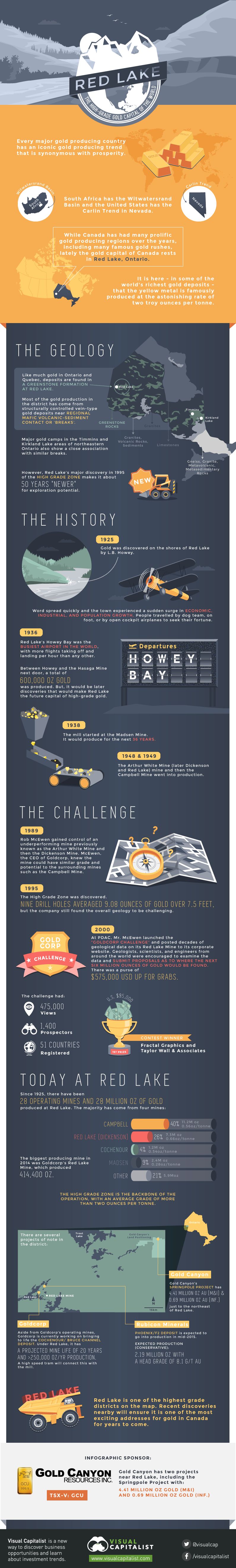

Red Lake: The High-Grade Gold Capital of the World

Sponsored by Gold Canyon Resources (TSX-V: GCU) Every major gold producing country has an iconic gold producing trend that is synonymous with prosperity. South Africa has the Witwatersrand Basin and the United States has the Carlin Trend in Nevada. While Canada has had many prolific gold producing regions over the years, including many famous gold rushes, lately the gold capital of Canada rests in Red Lake, Ontario. It is here – in some of the world’s richest gold deposits – that the yellow metal is famously produced at the astonishing rate of two troy ounces per tonne. The Geology Like much gold in Ontario and Quebec, deposits are found in a greenstone formation at Red Lake. Most of the gold production in the district has come from structurally controlled vein-type gold deposits near regional mafic volcanic-sediment contact or ‘breaks’. Major gold camps in the Timmins and Kirkland Lake areas of northeastern Ontario also show a close association with similar breaks. However, Red Lake’s major discovery in 1995 of the High Grade Zone makes it about 50 years “newer” for exploration potential. The History Gold was discovered on the shores of Red Lake by L.B. Howey in 1925. Word spread quickly and the town experienced a sudden surge in economic, industrial, and population growth. People travelled by dog team, on foot, or by open cockpit airplanes to seek their fortune. By 1936, Red Lake’s Howey Bay was the busiest airport in the world, with more flights taking off and landing per hour than any other. Between Howey and the Hasaga Mine next door, a total of 600,000 oz gold was produced. But, it would be later discoveries that would make Red Lake the future capital of high-grade gold. In 1938, the mill started at the Madsen Mine. It would produce for the next 36 years. In 1948 and 1949 respectively, the Arthur White Mine (later Dickenson and Red Lake) mine and then the Campbell Mine went into production. The Challenge In the 1989, Rob McEwen gained control of an underperforming mine previously known as the Arthur White Mine and then the Dickenson Mine. McEwen, the CEO of Goldcorp, knew the mine could have similar grade and potential to the surrounding mines such as the Campbell Mine. In 1995, the High Grade Zone was discovered. Nine drill holes averaged 9.08 ounces of gold over 7.5 feet, but the company still found the overall geology to be challenging. In 2000 at PDAC, Mr. McEwen launched the “Goldcorp Challenge” and posted decades of geological data on its Red Lake Mine to its corporate website. Geologists, scientists, and engineers from around the world were encouraged to examine the data and submit proposals as to where the next six million ounces of gold would be found. There was a purse of $575,000 USD up for grabs. It was viewed 475,000 times and 1,400 prospectors from 51 countries registered as participants. Finishing 1st place in the contest: First Prize – US$95,000 – Fractal Graphics and Taylor Wall & Associates Today at Red Lake Since 1925, there have been 28 operating mines and 28 million oz of gold produced at Red Lake. The majority has come from four mines: Red Lake (Dickenson), Campbell, Madsen, and Cochenour. The biggest producing mine in 2014 was Goldcorp’s Red Lake Mine, which produced 414,400 oz. The High Grade Zone is the backbone of the operation, with an average grade of more than two ounces per tonne. There are several current projects of note in the district:

