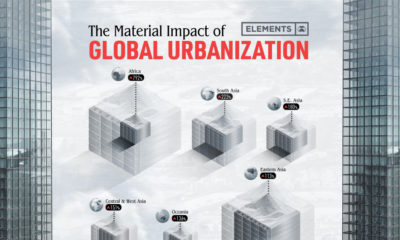

Today’s visualization relies on data compiled by CityLab researchers to identify the world’s largest megaregions. The team defines megaregions as:

Areas of continuous light, based on the latest night satellite imagery Capturing metro areas or networks of metro areas, with a combined population of 5 million or higher Generating economic output (GDP) of over $300 billion, on a PPP basis

The satellite imagery comes from the NOAA, while the base data for economic output is calculated from Oxford Economics via Brookings’ Global Metro Monitor 2018. It’s worth pointing out that each megaregion may not be connected by specific trade relationships. Rather, satellite data highlights the proximity between these rough but useful regional estimates contributing to the global economy—and supercities are at the heart of it.

From Megalopolis to Megaregion

Throughout history, academics have described vast, interlinked urban regions as a ‘megalopolis’, or ‘megapolis’. Economic geographer Jean Gottman popularized the Greek term, referring to the booming and unprecedented urbanization in Bos-Wash—the northeast stretch from Boston and New York down to Washington, D.C.: —Gottmann, Megalopolis (1961) By looking at adjacent metropolitan areas rather than country-level data, it can help provide an entirely new perspective on the global distribution of economic activity. Where in the world are the most powerful urban economic clusters today?

The Largest Megaregions Today

The world’s economy is a sum of its parts. Each megaregion contributes significantly to the global growth engine, but arguably, certain areas pull more weight than others. Altogether, these powerhouses bring in over $28 trillion in economic output. Unsurprisingly, Bos-Wash reigns supreme even today, with $3.6 trillion in economic output, over 13% of the total. The corridor hosts some of the highest-paying sectors: information technology, finance, and professional services. The largest city in Brazil, São Paulo, is the only city in the Southern Hemisphere to make the list. The city was once heavily reliant on manufacturing and trade, but the $780 billion city economy is now embracing its role as a nascent financial hub. On the other side of the world, the cluster of Asian megaregions combines for $8.7 trillion in total economic output. Of these, Greater Tokyo in Japan is the largest, while Shandong might be a name that fewer people are familiar with. Sandwiched between Beijing and Shanghai, the coastal province houses multiple high-tech industrial and export processing zones. The data is even more interesting when broken down into economic output per capita—Abu-Dubai churns out an impressive $86,200 per person. Meanwhile, Delhi-Lahore is lowest on the per-capita list, at $14,946 per person across nearly 28 million people.

Where To Next?

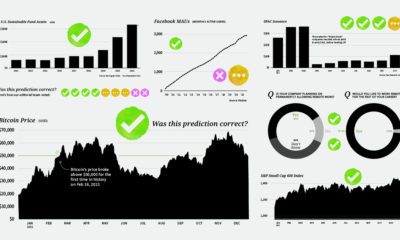

This trend shows no sign of slowing down, as megacities are on the rise in the coming decade. Eventually, more Indian and African megaregions will make its way onto this list, led by cities like Lagos and Chennai. Stay tuned to Visual Capitalist for a North America-specific outlook coming soon, and a deep dive into the biggest factors contributing to the growth of these megaregions. on Last year, stock and bond returns tumbled after the Federal Reserve hiked interest rates at the fastest speed in 40 years. It was the first time in decades that both asset classes posted negative annual investment returns in tandem. Over four decades, this has happened 2.4% of the time across any 12-month rolling period. To look at how various stock and bond asset allocations have performed over history—and their broader correlations—the above graphic charts their best, worst, and average returns, using data from Vanguard.

How Has Asset Allocation Impacted Returns?

Based on data between 1926 and 2019, the table below looks at the spectrum of market returns of different asset allocations:

We can see that a portfolio made entirely of stocks returned 10.3% on average, the highest across all asset allocations. Of course, this came with wider return variance, hitting an annual low of -43% and a high of 54%.

A traditional 60/40 portfolio—which has lost its luster in recent years as low interest rates have led to lower bond returns—saw an average historical return of 8.8%. As interest rates have climbed in recent years, this may widen its appeal once again as bond returns may rise.

Meanwhile, a 100% bond portfolio averaged 5.3% in annual returns over the period. Bonds typically serve as a hedge against portfolio losses thanks to their typically negative historical correlation to stocks.

A Closer Look at Historical Correlations

To understand how 2022 was an outlier in terms of asset correlations we can look at the graphic below:

The last time stocks and bonds moved together in a negative direction was in 1969. At the time, inflation was accelerating and the Fed was hiking interest rates to cool rising costs. In fact, historically, when inflation surges, stocks and bonds have often moved in similar directions. Underscoring this divergence is real interest rate volatility. When real interest rates are a driving force in the market, as we have seen in the last year, it hurts both stock and bond returns. This is because higher interest rates can reduce the future cash flows of these investments. Adding another layer is the level of risk appetite among investors. When the economic outlook is uncertain and interest rate volatility is high, investors are more likely to take risk off their portfolios and demand higher returns for taking on higher risk. This can push down equity and bond prices. On the other hand, if the economic outlook is positive, investors may be willing to take on more risk, in turn potentially boosting equity prices.

Current Investment Returns in Context

Today, financial markets are seeing sharp swings as the ripple effects of higher interest rates are sinking in. For investors, historical data provides insight on long-term asset allocation trends. Over the last century, cycles of high interest rates have come and gone. Both equity and bond investment returns have been resilient for investors who stay the course.