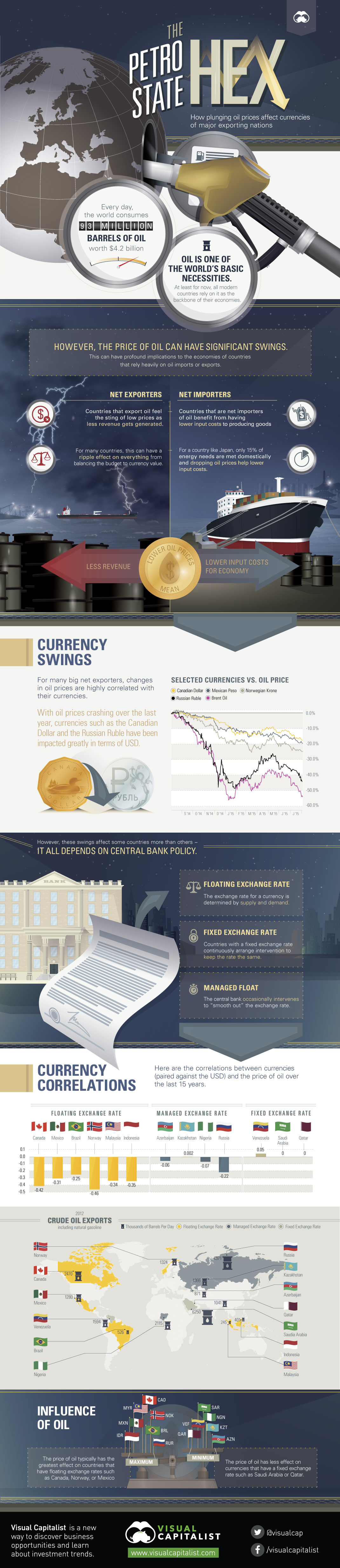

The Petrostate Hex: How Plunging Oil Prices Affect Currencies

Every day, the world consumes 93 million barrels of oil, which is worth $4.2 billion. Oil is one of the world’s most basic necessities. At least for now, all modern countries rely on oil and its derivatives as the backbone of their economies. However, the price of oil can have significant swings. These changes in price can have profound implications depending on whether an economy is a net importer or net exporter of crude. Net exporters, countries that sell more oil abroad than they bring in, feel the sting when prices plunge. Less revenue gets generated, and this can impact everything from balancing the budget to the value of their currency in the world market. Net importers, on the other hand, benefit from lower prices as it decreases input costs for production. For example, a country like Japan only meets 15% of its energy needs domestically, and must import 3.5 million barrels of oil each day. A lower oil price significantly decreases these costs.

Currency Swings

For many major net exporters of oil, changes in oil prices are highly correlated with their currencies. With oil prices crashing over the last year, currencies such as the Canadian dollar and Russian ruble have been highly impacted in terms of USD. For example, the ruble is down over 40% since the price of oil began to crash in 2014. With a breakeven cost of $105/bbl, the dropping price of crude as well as dwindling ruble have sent ripples through the Russian economy.

Central Bank Policy

The impact of oil on currency depends on how central banks approach policy: Floating exchange rate: The exchange rate is determined by supply and demand. Fixed exchange rate: Countries with fixed exchange rates continuously arrange intervention to keep the rate the same. Managed float: The central bank occasionally intervenes to “smooth out” the exchange rate.

Currency Correlations

The price of oil typically has the largest effect on countries with floating exchange rates such as Canada, Norway, or Mexico. Over the last 15 years, the loonie (-0.42), krone (-0.46), and peso (-0.31) have all had large negative correlations in exchange rates (paired with USD) against the price of oil. Meanwhile, countries that have pegged their rate tend to feel the impact of oil price swings elsewhere in their economy. This is because such countries have to buy or sell currencies on the open market to maintain the currency peg. Another method that can be used is to enforce a particular exchange rate by making it illegal to trade currencies at other rates, but this can often create a black market. As a result, countries with fixed-rate policies such as Venezuela, Saudi Arabia, and Qatar have little to no correlation in their exchange rates (paired with USD) against the price of oil.

