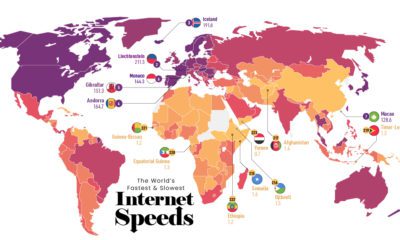

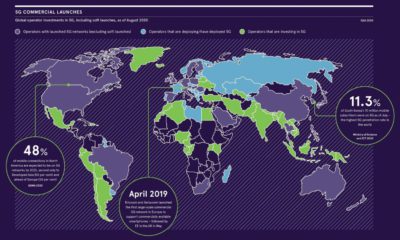

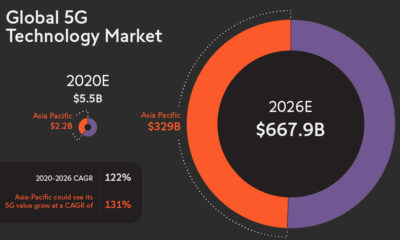

We’re on the cusp of a 5G revolution. Whereas 4G brought us the network speeds necessary for online apps and mobile-streaming, 5G represents a monumental leap forward. Beyond the improvements to our existing ecosystem of devices—more speed and better stability—researchers believe that 5G can serve as the underpinning for fully-connected industries and cities. Change doesn’t happen overnight, and for us to experience 5G’s true potential, we’ll need to be patient. In light of this, today’s infographic from Raconteur visualizes the forecasted impact of 5G to help us identify the countries and industries that will most effectively leverage its power.

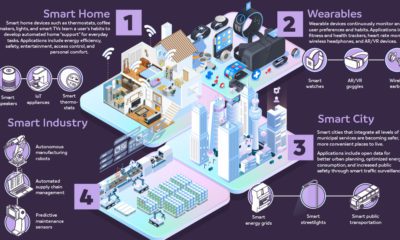

5G-Empowered Industries

5G networks are expected to generate $13.2 trillion in global sales activity by 2035. To make this easier to digest, here are the five industries which stand to benefit the most. Let’s focus on manufacturing, an industry which is expected to see a massive $4.6 trillion in 5G-enabled sales. Efficiency is the name of the game here, and researchers predict that this technology will allow for the world’s first “smart factories”. Such factories would leverage the faster speed and reliability of 5G networks to eliminate cabled connections, improve automated processes, and most importantly, gather more data. – AT&T Business Editorial Robots won’t be the only ones to benefit, however. While today’s factories may be lined with machines, humans are still required to be onsite for troubleshooting when issues arise. Some processes may also be too intricate to be effectively automated, thus requiring a human’s touch. With the lower latencies (shorter delay) boasted by 5G networks, virtual and augmented reality devices can become reliable enough for use in high precision work. This exciting development has the potential to greatly increase a human worker’s productivity, as well as allow them to work in closer harmony with robots. In fact, such technologies are already being used on factory floors.

Leading The Way

Developing 5G networks and implementing them into the many industries of the global economy is a massive undertaking, and just seven countries are expected to account for 79% of all 5G-related investment. By 2035, here’s how these countries are expected to rank. Incidentally, these seven nations are also some of the world’s most innovative economies. Let’s take a closer look at the two biggest players in 5G development.

United States

It’s not a surprise to see the U.S. on top in terms of 5G investment, though it seems the country is in a peculiar position. China is right on their heels in terms of investment, and is even forecasted to surpass them in 5G-enabled output and employment. Chinese tech giant Huawei is likely a factor behind these numbers. The company—which America has no direct rival to—is currently the world’s largest manufacturer of telecommunications equipment. Developments such as these have formed the general consensus that China is winning the “5G race”, but putting America down for a second place finish may be a mistake. With renowned tech hubs like Silicon Valley, the U.S. still leads the rest of the world in terms of patent activity and high-tech company density. – Adam Segal, Director, Council on Foreign Relations Part of what makes 5G so special is its potential to be used across a wider variety of applications including autonomous vehicles and manufacturing. Perhaps it’s here where American tech firms can use their innovative capacity and software expertise to carve out an advantage.

