It’s Official: Bitcoin was the Top Performing Currency of 2015

The Money Project is an ongoing collaboration between Visual Capitalist and Texas Precious Metals that seeks to use intuitive visualizations to explore the origins, nature, and use of money.

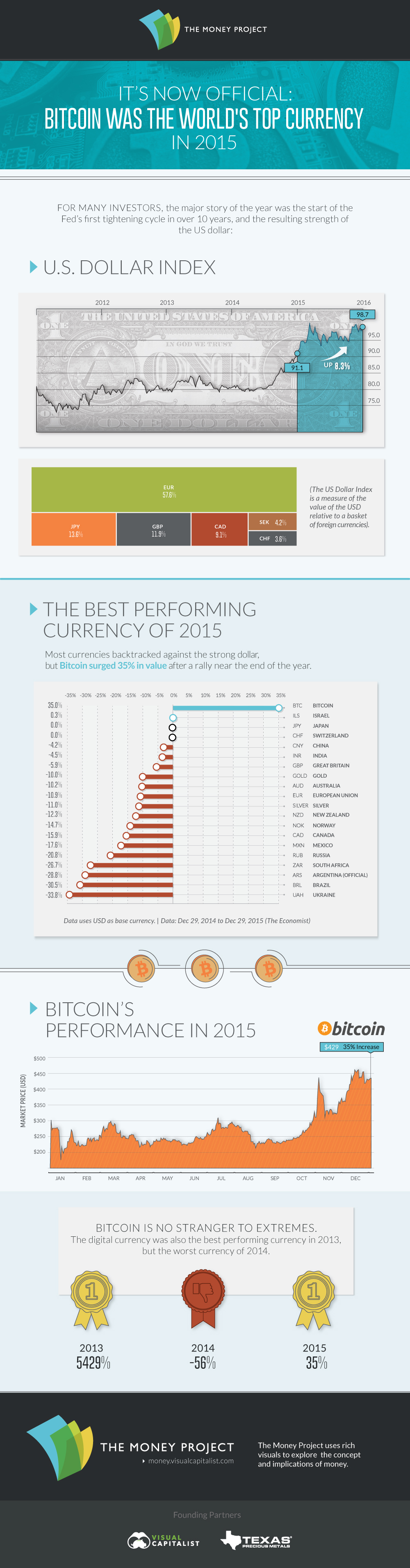

For most investors, the major story of 2015 was the expectation and eventual fulfillment of a rate hike, signalling the start of tightening monetary policy in the United States. This policy is divergent to those of other major central banks, and this has translated into considerable strength and momentum for the U.S. dollar.

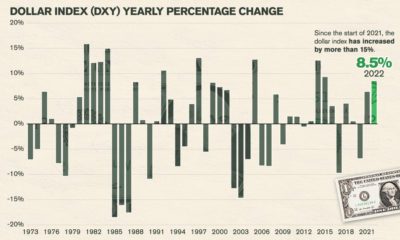

Using the benchmark of the U.S. Dollar Index, a comparison against a basket of major currencies, the dollar gained 8.3% throughout the year.

Despite this strength, the best performing currency in 2015 was not the dollar. In fact, the top currency of 2015 is likely to be considered the furthest thing from the greenback.

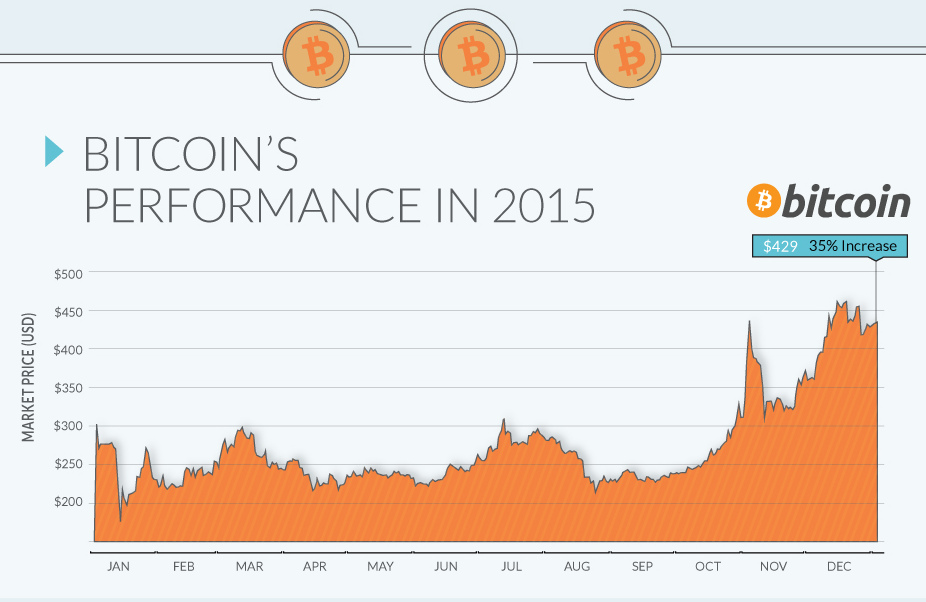

Bitcoin, a digital and decentralized cryptocurrency, staged a late comeback in 2015 to overtake the dollar by a whopping 35% by the end of the year.

