We rely on smartphones every waking minute to stay connected. However, the various products and services—also known as the smartphone multiplier market—that allow us to use these devices in the first place can often be an afterthought.

The Smartphone Plateau

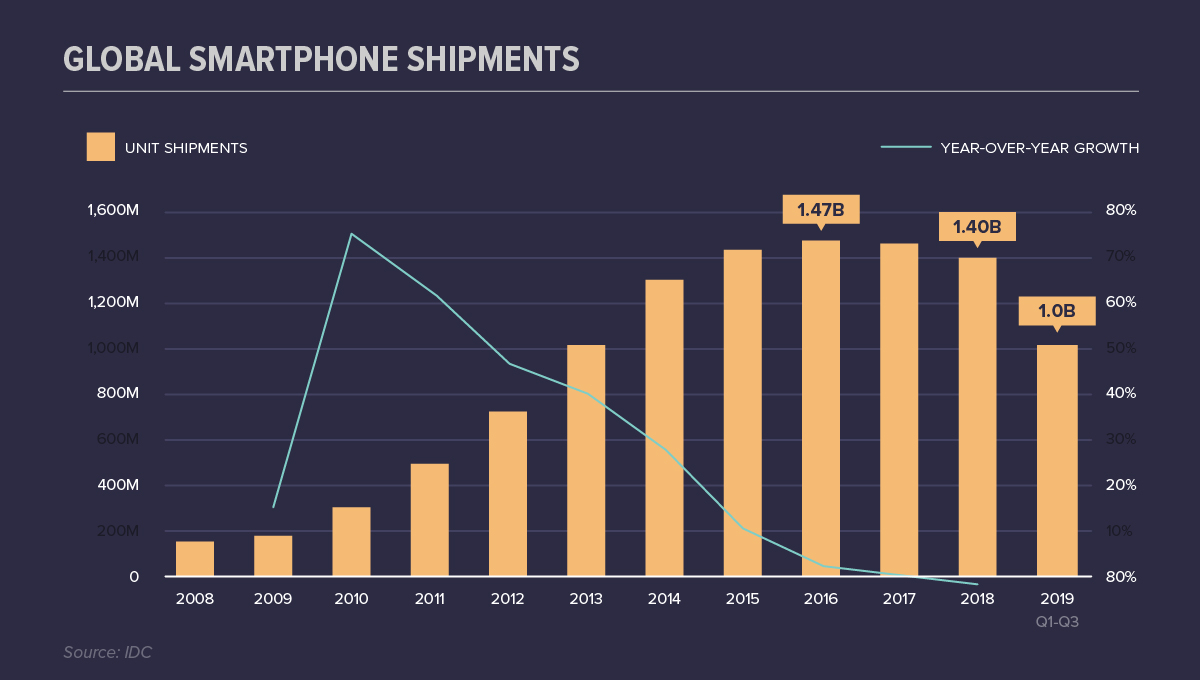

There are over 3.3 billion smartphone users in the world today. The smartphone economy—estimated to pull in $944 billion in total revenue in 2020—is so massive that it rivals the GDP of countries like Indonesia and the Netherlands. At the moment, the smartphones themselves contribute over half the market value. Despite the continued hype surrounding the release of new models, global unit shipments of smartphone devices appears to have reached a saturation point:

There are two theories as to why shipments are leveling off. First, product innovation is more iterative today than in the past, which means there are fewer groundbreaking features to entice consumers into purchasing new devices. A second factor is that people are simply holding onto their devices for longer than in the past. As device sales plateau, tech giants are diversifying efforts to find new ways to lure customers back in—and another related market is growing more lucrative as a result.

What is a “Smartphone Multiplier”?

When people think of the smartphone market, hardware likely springs to mind first, but an equally important part of the equation is the plethora of apps, services, accessories, and complementary devices that help us connect with the digital world. The ecosystem of these products and services are known as smartphone multipliers. According to Deloitte, this ecosystem will drive $459 billion of revenues in 2020, an impressive 15% increase from the prior year. The market can be broken down into three main categories: Largely driven by mobile advertising and app sales, content is by far the largest subcategory, accounting for 68% of revenues:

Mobile advertising surpassed TV as the largest advertising channel in 2019, partially thanks to the relentless growth of online video and social media, making ads virtually unavoidable on a smartphone. Gaming apps are benefiting from the immense processing power of today’s smartphones—and will bring in over two-thirds of total app revenue in 2020. Apple’s app store brought in approximately $1.8 billion in sales between Christmas Eve and New Year’s Day alone. If you’ve ever owned a pair of headphones or a powerbank, it’s easy to understand why accessories are the third-largest subcategory in the smartphone multiplier market. With more people ditching the cable for wireless headphones, this subcategory is also set to grow even more. The Next $1T Economy? In the U.S., 73% of adults go online several times a day or almost constantly, which makes it clear that they aren’t going to give up their smartphones anytime soon. As a result, smartphone multipliers will continue to evolve and flourish, presenting a unique opportunity for investors and businesses. Altogether, it’s expected that the smartphone multiplier market will grow between 5 and 10% annually through 2023, likely propelling the entire smartphone economy past the $1 trillion benchmark in the coming years.

The Next $1T Economy?