China

Being the world’s largest manufacturer means China is well-positioned to leverage the power of 5G networks. With nearly 11 million 5G-enabled jobs and over $1.3 trillion in output by 2035, China’s estimates are magnitudes larger than the other countries on this list. A reason why China is such a cost-efficient place to make things is its well-established network of suppliers, manufacturers, and distributors. All three of these sectors are likely to implement 5G networks for improved speed and efficiency. China is no slouch when it comes to innovation, either. In terms of patent activity, it ranks second in the world. Shenzhen, once a small fishing village, has become China’s answer to Silicon Valley, and is home to domestic telecom giants like Huawei and ZTE Corporation. Yet, China faces serious obstacles as it seeks to supply the rest of the world with 5G equipment. Huawei is the subject of U.S. sanctions over allegations of its dealings with Iran. Further skepticism arises from the company’s dubious ownership structure, reliance on state subsidies, and claims of espionage. – Foreign Policy (magazine) Regardless of the damage these controversies may cause, China shows no signs of slowing down. The country already holds bragging rights for the world’s largest 5G consumer network, and even claims to have begun research on 6G, an eventual successor to 5G.

The Waiting Game

It’s important to remember that the vast majority of 5G benefits are still years away. Thus, this next generation of mobile networks can be thought of as an enabling technology—new innovations and complementary technologies will be needed to realize its full potential. While today’s infographic paints an intuitive visualization of the 5G roadmap, only time will tell which industries and countries actually see the most benefits. on But fast forward to the end of last week, and SVB was shuttered by regulators after a panic-induced bank run. So, how exactly did this happen? We dig in below.

Road to a Bank Run

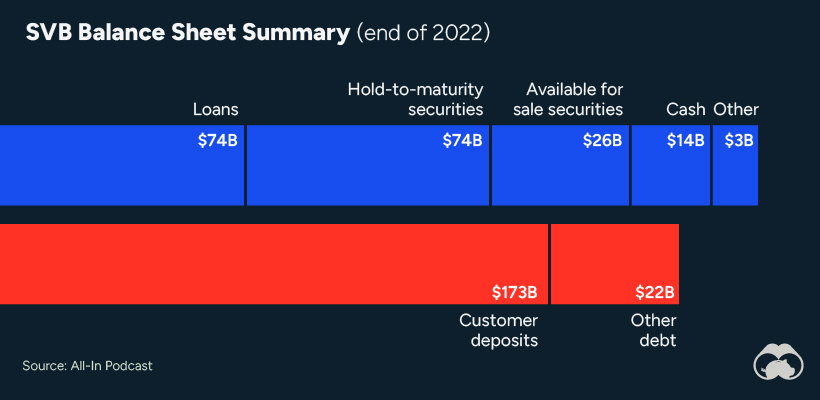

SVB and its customers generally thrived during the low interest rate era, but as rates rose, SVB found itself more exposed to risk than a typical bank. Even so, at the end of 2022, the bank’s balance sheet showed no cause for alarm.