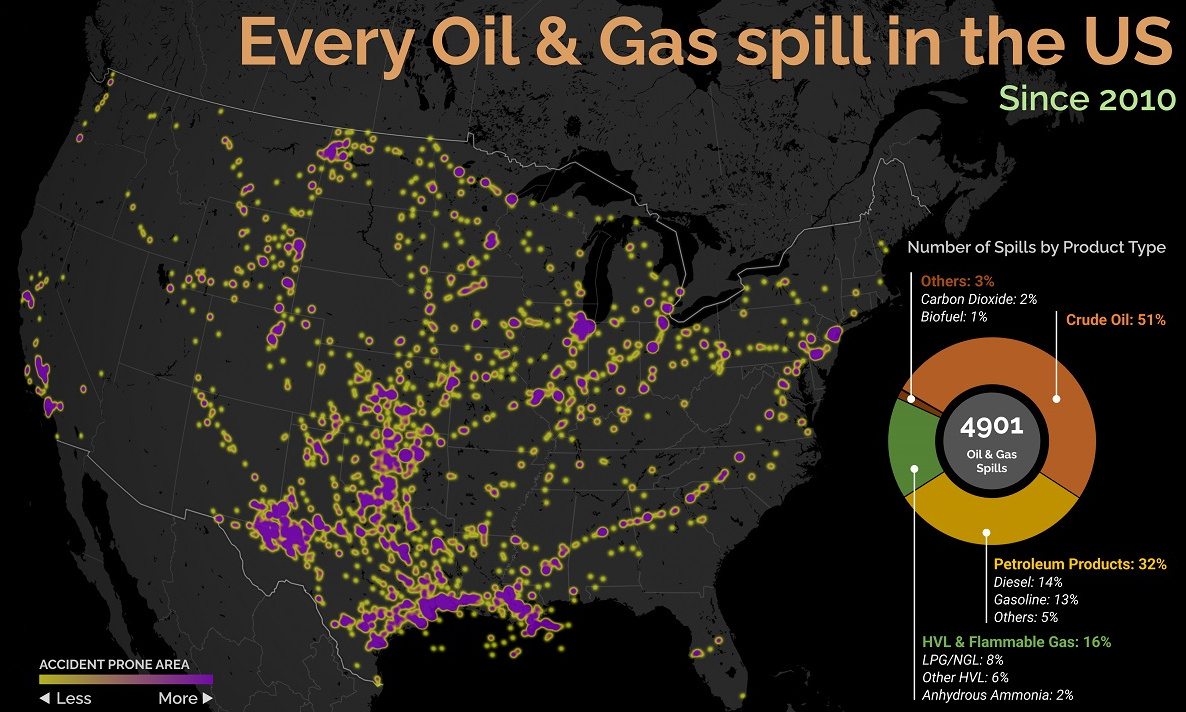

on Aside from the obvious climate impact they bring, one other downside in particular is spills, which can lead to ecological and economic damage. These can happen due to pipeline leaks, train derailments, or other industrial disasters. This graphic from Preyash Shah provides a visual overview of every oil and gas spill in the contiguous U.S. since 2010. Data is tracked by the U.S. government’s Pipeline and Hazardous Materials Safety Administration (PHMSA).

U.S. Oil and Gas Spills (2010‒2022)

The majority of spills that have occurred come mostly from crude oil, followed by petroleum products and gas. Note that this data covers the quantity of spills and not damages or volume.

Crude oil, which makes up just over half of documented spills, is also one of the most costly. Contaminations can persist for years after a spill, and its impact on local mammals and waterfowl is particularly harsh. This has been the case with the Deepwater Horizon spill (also known as the “BP oil spill”), which experts say is still causing harm in the Gulf of Mexico. Other products with lots of spills include petroleum products such as diesel or gasoline, as well as liquefied natural gas or other volatile liquids. Interestingly, liquefied carbon dioxide can also be transported in pipelines, commonly used for carbon capture storage, but requires high pressure to maintain its state. When looking at the location of spills, it’s clear that the South Central states have experienced the highest number of disasters. In contrast, the West Coast has had substantially less activity. However, this makes much more sense when looking at the dominant oil producing states, where Texas and surrounding neighbors reign supreme. Of the 4,901 spills during this period, Texas accounts for 1,936 or roughly 40% of all oil and gas spills. This is followed by Oklahoma, which has had 407 spills and is one of the largest net exporters of oil and gas in the country.

What Causes Spills?

Oil and gas spills actually have a surprisingly long history, with one of the earliest dating back to 1889, when a spill was reported on the coast between Los Angeles and San Diego. Causes have consisted primarily of weather, natural disasters, equipment and technological malfunction, as well as human error. However, they only became a widespread problem around the halfway mark of the 20th century, when petroleum extraction and production really began to take off. This era also saw the emergence of supertankers, which can transport half a million tons of oil but therefore make the risk of spills even costlier. In fact, the biggest spill off U.S. waters after the Deepwater Horizon disaster is the 1989 Exxon Valdez spill in Alaska, when a tanker crashed into a reef and 11 million gallons of oil spilled into the Pacific Ocean.