The 2020 ranking from the World Intellectual Property Organization (WIPO) reveals just that. The above map breaks down the most innovative countries in each World Bank income group, based on data from WIPO’s Global Innovation Index (GII), which evaluates nations across 80 innovation indicators like research and development (R&D), venture capital, and high-tech production. While wealthier nations continue to lead global innovation, the GII also shows that middle-income countries—particularly in Asia—are making impressive strides.

Fueling Innovation

The economic and regulatory spheres within countries can have an enormous impact on their level of innovation—and vice versa, as innovation in turn becomes an economic driver, stimulating further investment. The positive feedback loop between investment and innovation results in the success of some of the top countries in the table below, which shows the three most innovative countries in each income group. Switzerland, Sweden, and the U.S. are the top three in the high-income group. Considering that Switzerland has the second-highest GDP per capita globally, it is not a surprise leader on this list. Upper middle-income countries are led by China, Malaysia, and Bulgaria. Note that China far surpasses other nations in the upper-middle-income group ranking, reaching 14th spot overall in 2020. Others in the income group only appear in the overall ranking after 30th place. Below are several income group leaders, and some of their key areas of output:

Switzerland: First in Knowledge Creation, second in Global Brand Value U.S.: First in Entertainment and Media, Computer Software Spending, Intellectual Property Receipts China: First in Patents Registered Vietnam: Second in High-Technology Net Exports India: First in Information and Communication Technology Services Exports Tanzania: 23rd in Printing and Other Media

Shining a Light on Global Innovators

Since 2011, Switzerland has led the world in innovation according to this index, and the top five countries have seen few changes in recent years. Sweden regained second place in 2019 and the U.S. moved into third—positions they maintain in 2020. The Netherlands entered the top two in 2018 and now sits at fifth. Here’s how the overall ranking shakes out: Nordic countries like Sweden, Denmark, and Finland continue their strong showing across innovation factors—like Knowledge Creation, Global Brand Value, Environmental Performance, and Intellectual Property Receipts—leading to their continued presence atop global innovators. But the nations making the biggest moves in GII ranking are found in Asia. China, Vietnam, India, and the Philippines have risen the most of all countries, with all four now in the top 50. China broke into the top 15 in 2019 and remains the only middle-income economy in the top 30. In 2020, South Korea became the second Asian economy to enter the top 10, after Singapore. As the first Asian country to move into the global top five, Singapore joined the leaders in 2018, and now sits at 8th place. In another first for 2020, India has now broken into the top 50.

Innovation Input & Output: The Overachievers

While annual rankings like these confirm the importance of a robust economy and innovation investment, variations in the relationship between input and output are not uncommon. The correlation between wealth and innovation isn’t always straightforward, and neither is the connection between innovation input and output. Below is an overview of the GII inputs and outputs, as well as several of the world’s overall leaders in each pillar. Input variables can be characterized as factors that foster innovation—everything from the quality of a country’s university institutions to its levels of ecological sustainability. Output factors include innovation indicators like the creation of new businesses, and even the number of Wikipedia edits made per million people. Countries with impressive innovation outputs compared to input levels include:

China: 26th in inputs, but sixth in overall innovation outputs Netherlands: 11th in innovation input, but fourth across outputs Thailand: 48th in overall input, first in business R&D Malaysia: 34th in overall input, first in high-tech net exports

Innovation Fuel Reductions Up Ahead?

