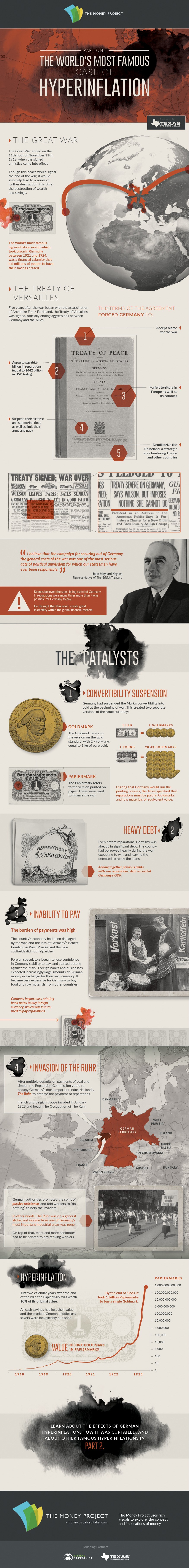

The World’s Most Famous Case of Hyperinflation (Part 1 of 2)

The Money Project is an ongoing collaboration between Visual Capitalist and Texas Precious Metals that seeks to use intuitive visualizations to explore the origins, nature, and use of money. The Great War ended on the 11th hour of November 11th, 1918, when the signed armistice came into effect. Though this peace would signal the end of the war, it would also help lead to a series of further destruction: this time the destruction of wealth and savings. The world’s most famous hyperinflation event, which took place in Germany from 1921 and 1924, was a financial calamity that led millions of people to have their savings erased.

The Treaty of Versailles

Five years after the assassination of Archduke Franz Ferdinand, the Treaty of Versailles was signed, officially ending the state of war between Germany and the Allies. The terms of the agreement, which were essentially forced upon Germany, made the country: “I believe that the campaign for securing out of Germany the general costs of the war was one of the most serious acts of political unwisdom for which our statesmen have ever been responsible.” – John Maynard Keynes, representative of the British Treasury Keynes believed the sums being asked of Germany in reparations were many times more than it was possible for Germany to pay. He thought that this could create large amounts of instability with the global financial system.

The Catalysts

- Germany had suspended the Mark’s convertibility into gold at the beginning of war. This created two separate versions of the same currency: Goldmark: The Goldmark refers to the version on the gold standard, with 2790 Mark equal to 1 kg of pure gold. This meant: 1 USD = 4 Goldmarks, £1 = 20.43 Goldmarks Papiermark: The Papiermark refers to the version printed on paper. These were used to finance the war. In fear that Germany would run the printing presses, the Allies specified that reparations must be paid in the Goldmarks and raw materials of equivalent value.

- Heavy Debt Even before reparations, Germany was already in significant debt. The country had borrowed heavily during the war with expectations that it would be won, leaving the losers repay the loans. Adding together previous debts with the reparations, debt exceeded Germany’s GDP.

- Inability to Pay The burden of payments was high. The country’s economy had been damaged by the war, and the loss of Germany’s richest farmland (West Prussia) and the Saar coalfields did not help either. Foreign speculators began to lose confidence in Germany’s ability to pay, and started betting against the Mark. Foreign banks and businesses expected increasingly large amounts of German money in exchange for their own currency. It became very expensive for Germany to buy food and raw materials from other countries. Germany began mass printing bank notes to buy foreign currency, which was in turn used to pay reparations.

- Invasion of The Ruhr

After multiple defaults on payments of coal and timber, the Reparation Commission voted to occupy Germany’s most important industrial lands (The Ruhr) to enforce the payment of reparations.

French and Belgian troops invaded in January 1923 and began The Occupation of The Ruhr.

German authorities promoted the spirit of passive resistance, and told workers to “do nothing” to help the invaders. In other words, The Ruhr was in a general strike, and income from one of Germany’s most important industrial areas was gone.

On top of that, more and more banknotes had to be printed to pay striking workers.

Hyperinflation

Just two calendar years after the end of the war, the Papiermark was worth 10% of its original value. By the end of 1923, it took 1 trillion Papiermarks to buy a single Goldmark. All cash savings had lost their value, and the prudent German middleclass savers were inexplicably punished. Learn about the effects of German hyperinflation, how it was curtailed, and about other famous hyperinflations in Part 2 (released sometime the week of Jan 18-22, 2016).

