Interestingly, mega-deal counts aren’t the only thing ballooning in venture capital financing. Almost everything has gotten bigger: venture capital funds, deal sizes, and exit valuations. Today’s infographic comes from Pitchbook’s quarterly Venture Monitor, and visualizes the trends shaping the U.S. venture capital landscape.

Fundraising

Venture capital fundraising remains robust, with $29.6 billion raised across 162 funds year-to-date. Not only that, a higher proportion of funds are quite large. Roughly 9% were sized $500 million or more, with 15 such mega-funds closed year-to-date. What does it mean to “close” a fund? Before they can begin operations, a venture capital fund manager will raise money from investors. The fund closes to signify the end of a fundraising round and can go through multiple closings until it reaches its targeted fundraising amount.

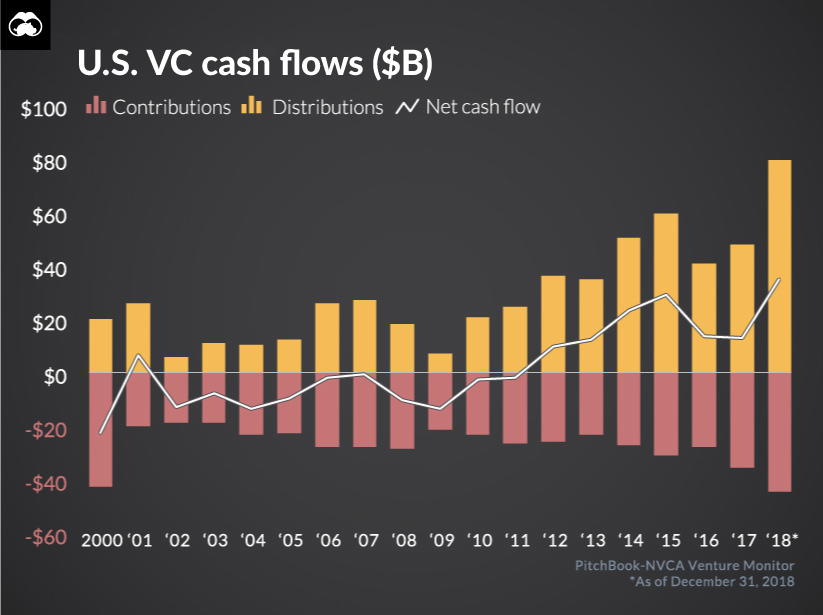

In the coming years, fundraising will likely remain strong. Venture capital net cash flows have been positive since 2012, which means capital is being returned to the limited partners of a fund faster than they can reinvest it into new vehicles. With this excess cash, investors will likely contribute to the next round of venture capital funds—continuing the virtuous cycle.

Dealmaking

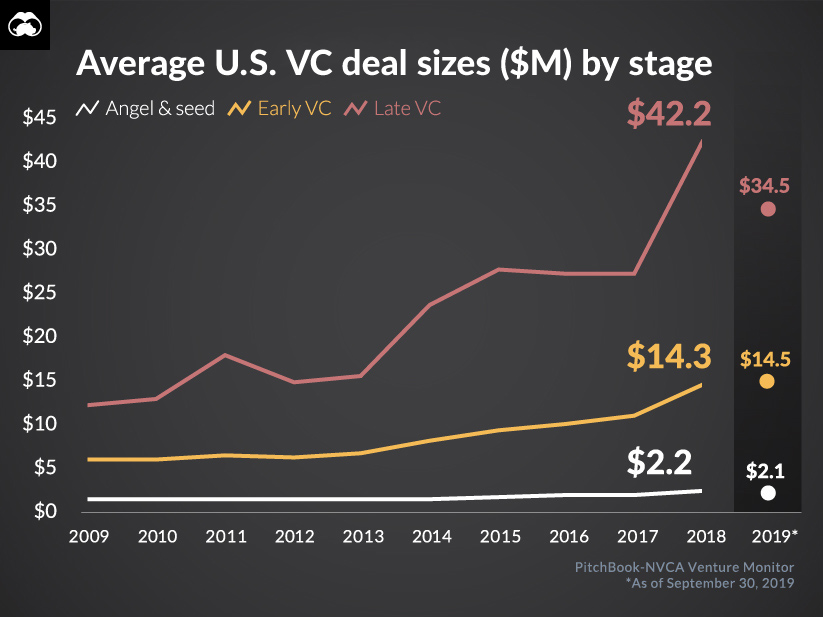

Total deal value is set to surpass $100 billion for a second consecutive year, partly driven by the rise of mega-deals. At every stage of startup financing, average deal sizes remain elevated.

While the focus has shifted to the massive amount of capital available at later stages, angel and seed-stage deals are still quite healthy, with an average deal size of over $2 million. At late financing stages, the 2019 average deal size is nearly $35 million, second only to 2018’s record of $44 million. Companies continue to raise large sums of capital prior to going public, with 140 late-stage mega-deals completed in 2019.

Exits

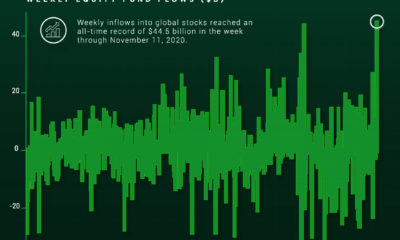

Total exit value reached $200 billion for the first time in a decade. Interestingly, initial public offerings (IPOs) comprised a whopping 82% of overall exit value. Multi-billion dollar IPOs continue to dominate headlines, with six such public debuts occurring in the third quarter. Notably missing from the list is WeWork. The company failed to go public due to profitability concerns, and anchor investor Softbank recently provided $9.5 billion in bailout financing in an attempt to rescue the company.