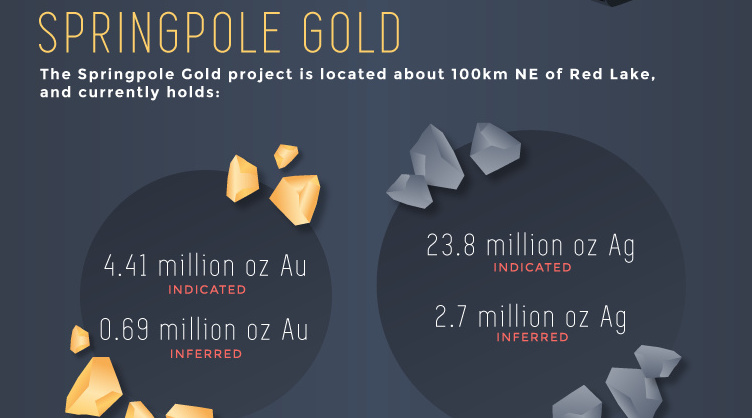

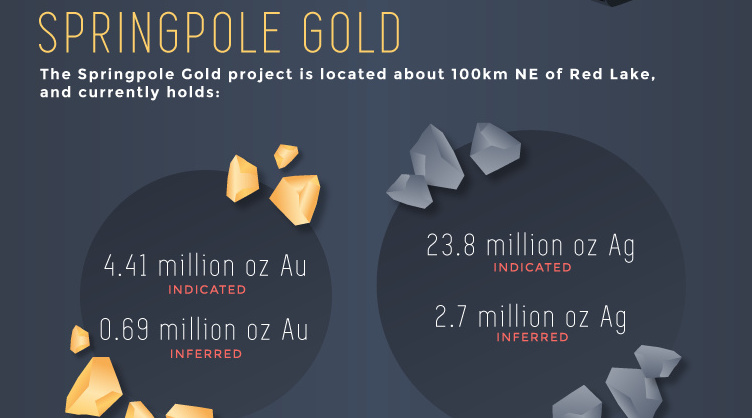

Rubicon Minerals: Rubicon’s Phoenix / F2 Deposit is expected to go into production in mid-2015. It is expected (conservatively) to produce 2.19 million oz with a head grade of 8.1 g/t Au Gold Canyon: Gold Canyon’s Springpole project has 4.41 million oz gold (M&I) and 0.69 million oz gold (Inf.) just to the northeast of Red Lake Goldcorp: Aside from Goldcorp’s operating mines, Goldcorp is currently working on bringing to life the Cochenour / Bruce Channel deposit. Under Red Lake, it has a projected mine life of 20 years and >250,000 oz/yr production. A high speed tram will connect this with the mill.

on Did you know that nearly one-fifth of all the gold ever mined is held by central banks? Besides investors and jewelry consumers, central banks are a major source of gold demand. In fact, in 2022, central banks snapped up gold at the fastest pace since 1967. However, the record gold purchases of 2022 are in stark contrast to the 1990s and early 2000s, when central banks were net sellers of gold. The above infographic uses data from the World Gold Council to show 30 years of central bank gold demand, highlighting how official attitudes toward gold have changed in the last 30 years.

Why Do Central Banks Buy Gold?

Gold plays an important role in the financial reserves of numerous nations. Here are three of the reasons why central banks hold gold:

