Dalio founded Bridgewater Associates out of his apartment in 1975, and now the long-running hedge fund is recognized as the world’s largest by assets under management (AUM) with $122.2 billion, and as the fifth most important private company in the United States by Fortune magazine. However, since 2011, the billionaire has passed the baton for the role of CEO at Bridgewater – and he’s also been focused on passing on his knowledge as well.

The Knowledge Baton

Most recently, Ray Dalio has been praised for releasing his book entitled Principles: Life and Work, where he outlines the principles that have guided his impressive success with Bridgewater. Just as timeless, however, is this 30 minute animated video that he and Bridgewater released a few years ago, which gives their unique template for how the global economy works. It’s possible that you may have seen this before – but if not, it can be a useful tool to understand how the pieces fit together.

Dalio starts at the micro level, showing how individual transactions are part of the overall economic machine. Then, using human nature and history as a guide, Dalio reduces the complex global economy down to just three major forces that must be understood.

Three Major Forces

Dalio says this model has guided Bridgewater for over 30 years, and that there are three major forces that shape the economy:

- Productivity Growth Productivity growth, which is measured as a percentage of GDP, grows over time as knowledge, technology, and innovations help to raise our productivity and living standards.

- Short-Term Debt Cycle Usually lasting 5-8 years, the short-term debt cycle is a repeating pattern that occurs as credit expands and contracts.

- Long-Term Debt Cycle Usually lasting 75-100 years, the long-term debt cycle usually ends in a period of extreme deleveraging, where global debt is unsustainable and asset prices fall. Based on Dalio’s model and his concerns about the abuse of money printing by central banks, it’s clear why he routinely holds gold for about 5-10% of his personal portfolio, as well.

Rules of Thumb

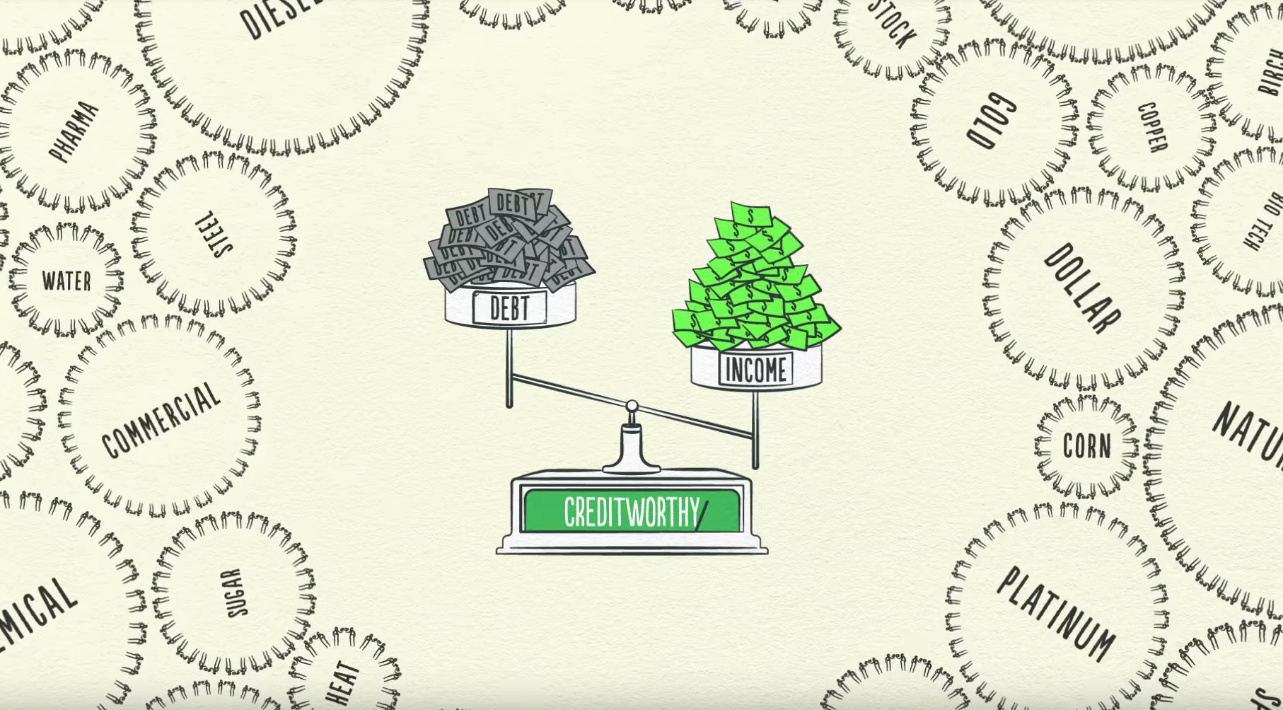

The video ends with Dalio giving three rules of thumb – takeaways that make sense for individuals, companies, and policymakers. Rule #1. Don’t have debt rise faster than income Your debt burdens will eventually crush you. Rule #2. Don’t have income rise faster than productivity You’ll eventually become uncompetitive. Rule #3. Do all that you can to raise productivity In the long run, that’s what matters the most. With an estimated net worth of $17 billion, it seems Dalio’s rules could be worth keeping in mind.

on Last year, stock and bond returns tumbled after the Federal Reserve hiked interest rates at the fastest speed in 40 years. It was the first time in decades that both asset classes posted negative annual investment returns in tandem. Over four decades, this has happened 2.4% of the time across any 12-month rolling period. To look at how various stock and bond asset allocations have performed over history—and their broader correlations—the above graphic charts their best, worst, and average returns, using data from Vanguard.

How Has Asset Allocation Impacted Returns?

Based on data between 1926 and 2019, the table below looks at the spectrum of market returns of different asset allocations:

We can see that a portfolio made entirely of stocks returned 10.3% on average, the highest across all asset allocations. Of course, this came with wider return variance, hitting an annual low of -43% and a high of 54%.

A traditional 60/40 portfolio—which has lost its luster in recent years as low interest rates have led to lower bond returns—saw an average historical return of 8.8%. As interest rates have climbed in recent years, this may widen its appeal once again as bond returns may rise.

Meanwhile, a 100% bond portfolio averaged 5.3% in annual returns over the period. Bonds typically serve as a hedge against portfolio losses thanks to their typically negative historical correlation to stocks.

A Closer Look at Historical Correlations

To understand how 2022 was an outlier in terms of asset correlations we can look at the graphic below:

The last time stocks and bonds moved together in a negative direction was in 1969. At the time, inflation was accelerating and the Fed was hiking interest rates to cool rising costs. In fact, historically, when inflation surges, stocks and bonds have often moved in similar directions. Underscoring this divergence is real interest rate volatility. When real interest rates are a driving force in the market, as we have seen in the last year, it hurts both stock and bond returns. This is because higher interest rates can reduce the future cash flows of these investments. Adding another layer is the level of risk appetite among investors. When the economic outlook is uncertain and interest rate volatility is high, investors are more likely to take risk off their portfolios and demand higher returns for taking on higher risk. This can push down equity and bond prices. On the other hand, if the economic outlook is positive, investors may be willing to take on more risk, in turn potentially boosting equity prices.

Current Investment Returns in Context

Today, financial markets are seeing sharp swings as the ripple effects of higher interest rates are sinking in. For investors, historical data provides insight on long-term asset allocation trends. Over the last century, cycles of high interest rates have come and gone. Both equity and bond investment returns have been resilient for investors who stay the course.