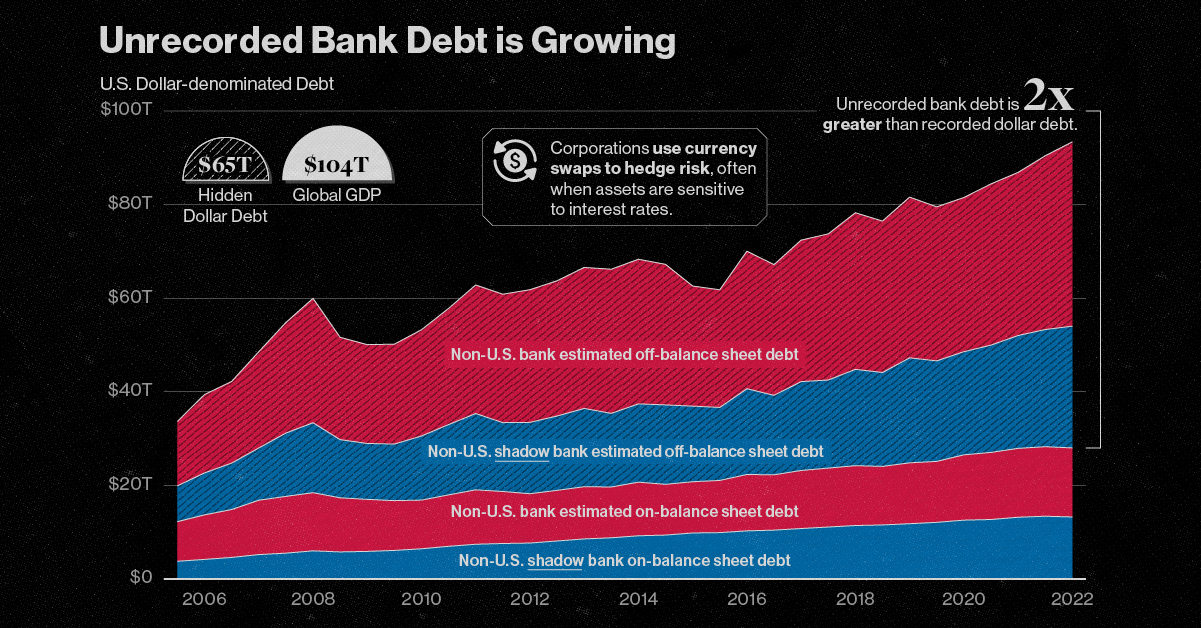

The Money Project aims to use intuitive visualizations to explore ideas around the very concept of money itself. Founded in 2015 by Visual Capitalist and Texas Precious Metals, the Money Project will look at the evolving nature of money, and will try to answer the difficult questions that prevent us from truly understanding the role that money plays in finance, investments, and accumulating wealth. on The scale of hidden dollar debt around the world is huge. No less than $65 trillion in unrecorded dollar debt circulates across the global financial system in non-U.S. banks and shadow banks. To put in perspective, global GDP sits at $104 trillion. This dollar debt is in the form of foreign-exchange swaps, which have exploded over the last decade due to years of monetary easing and ultra-low interest rates, as investors searched for higher yields. Today, unrecorded debt from these foreign-exchange swaps is worth more than double the dollar debt officially recorded on balance sheets across these institutions. Based on analysis from the Bank of International Settlements (BIS), the above infographic charts the rise in hidden dollar debt across non-U.S. financial institutions and examines the wider implications of its growth.

Dollar Debt: A Beginners Guide

To start, we will briefly look at the role of foreign-exchange (forex) swaps in the global economy. The forex market is the largest in the world by a long stretch, with trillions traded daily. Some of the key players that use foreign-exchange swaps are:

Corporations Financial institutions Central banks

To understand forex swaps is to look at the role of currency risk. As we have seen in 2022, the U.S. dollar has been on a tear. When this happens, it hurts company earnings that generate revenue across borders. That’s because they earn revenue in foreign currencies (which have likely declined in value against the dollar) but end up converting earnings to U.S. dollars. In order to reduce currency risk, market participants will buy forex swaps. Here, two parties agree to exchange one currency for another. In short, this helps protect the company from unfavorable foreign exchange rates. What’s more, due to accounting rules, forex swaps are often unrecorded on balance sheets, and as a result are quite opaque.

A Mountain of Debt

Since 2008, the value of this opaque, unrecorded dollar debt has nearly doubled.

*As of June 30, 2022

Driving its rise in part was an era of rock-bottom interest rates globally. As investors sought out higher returns, they took on greater leverage—and forex swaps are one example of this.

Now, as interest rates have been rising, forex swaps have increased amid higher market volatility as investors look to hedge currency risk. This appears in both non-U.S. banks and non-U.S. shadow banks, which are unregulated financial intermediaries.

Overall, the value of unrecorded debt is staggering. An estimated $39 trillion is held by non-U.S. banks along with $26 trillion in overseas shadow banks around the world.

Past Case Studies

Why does the massive growth in dollar debt present risks? During the market crashes of 2008 and 2020, forex swaps faced a funding squeeze. To borrow U.S. dollars, market participants had to pay high rates. A lot of this hinged on the impact of extreme volatility on these swaps, putting pressure on funding rates. Here are two examples of how volatility can heighten risk in the forex market:

Exchange-rate volatility: Sharp swings in USD can spur a liquidity crunch U.S. interest-rate volatility: Sudden rate fluctuations can mean much higher costs for these trades

In both cases, the U.S. central bank had to step in to provide liquidity in the market and prevent dollar shortages. This was done through pumping cash into the system and creating swap lines with other non-U.S. banks such as the Bank of Canada or the Bank of Japan. These were designed to protect from declining currency values and a liquidity crunch.

Dollar Debt: The Wider Implications

The risk from growing dollar debt and these swap lines arises when a non-U.S. bank or shadow bank may not be able to hold up their end of the agreement. In fact, on a daily basis, there is an estimated $2.2 trillion in forex swaps exposed to settlement risk. Given its vast scale, this dollar debt could have greater systemic spillover effects. If participants fail to pay it could undermine financial market stability. Because demand for U.S. dollars increases during market uncertainty, a worsening economic climate could potentially expose the forex market to more vulnerabilities.