Bitcoin is no stranger to extremes. During the year it came into the mainstream in 2013, Bitcoin gained 5,429% to easily surpass all other currencies in gains. However, the following year it would become a dog, losing -56% of its value to become the world’s worst performing currency in 2014.

The second best performing major currency, relative to the USD, was the Israeli shekel. It gained 0.3% throughout the year, and the Japanese yen (0%) and Swiss franc (0%) were close behind, finishing on par with how they started the year.

The world’s worst performing currencies are from countries that were battered by commodities or geopolitical strife.

Ukraine’s hryvnia fell -33.8% in the aftermath of Crimea. Brazil’s real (-30.5%), the Canadian dollar (-15.9%), Russian ruble (-20.8%), and South African rand (-26.7%) all lost significant value in the purging of global commodities. Gold finished the year down -10%, and silver at -11%.

About the Money Project

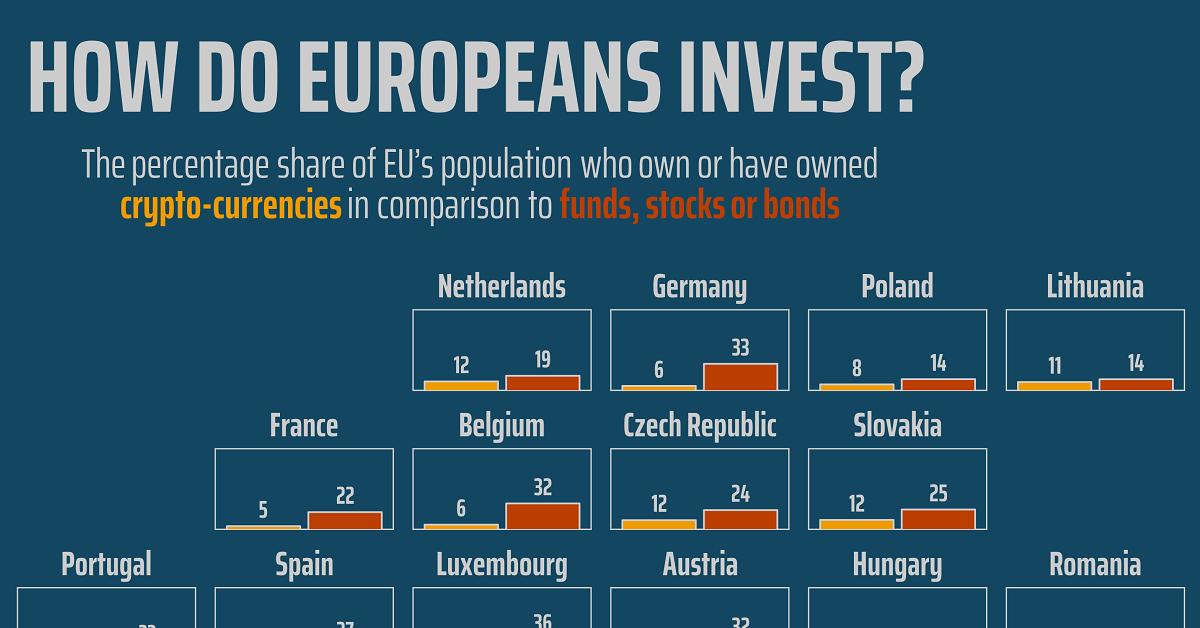

The Money Project aims to use intuitive visualizations to explore ideas around the very concept of money itself. Founded in 2015 by Visual Capitalist and Texas Precious Metals, the Money Project will look at the evolving nature of money, and will try to answer the difficult questions that prevent us from truly understanding the role that money plays in finance, investments, and accumulating wealth. on For a modern example, we can see how different countries (and regions) act when it comes to cryptocurrency. Within the European Union—one of the regions dealing with faster crypto adoption—attitudes towards investing can vary considerably. This graphic from Gilbert Fontana looks at crypto popularity amongst investors in the EU using data from the European Commission’s Eurobarometer. It compares exposure to cryptocurrencies relative to stocks, funds, and bonds.

Crypto Popularity in Europe in 2022

Given that crypto has experienced bubble-like asset rallies, including a dramatic rise to over a trillion dollars in value before crashing, it’s fair to say it’s well known by now. But even with a vast rise in awareness, there are still discrepancies between the level of investment crypto receives amongst European Union nations. Let’s see which countries have the highest proportion of citizens invested in crypto: Topping the list is Slovenia, considered by some the most crypto-friendly nation in the world. According to the survey, 18% of the country’s population has some sort of investment in it. Cyprus also ranks high in its crypto-friendly rank and hits an investment figure of 13%. Also notable is the Grand Duchy of Luxembourg, which despite having a small population of 640,000 also has a strong reputation as a global financial hub. When it comes to crypto, 14% of the population owns or has owned the asset, relative to 36% for stocks, bonds, or funds.

Crypto Unpopularity?

In regards to the countries with lower levels of crypto investment, one observation is that they tend to be wealthier and more developed EU nations. Here’s how the nations at or below the 10% crypto-investment threshold rank: At the “bottom” of crypto interest are France, Germany and Italy, also the EU’s largest economies. At a glance, this might suggest that citizens of stronger economies invest less in crypto. However, it’s important to note that the countries with higher levels of crypto investment tend to have lower levels of wealth on average. Though less of their investors seem to engage in crypto trading, countries like France and Germany might have more comparable levels of crypto investment on a pure dollar-basis.