Every day, your feeds are likely dominated by the latest news about Silicon Valley’s biggest tech giants. However, what is less commonly talked about is the alternate universe that exists on the other side of China’s Great Firewall. It’s there that four Chinese tech giants are taking advantage of a lack of foreign competition to post explosive growth numbers – some which compare favorably even to their American peers.

Bizarro World

Like the “Bizarro Jerry” episode of Seinfeld, the Chinese-based tech giants look recognizably familiar – but markedly different – to the ones we know so well.

Alibaba

Likely the best known of China’s tech giants, Alibaba is the dominant online retailer in the country. The company had revenues of $25.1 billion in 2017 and is seeing that revenue grow at impressive speeds. In its most recent quarterly results (Q3, 2017), the company noted a 56% jump in revenue.

Baidu

Baidu is the largest search engine in China and also a leading player in AI. It’s the most visited website in China, and ranks #4 globally. The company will announce 2017 annual results in the coming weeks, after reporting a 29% jump in revenue in Q3 2017. Google’s searching for a way in: Google was blocked in China in 2010 after refusing to filter search requests. However, since then, the giant has been able to take very small steps in entering the Chinese market – even though its signature search engine is still blocked, Google now has at least three offices in the country.

Tencent

Tencent has recently been in the news for its rapidly surging stock. The company, which owns the dominant social platform in China (WeChat), is now valued at over $500 billion. For those keeping tabs, Facebook is currently worth $550 billion. It’s complicated: Facebook remains blocked by China, meaning that Zuckerberg and company can’t take advantage of a 1 billion plus market of people with growing buying power. Even if it found its way in, there are multiple social platforms in China and competition would be stiff.

Xiaomi

Dubbed as “China’s Apple”, Xiaomi is one of the world’s most valuable private companies. Things have been hot and cold for the ambitious smartphone manufacturer, but recently reports have surfaced that Xiaomi will IPO in the second half of 2018 for upwards of $50 billion. Apple’s shine has dulled: Apple’s entrance into the Chinese market was once described as a success, but recently competition from domestic manufacturers has derailed that claim.

Crossing Over

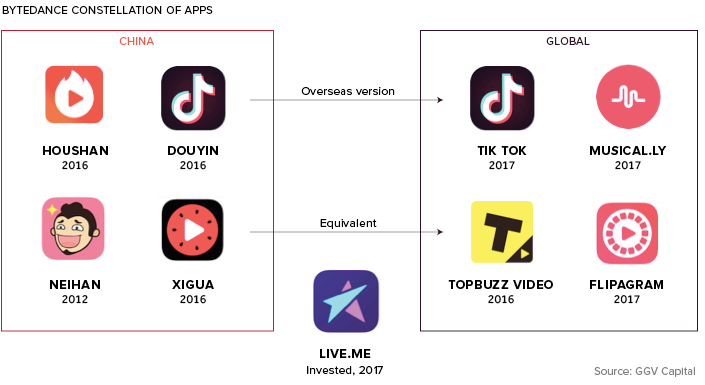

After a new round of financing, Bytedance – a Chinese company specializing in short-form video – surpassed Uber as the most valuable startup in the world, valued at $75 billion.

Unlike some of its peers, Bytedance has found success outside of China. Tik Tok, for example, has well over 300 million users world wide, and the company is making investments into other popular broadcasting platforms, such as Live.me. on But fast forward to the end of last week, and SVB was shuttered by regulators after a panic-induced bank run. So, how exactly did this happen? We dig in below.

Road to a Bank Run

SVB and its customers generally thrived during the low interest rate era, but as rates rose, SVB found itself more exposed to risk than a typical bank. Even so, at the end of 2022, the bank’s balance sheet showed no cause for alarm.

As well, the bank was viewed positively in a number of places. Most Wall Street analyst ratings were overwhelmingly positive on the bank’s stock, and Forbes had just added the bank to its Financial All-Stars list. Outward signs of trouble emerged on Wednesday, March 8th, when SVB surprised investors with news that the bank needed to raise more than $2 billion to shore up its balance sheet. The reaction from prominent venture capitalists was not positive, with Coatue Management, Union Square Ventures, and Peter Thiel’s Founders Fund moving to limit exposure to the 40-year-old bank. The influence of these firms is believed to have added fuel to the fire, and a bank run ensued. Also influencing decision making was the fact that SVB had the highest percentage of uninsured domestic deposits of all big banks. These totaled nearly $152 billion, or about 97% of all deposits. By the end of the day, customers had tried to withdraw $42 billion in deposits.

What Triggered the SVB Collapse?

While the collapse of SVB took place over the course of 44 hours, its roots trace back to the early pandemic years. In 2021, U.S. venture capital-backed companies raised a record $330 billion—double the amount seen in 2020. At the time, interest rates were at rock-bottom levels to help buoy the economy. Matt Levine sums up the situation well: “When interest rates are low everywhere, a dollar in 20 years is about as good as a dollar today, so a startup whose business model is “we will lose money for a decade building artificial intelligence, and then rake in lots of money in the far future” sounds pretty good. When interest rates are higher, a dollar today is better than a dollar tomorrow, so investors want cash flows. When interest rates were low for a long time, and suddenly become high, all the money that was rushing to your customers is suddenly cut off.” Source: Pitchbook Why is this important? During this time, SVB received billions of dollars from these venture-backed clients. In one year alone, their deposits increased 100%. They took these funds and invested them in longer-term bonds. As a result, this created a dangerous trap as the company expected rates would remain low. During this time, SVB invested in bonds at the top of the market. As interest rates rose higher and bond prices declined, SVB started taking major losses on their long-term bond holdings.

Losses Fueling a Liquidity Crunch

When SVB reported its fourth quarter results in early 2023, Moody’s Investor Service, a credit rating agency took notice. In early March, it said that SVB was at high risk for a downgrade due to its significant unrealized losses. In response, SVB looked to sell $2 billion of its investments at a loss to help boost liquidity for its struggling balance sheet. Soon, more hedge funds and venture investors realized SVB could be on thin ice. Depositors withdrew funds in droves, spurring a liquidity squeeze and prompting California regulators and the FDIC to step in and shut down the bank.

What Happens Now?

While much of SVB’s activity was focused on the tech sector, the bank’s shocking collapse has rattled a financial sector that is already on edge.

The four biggest U.S. banks lost a combined $52 billion the day before the SVB collapse. On Friday, other banking stocks saw double-digit drops, including Signature Bank (-23%), First Republic (-15%), and Silvergate Capital (-11%).

Source: Morningstar Direct. *Represents March 9 data, trading halted on March 10.

When the dust settles, it’s hard to predict the ripple effects that will emerge from this dramatic event. For investors, the Secretary of the Treasury Janet Yellen announced confidence in the banking system remaining resilient, noting that regulators have the proper tools in response to the issue.

But others have seen trouble brewing as far back as 2020 (or earlier) when commercial banking assets were skyrocketing and banks were buying bonds when rates were low.