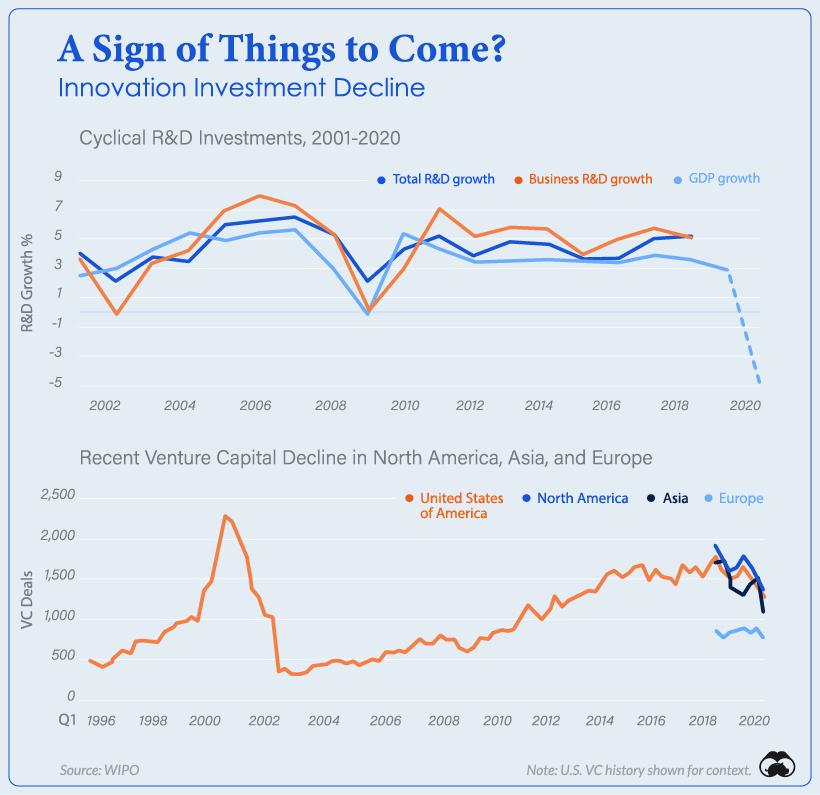

Although financial markets have ignited, the economy as a whole has not fared well since lockdowns began. This begs the question of whether a steep decline in innovation capital will follow. In response to the 2020 pandemic, will spending on R&D echo the 2009 recession and aftermath of 9/11? Will venture capital flows continue to decline more than they have since 2018?

Because innovation is so entwined with the economic growth strategies of companies and nations alike, the WIPO notes that the potential decline may not be as severe as historical trends might suggest.

No Stopping Human Innovation

Thankfully, innovation opportunities are not solely contingent on the level of capital infused during any given year. Instead, the cumulative results of continuous innovation stimuli may be enough to maintain growth, while strategic cash reserves are put to use. What the GII ranking shows is that inputs don’t always equal outputs—and that innovative strides can be made with even modest levels of capital flow. on But fast forward to the end of last week, and SVB was shuttered by regulators after a panic-induced bank run. So, how exactly did this happen? We dig in below.

Road to a Bank Run

SVB and its customers generally thrived during the low interest rate era, but as rates rose, SVB found itself more exposed to risk than a typical bank. Even so, at the end of 2022, the bank’s balance sheet showed no cause for alarm.

As well, the bank was viewed positively in a number of places. Most Wall Street analyst ratings were overwhelmingly positive on the bank’s stock, and Forbes had just added the bank to its Financial All-Stars list. Outward signs of trouble emerged on Wednesday, March 8th, when SVB surprised investors with news that the bank needed to raise more than $2 billion to shore up its balance sheet. The reaction from prominent venture capitalists was not positive, with Coatue Management, Union Square Ventures, and Peter Thiel’s Founders Fund moving to limit exposure to the 40-year-old bank. The influence of these firms is believed to have added fuel to the fire, and a bank run ensued. Also influencing decision making was the fact that SVB had the highest percentage of uninsured domestic deposits of all big banks. These totaled nearly $152 billion, or about 97% of all deposits. By the end of the day, customers had tried to withdraw $42 billion in deposits.

What Triggered the SVB Collapse?

While the collapse of SVB took place over the course of 44 hours, its roots trace back to the early pandemic years. In 2021, U.S. venture capital-backed companies raised a record $330 billion—double the amount seen in 2020. At the time, interest rates were at rock-bottom levels to help buoy the economy. Matt Levine sums up the situation well: “When interest rates are low everywhere, a dollar in 20 years is about as good as a dollar today, so a startup whose business model is “we will lose money for a decade building artificial intelligence, and then rake in lots of money in the far future” sounds pretty good. When interest rates are higher, a dollar today is better than a dollar tomorrow, so investors want cash flows. When interest rates were low for a long time, and suddenly become high, all the money that was rushing to your customers is suddenly cut off.” Source: Pitchbook Why is this important? During this time, SVB received billions of dollars from these venture-backed clients. In one year alone, their deposits increased 100%. They took these funds and invested them in longer-term bonds. As a result, this created a dangerous trap as the company expected rates would remain low. During this time, SVB invested in bonds at the top of the market. As interest rates rose higher and bond prices declined, SVB started taking major losses on their long-term bond holdings.

Losses Fueling a Liquidity Crunch

When SVB reported its fourth quarter results in early 2023, Moody’s Investor Service, a credit rating agency took notice. In early March, it said that SVB was at high risk for a downgrade due to its significant unrealized losses. In response, SVB looked to sell $2 billion of its investments at a loss to help boost liquidity for its struggling balance sheet. Soon, more hedge funds and venture investors realized SVB could be on thin ice. Depositors withdrew funds in droves, spurring a liquidity squeeze and prompting California regulators and the FDIC to step in and shut down the bank.

What Happens Now?

While much of SVB’s activity was focused on the tech sector, the bank’s shocking collapse has rattled a financial sector that is already on edge.

The four biggest U.S. banks lost a combined $52 billion the day before the SVB collapse. On Friday, other banking stocks saw double-digit drops, including Signature Bank (-23%), First Republic (-15%), and Silvergate Capital (-11%).

Source: Morningstar Direct. *Represents March 9 data, trading halted on March 10.

When the dust settles, it’s hard to predict the ripple effects that will emerge from this dramatic event. For investors, the Secretary of the Treasury Janet Yellen announced confidence in the banking system remaining resilient, noting that regulators have the proper tools in response to the issue.

But others have seen trouble brewing as far back as 2020 (or earlier) when commercial banking assets were skyrocketing and banks were buying bonds when rates were low.