About the Money Project

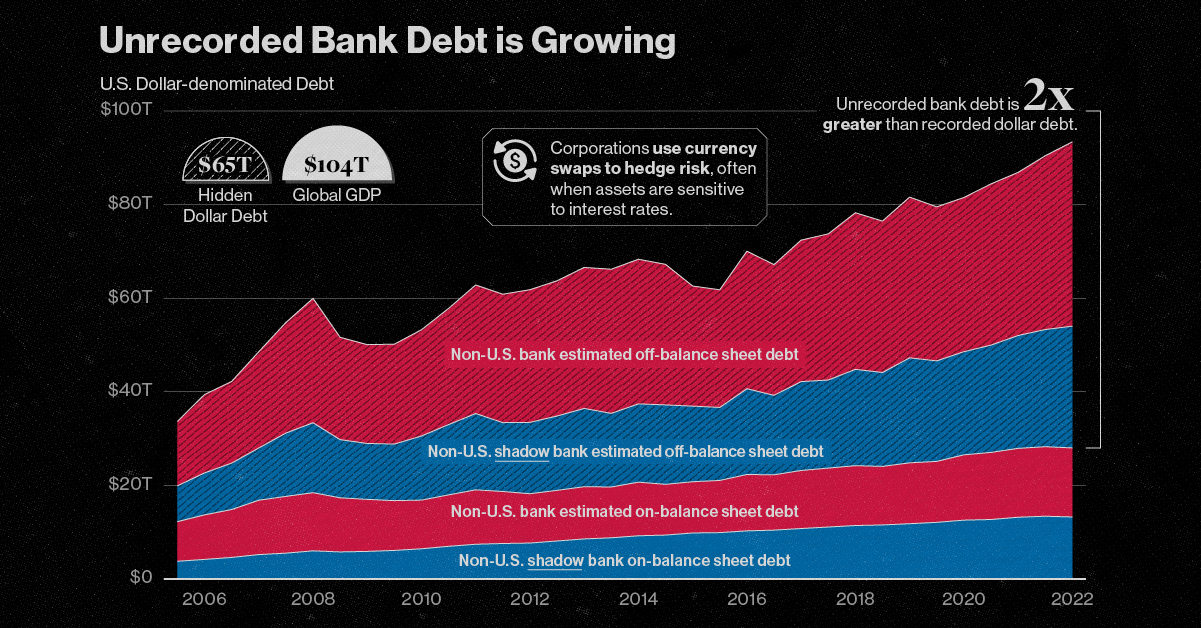

The Money Project aims to use intuitive visualizations to explore ideas around the very concept of money itself. Founded in 2015 by Visual Capitalist and Texas Precious Metals, the Money Project will look at the evolving nature of money, and will try to answer the difficult questions that prevent us from truly understanding the role that money plays in finance, investments, and accumulating wealth. on The scale of hidden dollar debt around the world is huge. No less than $65 trillion in unrecorded dollar debt circulates across the global financial system in non-U.S. banks and shadow banks. To put in perspective, global GDP sits at $104 trillion. This dollar debt is in the form of foreign-exchange swaps, which have exploded over the last decade due to years of monetary easing and ultra-low interest rates, as investors searched for higher yields. Today, unrecorded debt from these foreign-exchange swaps is worth more than double the dollar debt officially recorded on balance sheets across these institutions. Based on analysis from the Bank of International Settlements (BIS), the above infographic charts the rise in hidden dollar debt across non-U.S. financial institutions and examines the wider implications of its growth.

Dollar Debt: A Beginners Guide

To start, we will briefly look at the role of foreign-exchange (forex) swaps in the global economy. The forex market is the largest in the world by a long stretch, with trillions traded daily. Some of the key players that use foreign-exchange swaps are:

Corporations Financial institutions Central banks

To understand forex swaps is to look at the role of currency risk. As we have seen in 2022, the U.S. dollar has been on a tear. When this happens, it hurts company earnings that generate revenue across borders. That’s because they earn revenue in foreign currencies (which have likely declined in value against the dollar) but end up converting earnings to U.S. dollars. In order to reduce currency risk, market participants will buy forex swaps. Here, two parties agree to exchange one currency for another. In short, this helps protect the company from unfavorable foreign exchange rates. What’s more, due to accounting rules, forex swaps are often unrecorded on balance sheets, and as a result are quite opaque.

A Mountain of Debt

Since 2008, the value of this opaque, unrecorded dollar debt has nearly doubled.

*As of June 30, 2022

Driving its rise in part was an era of rock-bottom interest rates globally. As investors sought out higher returns, they took on greater leverage—and forex swaps are one example of this.

Now, as interest rates have been rising, forex swaps have increased amid higher market volatility as investors look to hedge currency risk. This appears in both non-U.S. banks and non-U.S. shadow banks, which are unregulated financial intermediaries.

Overall, the value of unrecorded debt is staggering. An estimated $39 trillion is held by non-U.S. banks along with $26 trillion in overseas shadow banks around the world.

Past Case Studies

Why does the massive growth in dollar debt present risks? During the market crashes of 2008 and 2020, forex swaps faced a funding squeeze. To borrow U.S. dollars, market participants had to pay high rates. A lot of this hinged on the impact of extreme volatility on these swaps, putting pressure on funding rates. Here are two examples of how volatility can heighten risk in the forex market:

Exchange-rate volatility: Sharp swings in USD can spur a liquidity crunch U.S. interest-rate volatility: Sudden rate fluctuations can mean much higher costs for these trades

In both cases, the U.S. central bank had to step in to provide liquidity in the market and prevent dollar shortages. This was done through pumping cash into the system and creating swap lines with other non-U.S. banks such as the Bank of Canada or the Bank of Japan. These were designed to protect from declining currency values and a liquidity crunch.

Dollar Debt: The Wider Implications

The risk from growing dollar debt and these swap lines arises when a non-U.S. bank or shadow bank may not be able to hold up their end of the agreement. In fact, on a daily basis, there is an estimated $2.2 trillion in forex swaps exposed to settlement risk. Given its vast scale, this dollar debt could have greater systemic spillover effects. If participants fail to pay it could undermine financial market stability. Because demand for U.S. dollars increases during market uncertainty, a worsening economic climate could potentially expose the forex market to more vulnerabilities.