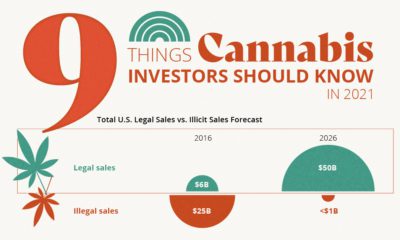

According to ArcView Research, it’s already a multi-billion dollar industry – and by 2022, the legal market could be worth $32 billion globally. As in any nascent industry, the early days of cannabis have been exciting and formative. As it begins to mature, it’ll become clearer what products will drive future growth. In this context, cannabis edibles and beverages have taken center stage – and today’s infographic from Trait Biosciences outlines the magnitude of this opportunity, along with some of the challenges the market faces going forward.

The Rise of Edibles

From dark chocolate to CBD-infused beverages, the cannabis edibles market is one of the most diverse and exciting markets for both consumers and businesses. Edibles and beverages have already more than doubled in their share of the overall cannabis market since 2011, and the market is expected to grow in size from $1 billion to $4.1 billion between the years 2017 and 2022. This year, the Specialty Food Association even named cannabis edibles and beverages as a “Food Trend of the Year” – a nod to the fact that edibles are going mainstream, even within the scope of the much larger food and beverages industry. Not surprisingly, as this category emerges, there are many big brands exploring options in the edibles market, including Constellation Brands, Molson Coors, Mondelez, Carl’s Jr, Anheuser Busch, Neal Brothers, and Coca-Cola. In particular, the beverages space seems to be hot: Constellation shelled out $4 billion for a stake in the largest cannabis company globally (Canopy Growth), and beer-maker Anheuser Busch partnered with Tilray to research THC and CBD drinks.

Marketplace Risks

There are four major sources of risk that could impact future growth potential for companies in the fast-moving cannabis edibles market:

Regulatory risks: Regulators are becoming increasingly concerned about the dosage, packaging, and labeling of edibles products Stiff competition: Mega brands are entering the edibles space at a blistering pace, and could dominate market share from newer entrants Taxes: Complex layers of taxation could decrease demand for edibles, such as in California, while also pushing consumers towards the black market Consumer concerns: Unpredictable dosage amounts, taste, and even toxins have surfaced as issues with the media, as consumers voice their concerns with edible products

But above and beyond these known risks, there is another potential hindrance to the edibles and beverages market that flies under the radar: how cannabinoids are absorbed into the bloodstream when ingested.

The Journey Into the Bloodstream

Unlike substances like sugar or alcohol, cannabinoids are not soluble in water. Instead, they are soluble in fats. A substance such as sugar can enter the bloodstream within 10-15 minutes of ingesting. On the other hand, fat soluble substances such as cannabinoids have to wait – which is why sometimes edibles take hours to kick in. Ultimately, cannabinoids are absorbed through the body’s fat. This happens in the small intestines, which help distribute them to the rest of the body.

Implications for Edibles and Beverages

For some cannabis producers, fat-solubility just means slow onset times and a generally undesirable taste. For other products, like CBD beverages, it creates bigger problems. Water and oil simply don’t mix. To get around this, producers are using special emulsion techniques to make oil particles smaller, so that they mix with water better, increase bioavailability, and speed up onset times.

Macroemulsion: Think of this as mixing oil and vinegar. It’s your common emulsion that will separate over time, since oil and water don’t mix Nanoemulsion: Stable but thermodynamically unstable. Uses surfactants to keep water/oil binded Microemulsion: Stable, but uses a higher concentration of surfactants (which lower the surface tension between two liquids)

While these techniques are seeing increased usage by producers of cannabis products, they do have their own set of limitations. Oil and water solutions still unbind over time, and products may only have a limited shelflife. Reporting by WSJ has found that these beverages also have a questionable aftertaste for many consumers, and onset times of these products are still not as fast as smoking or vaping. It’s also worth noting that various health regulators, scientific journals, and international organizations have raised concerns about using nano-sized particles in food and beverages. For example, the Canadian government warns that there is a “causal relationship between nanoparticle exposure and adverse health effects”, while the respected scientific journal Nature warns that nanoparticles “may behave differently within the human body”, and that “safety of nanoparticles should be judged on a case-by-case basis”.