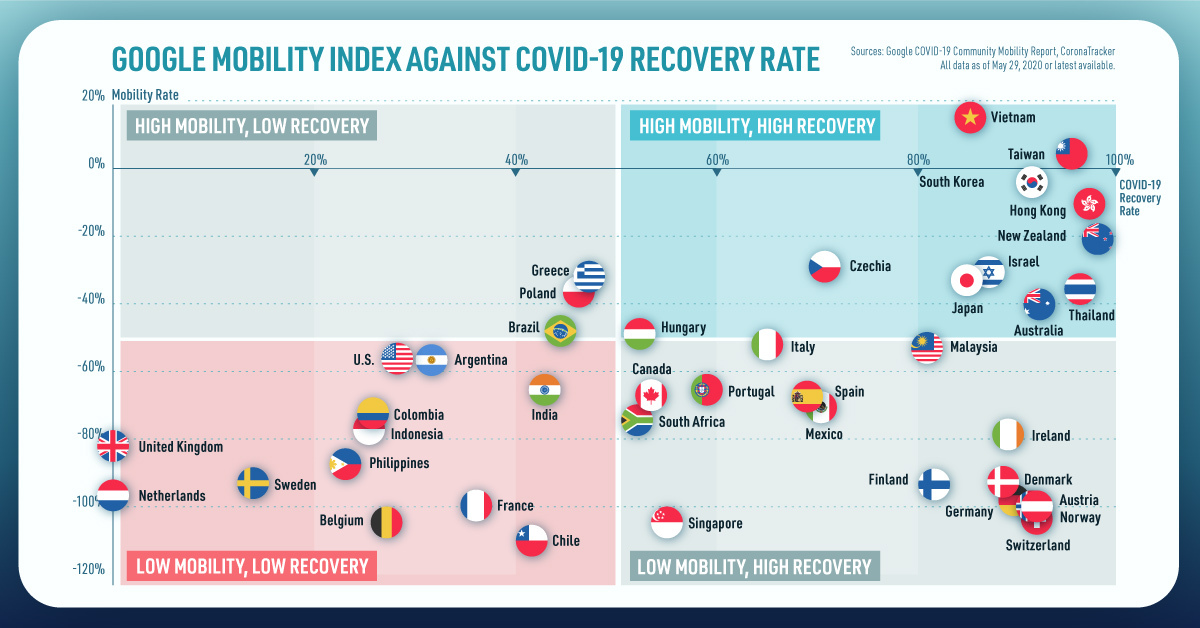

In the U.S., 73% of adults go online several times a day or almost constantly, which makes it clear that they aren’t going to give up their smartphones anytime soon. As a result, smartphone multipliers will continue to evolve and flourish, presenting a unique opportunity for investors and businesses. Altogether, it’s expected that the smartphone multiplier market will grow between 5 and 10% annually through 2023, likely propelling the entire smartphone economy past the $1 trillion benchmark in the coming years. on Today’s chart measures the extent to which 41 major economies are reopening, by plotting two metrics for each country: the mobility rate and the COVID-19 recovery rate: Data for the first measure comes from Google’s COVID-19 Community Mobility Reports, which relies on aggregated, anonymous location history data from individuals. Note that China does not show up in the graphic as the government bans Google services. COVID-19 recovery rates rely on values from CoronaTracker, using aggregated information from multiple global and governmental databases such as WHO and CDC.

Reopening Economies, One Step at a Time

In general, the higher the mobility rate, the more economic activity this signifies. In most cases, mobility rate also correlates with a higher rate of recovered people in the population. Here’s how these countries fare based on the above metrics. Mobility data as of May 21, 2020 (Latest available). COVID-19 case data as of May 29, 2020. In the main scatterplot visualization, we’ve taken things a step further, assigning these countries into four distinct quadrants:

1. High Mobility, High Recovery

High recovery rates are resulting in lifted restrictions for countries in this quadrant, and people are steadily returning to work. New Zealand has earned praise for its early and effective pandemic response, allowing it to curtail the total number of cases. This has resulted in a 98% recovery rate, the highest of all countries. After almost 50 days of lockdown, the government is recommending a flexible four-day work week to boost the economy back up.

2. High Mobility, Low Recovery

Despite low COVID-19 related recoveries, mobility rates of countries in this quadrant remain higher than average. Some countries have loosened lockdown measures, while others did not have strict measures in place to begin with. Brazil is an interesting case study to consider here. After deferring lockdown decisions to state and local levels, the country is now averaging the highest number of daily cases out of any country. On May 28th, for example, the country had 24,151 new cases and 1,067 new deaths.

3. Low Mobility, High Recovery

Countries in this quadrant are playing it safe, and holding off on reopening their economies until the population has fully recovered. Italy, the once-epicenter for the crisis in Europe is understandably wary of cases rising back up to critical levels. As a result, it has opted to keep its activity to a minimum to try and boost the 65% recovery rate, even as it slowly emerges from over 10 weeks of lockdown.

4. Low Mobility, Low Recovery

Last but not least, people in these countries are cautiously remaining indoors as their governments continue to work on crisis response. With a low 0.05% recovery rate, the United Kingdom has no immediate plans to reopen. A two-week lag time in reporting discharged patients from NHS services may also be contributing to this low number. Although new cases are leveling off, the country has the highest coronavirus-caused death toll across Europe. The U.S. also sits in this quadrant with over 1.7 million cases and counting. Recently, some states have opted to ease restrictions on social and business activity, which could potentially result in case numbers climbing back up. Over in Sweden, a controversial herd immunity strategy meant that the country continued business as usual amid the rest of Europe’s heightened regulations. Sweden’s COVID-19 recovery rate sits at only 13.9%, and the country’s -93% mobility rate implies that people have been taking their own precautions.

COVID-19’s Impact on the Future

It’s important to note that a “second wave” of new cases could upend plans to reopen economies. As countries reckon with these competing risks of health and economic activity, there is no clear answer around the right path to take. COVID-19 is a catalyst for an entirely different future, but interestingly, it’s one that has been in the works for a while. —Carmen Reinhart, incoming Chief Economist for the World Bank Will there be any chance of returning to “normal” as we know it?