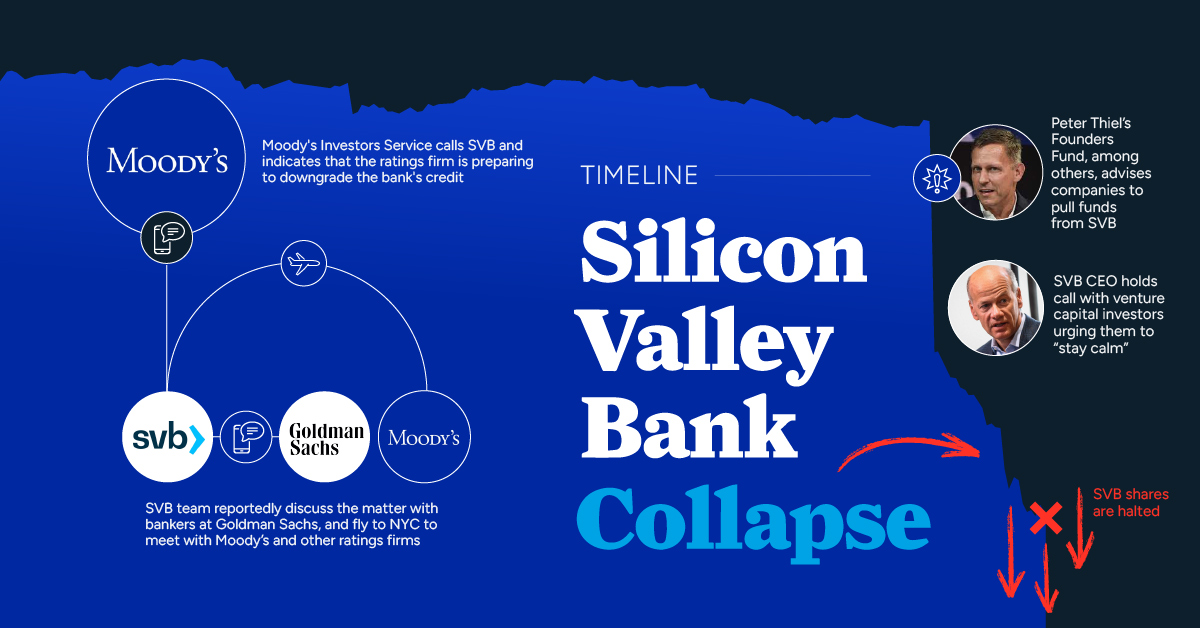

As well, the bank was viewed positively in a number of places. Most Wall Street analyst ratings were overwhelmingly positive on the bank’s stock, and Forbes had just added the bank to its Financial All-Stars list. Outward signs of trouble emerged on Wednesday, March 8th, when SVB surprised investors with news that the bank needed to raise more than $2 billion to shore up its balance sheet. The reaction from prominent venture capitalists was not positive, with Coatue Management, Union Square Ventures, and Peter Thiel’s Founders Fund moving to limit exposure to the 40-year-old bank. The influence of these firms is believed to have added fuel to the fire, and a bank run ensued. Also influencing decision making was the fact that SVB had the highest percentage of uninsured domestic deposits of all big banks. These totaled nearly $152 billion, or about 97% of all deposits. By the end of the day, customers had tried to withdraw $42 billion in deposits.

What Triggered the SVB Collapse?

While the collapse of SVB took place over the course of 44 hours, its roots trace back to the early pandemic years. In 2021, U.S. venture capital-backed companies raised a record $330 billion—double the amount seen in 2020. At the time, interest rates were at rock-bottom levels to help buoy the economy. Matt Levine sums up the situation well: “When interest rates are low everywhere, a dollar in 20 years is about as good as a dollar today, so a startup whose business model is “we will lose money for a decade building artificial intelligence, and then rake in lots of money in the far future” sounds pretty good. When interest rates are higher, a dollar today is better than a dollar tomorrow, so investors want cash flows. When interest rates were low for a long time, and suddenly become high, all the money that was rushing to your customers is suddenly cut off.” Source: Pitchbook Why is this important? During this time, SVB received billions of dollars from these venture-backed clients. In one year alone, their deposits increased 100%. They took these funds and invested them in longer-term bonds. As a result, this created a dangerous trap as the company expected rates would remain low. During this time, SVB invested in bonds at the top of the market. As interest rates rose higher and bond prices declined, SVB started taking major losses on their long-term bond holdings.

Losses Fueling a Liquidity Crunch

When SVB reported its fourth quarter results in early 2023, Moody’s Investor Service, a credit rating agency took notice. In early March, it said that SVB was at high risk for a downgrade due to its significant unrealized losses. In response, SVB looked to sell $2 billion of its investments at a loss to help boost liquidity for its struggling balance sheet. Soon, more hedge funds and venture investors realized SVB could be on thin ice. Depositors withdrew funds in droves, spurring a liquidity squeeze and prompting California regulators and the FDIC to step in and shut down the bank.

What Happens Now?

While much of SVB’s activity was focused on the tech sector, the bank’s shocking collapse has rattled a financial sector that is already on edge.

The four biggest U.S. banks lost a combined $52 billion the day before the SVB collapse. On Friday, other banking stocks saw double-digit drops, including Signature Bank (-23%), First Republic (-15%), and Silvergate Capital (-11%).

Source: Morningstar Direct. *Represents March 9 data, trading halted on March 10.

When the dust settles, it’s hard to predict the ripple effects that will emerge from this dramatic event. For investors, the Secretary of the Treasury Janet Yellen announced confidence in the banking system remaining resilient, noting that regulators have the proper tools in response to the issue.

But others have seen trouble brewing as far back as 2020 (or earlier) when commercial banking assets were skyrocketing and banks were buying bonds when rates were low.