Next Steps?

The cannabis edibles market is poised to be the next big thing – but when it comes to how these cannabinoids get absorbed by the body, there is still much work to be done. How will the industry and consumers move forward to capitalize on growing opportunities in the edibles and beverages market? on Humans have a storied and complicated relationship with drugs. Defined as chemical substances that cause a change in our physiology or psychology, many drugs are taken medicinally or accepted culturally, like caffeine, nicotine, and alcohol. But many drugs—including medicines and non-medicinal substances taken as drugs—are taken recreationally and can be abused. Each country and people have their own relationship to drugs, with some embracing the use of specific substances while others shun them outright. What are the most common drugs that are considered generally illicit in different parts of the world? Today’s graphics use data from the UN’s World Drug Report 2021 to highlight the most prevalent drug used in each country.

What Types of Common Drugs Are Tracked?

The World Drug Report looks explicitly at the supply and demand of the international illegal drug market, not including commonly legal substances like caffeine and alcohol. Drugs are grouped by class and type, with six main types of drugs found as the most prevalent drugs worldwide.

Cannabis*: Drugs derived from cannabis, including hemp. This category includes marijuana (dried flowers), hashish (resin), and other for various other parts of the plant or derived oils. Cocaine: Drugs derived from the leaves of coca plants. Labeled as either cocaine salts for powder form or crack for cocaine processed with baking soda and water into rock form. Opioids: Includes opiates which are derived directly from the opium poppy plant, including morphine, codeine, and heroin, as well as synthetic alkaloids. Amphetamine-type Stimulants (ATS): Amphetamine and drugs derived from amphetamine, including meth (also known as speed), MDMA, and ecstasy. Sedatives and Tranquilizers: Includes other drugs whose main purpose is to reduce energy, excitement, or anxiety, as well as drugs used primarily to initiate or help with sleep (also called hypnotics). Solvents and Inhalants: Gases or chemicals that can cause intoxication but are not intended to be drugs, including fuels, glues, and other industrial substances.

The report also tracked the prevalence of hallucinogens—psychoactive drugs which strongly affect the mind and cause a “trip”—but no hallucinogens ranked as the most prevalent drug in any one country. *Editor’s note: Recreational cannabis is legal in five countries, and some non-federal jurisdictions (i.e. states). However, in the context of this report, it was included because it is still widely illicit in most countries globally.

The Most Prevalent Drug in Each Country

According to the report, 275 million people used drugs worldwide in 2020. Between the ages of 15–64, around 5.5% of the global population used drugs at least once. Many countries grouped different types of the same drug class together, and a few like Saudi Arabia and North Macedonia had multiple different drug types listed as the most prevalent. But across the board, cannabis was the most commonly prevalent drug used in 107 listed countries and territories: How prevalent is cannabis worldwide? 72 locations or more than two-thirds of those reporting listed cannabis as the most prevalent drug. Unsurprisingly these include countries that have legalized recreational cannabis: Canada, Georgia, Mexico, South Africa, and Uruguay.

How Common Are Opioids and Other Drugs?

Though the global prevalence of cannabis is unsurprising, especially as it becomes legalized and accepted in more countries, other drugs also have strong footholds. Opioids (14 locations) were the most prevalent drugs in the Middle-East, South and Central Asia, including in India and Iran. Notably, Afghanistan is the world’s largest producer of opium, supplying more than 90% of illicit heroin globally. Amphetamine-type drugs (9 locations) were the third-most common drugs overall, mainly in East Asia. Methamphetamine was the reported most prevalent drug in China, South Korea, and Japan, while amphetamine was only the most common drug in Bangladesh. However, it’s important to note that illicit drug usage is tough to track. Asian countries where cannabis is less frequently found (or reported) might understate its usage. At the same time, the opioid epidemic in the U.S. and Canada reflects high opioid usage in the West. As some drugs become more widespread and others face a renewed “war,” the landscape is certain to shift over the next few years.