Sky High Valuations

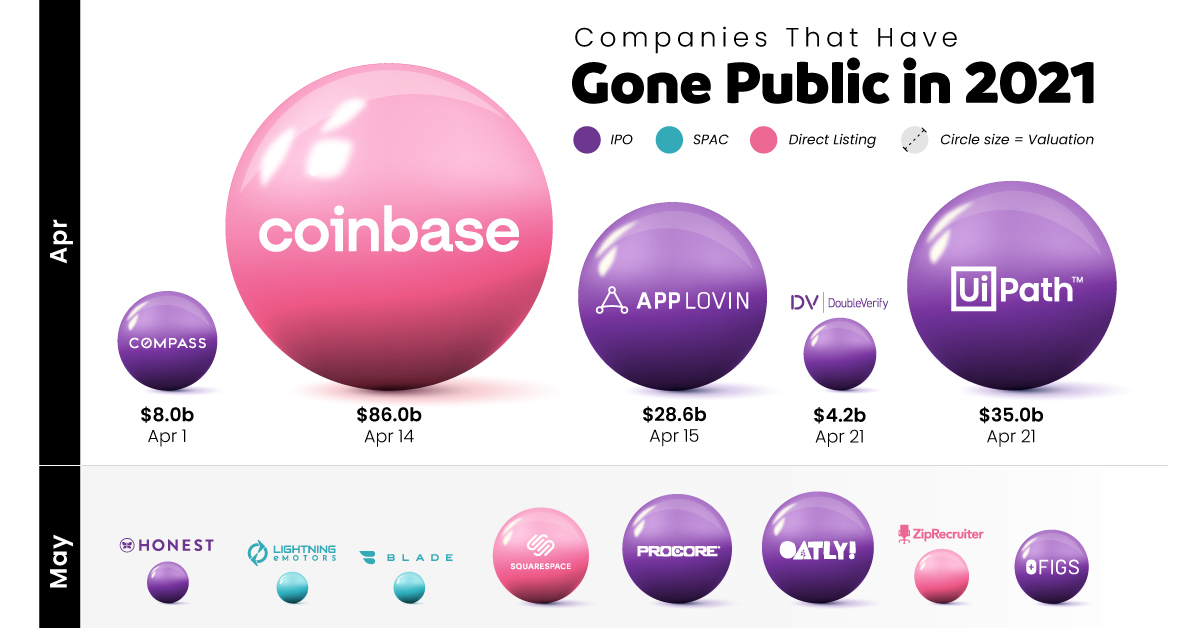

As venture capital reaches new heights, analysts will be paying closer attention to each startup’s profitability potential. –Alex Song, CEO and Co-Founder of Innovation Department With 2019 coming to a close, will fourth quarter venture capital activity be able to maintain its present momentum? on From much-hyped tech initial public offerings (IPOs) to food and healthcare services, many companies with already large followings have gone public this year. Some were supposed to go public in 2020 but got delayed due to the pandemic, and others saw the opportunity to take advantage of a strong current market. This graphic measures 68 companies that have gone public in 2021 — including IPOs, SPACs, and Direct Listings—as well as their subsequent valuations after listing.

Who’s Gone Public in 2021?

Historically, companies that wanted to go public employed one main method above others: the initial public offering (IPO). But companies going public today readily choose from one of three different options, depending on market situations, associated costs, and shareholder preference:

Initial Public Offering (IPO): A private company creates new shares which are underwritten by a financial organization and sold to the public. Special Purpose Acquisition Company (SPAC): A separate company with no operations is created strictly to raise capital to acquire the company going public. SPACs are the fastest method of going public, and have become popular in recent years. Direct Listing: A private company enters a market with only existing, outstanding shares being traded and no new shares created. The cost is lower than that of an IPO, since no fees need to be paid for underwriting.

The majority of companies going public in 2021 chose the IPO route, but some of the biggest valuations resulted from direct listings. Though there are many well-known names in the list, one of the biggest through lines continues to be the importance of tech. A majority of 2021’s newly public companies have been in tech, including multiple mobile apps, websites, and online services. The two biggest IPOs so far were South Korea’s Coupang, an online marketplace valued at $60 billion after going public, and China’s ride-hailing app Didi Chuxing, the year’s largest post-IPO valuation at $73 billion. And there were many apps and services going public through other means as well. Gaming company Roblox went public through a direct listing, earning a valuation of $30 billion, and cryptocurrency platform Coinbase has earned the year’s largest valuation so far, with an $86 billion valuation following its direct listing.

Big Companies Going Public in 2022

As with every year, some of the biggest companies going public were lined up for the later half. Tech will continue to be the talk of the markets. Payment processing firm Stripe was setting up to be the year’s biggest IPO with an estimated valuation of $95 billion, but got delayed. Likewise, online grocery delivery platform InstaCart, which saw a big upswing in traction due to the pandemic, has been looking to go public at a valuation of at least $39 billion. Of course, it’s common that potential public listings and offerings fall through. Whether they get delayed due to weak market conditions or cancelled at the last minute, anything can happen when it comes to public markets. This post has been updated as of January 1, 2022.