Balancing foreign exchange reserves Central banks have long held gold as part of their reserves to manage risk from currency holdings and to promote stability during economic turmoil. Hedging against fiat currencies Gold offers a hedge against the eroding purchasing power of currencies (mainly the U.S. dollar) due to inflation. Diversifying portfolios Gold has an inverse correlation with the U.S. dollar. When the dollar falls in value, gold prices tend to rise, protecting central banks from volatility. The Switch from Selling to Buying In the 1990s and early 2000s, central banks were net sellers of gold. There were several reasons behind the selling, including good macroeconomic conditions and a downward trend in gold prices. Due to strong economic growth, gold’s safe-haven properties were less valuable, and low returns made it unattractive as an investment. Central bank attitudes toward gold started changing following the 1997 Asian financial crisis and then later, the 2007–08 financial crisis. Since 2010, central banks have been net buyers of gold on an annual basis. Here’s a look at the 10 largest official buyers of gold from the end of 1999 to end of 2021: Rank CountryAmount of Gold Bought (tonnes)% of All Buying #1🇷🇺 Russia 1,88828% #2🇨🇳 China 1,55223% #3🇹🇷 Türkiye 5418% #4🇮🇳 India 3956% #5🇰🇿 Kazakhstan 3455% #6🇺🇿 Uzbekistan 3115% #7🇸🇦 Saudi Arabia 1803% #8🇹🇭 Thailand 1682% #9🇵🇱 Poland1282% #10🇲🇽 Mexico 1152% Total5,62384% Source: IMF The top 10 official buyers of gold between end-1999 and end-2021 represent 84% of all the gold bought by central banks during this period. Russia and China—arguably the United States’ top geopolitical rivals—have been the largest gold buyers over the last two decades. Russia, in particular, accelerated its gold purchases after being hit by Western sanctions following its annexation of Crimea in 2014. Interestingly, the majority of nations on the above list are emerging economies. These countries have likely been stockpiling gold to hedge against financial and geopolitical risks affecting currencies, primarily the U.S. dollar. Meanwhile, European nations including Switzerland, France, Netherlands, and the UK were the largest sellers of gold between 1999 and 2021, under the Central Bank Gold Agreement (CBGA) framework. Which Central Banks Bought Gold in 2022? In 2022, central banks bought a record 1,136 tonnes of gold, worth around $70 billion. Country2022 Gold Purchases (tonnes)% of Total 🇹🇷 Türkiye14813% 🇨🇳 China 625% 🇪🇬 Egypt 474% 🇶🇦 Qatar333% 🇮🇶 Iraq 343% 🇮🇳 India 333% 🇦🇪 UAE 252% 🇰🇬 Kyrgyzstan 61% 🇹🇯 Tajikistan 40.4% 🇪🇨 Ecuador 30.3% 🌍 Unreported 74165% Total1,136100% Türkiye, experiencing 86% year-over-year inflation as of October 2022, was the largest buyer, adding 148 tonnes to its reserves. China continued its gold-buying spree with 62 tonnes added in the months of November and December, amid rising geopolitical tensions with the United States. Overall, emerging markets continued the trend that started in the 2000s, accounting for the bulk of gold purchases. Meanwhile, a significant two-thirds, or 741 tonnes of official gold purchases were unreported in 2022. According to analysts, unreported gold purchases are likely to have come from countries like China and Russia, who are looking to de-dollarize global trade to circumvent Western sanctions. Share via: Facebook Twitter LinkedIn More

There were several reasons behind the selling, including good macroeconomic conditions and a downward trend in gold prices. Due to strong economic growth, gold’s safe-haven properties were less valuable, and low returns made it unattractive as an investment.

Central bank attitudes toward gold started changing following the 1997 Asian financial crisis and then later, the 2007–08 financial crisis. Since 2010, central banks have been net buyers of gold on an annual basis.

Here’s a look at the 10 largest official buyers of gold from the end of 1999 to end of 2021:

Source: IMF

The top 10 official buyers of gold between end-1999 and end-2021 represent 84% of all the gold bought by central banks during this period.

Russia and China—arguably the United States’ top geopolitical rivals—have been the largest gold buyers over the last two decades. Russia, in particular, accelerated its gold purchases after being hit by Western sanctions following its annexation of Crimea in 2014.

Interestingly, the majority of nations on the above list are emerging economies. These countries have likely been stockpiling gold to hedge against financial and geopolitical risks affecting currencies, primarily the U.S. dollar.

Meanwhile, European nations including Switzerland, France, Netherlands, and the UK were the largest sellers of gold between 1999 and 2021, under the Central Bank Gold Agreement (CBGA) framework.

Which Central Banks Bought Gold in 2022?

In 2022, central banks bought a record 1,136 tonnes of gold, worth around $70 billion. Türkiye, experiencing 86% year-over-year inflation as of October 2022, was the largest buyer, adding 148 tonnes to its reserves. China continued its gold-buying spree with 62 tonnes added in the months of November and December, amid rising geopolitical tensions with the United States. Overall, emerging markets continued the trend that started in the 2000s, accounting for the bulk of gold purchases. Meanwhile, a significant two-thirds, or 741 tonnes of official gold purchases were unreported in 2022. According to analysts, unreported gold purchases are likely to have come from countries like China and Russia, who are looking to de-dollarize global trade to circumvent Western sanctions.