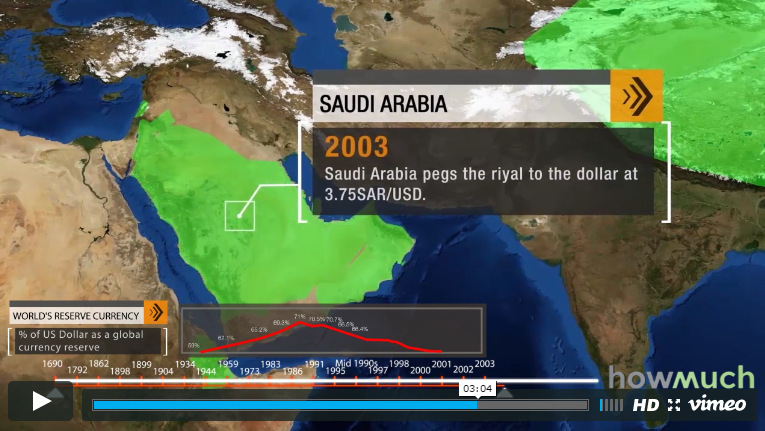

Video: How the U.S. Dollar Spread Across the World

The U.S. dollar is the world’s dominant reserve currency, making up about 64% of all official foreign exchange reserves. The euro is second on the list. The euro had shown decent promise as a reserve currency up until 2009, when it peaked at 28% of global reserves. However, between the European Debt Crisis and years of anemic growth in major European countries, the currency has declined to 20% of official global reserves today. Other currencies held as foreign reserves include British pounds (5%), Japanese yen (4%), Canadian dollars (2%), and Australian dollars (2%). Swiss francs and other currencies make up the remaining 3%. The Chinese yuan also recently won IMF approval to make up part of its Special Drawing Rights (SDR) basket. More and more trade is in Chinese currency, and the country’s bond markets are beginning to grow and internationalize. The yuan is not a significant player yet, but in the future it may be.

The Rise of the Dollar

History has shown that every 100 years or so, the world’s de facto reserve currency has been replaced. The last time this happened was after World War II, when the Bretton Woods system came into effect. Under this system, the U.S. dollar was established as the global anchor currency, linked to gold at a fixed rate. The combination of post-war growth in the U.S. economy along with the official link between dollars and gold provided the international monetary system with a degree of certainty that had been missing for decades. In 1971, Nixon severed the link between the U.S. dollar and gold, but continued U.S. economic and financial strength would keep the dollar prominent on the international monetary stage for decades to come.

What Does the Future Hold?

The video in this post, created by the team at HowMuch.net shows the evolution in acceptance of the greenback. At first, it was U.S. overseas territories such as Guam and the U.S. Virgin Islands that would adopt the dollar. Later in the 20th century, major nations from China to Argentina would attempt to peg their currencies to the dollar for much-needed stability. Will this dollar hegemony continue well into the future? As HowMuch.net notes in its post, it is the size, stability, and liquidity of the country’s financial markets that are the major underlying factors to determine the strength of a reserve currency. While China is now the largest economy in the world in terms of purchasing power, the financial markets of the United States still reign supreme. For example, U.S. stock markets still make up 52% of the total market capitalization of global equity markets. China’s markets are puny in comparison at around 2%. There are signs of a shift in momentum, however. U.S. Treasuries have less liquidity and China has been dumping them on the market. The yuan is officially part of the SDR basket in October 2016, and China could see an inflow of up to $3 trillion in renminbi assets as a result. The yuan has also now passed the yen in terms of cross-border trade volume.

on Did you know that nearly one-fifth of all the gold ever mined is held by central banks? Besides investors and jewelry consumers, central banks are a major source of gold demand. In fact, in 2022, central banks snapped up gold at the fastest pace since 1967. However, the record gold purchases of 2022 are in stark contrast to the 1990s and early 2000s, when central banks were net sellers of gold. The above infographic uses data from the World Gold Council to show 30 years of central bank gold demand, highlighting how official attitudes toward gold have changed in the last 30 years.

Why Do Central Banks Buy Gold?

Gold plays an important role in the financial reserves of numerous nations. Here are three of the reasons why central banks hold gold:

Balancing foreign exchange reserves Central banks have long held gold as part of their reserves to manage risk from currency holdings and to promote stability during economic turmoil. Hedging against fiat currencies Gold offers a hedge against the eroding purchasing power of currencies (mainly the U.S. dollar) due to inflation. Diversifying portfolios Gold has an inverse correlation with the U.S. dollar. When the dollar falls in value, gold prices tend to rise, protecting central banks from volatility. The Switch from Selling to Buying In the 1990s and early 2000s, central banks were net sellers of gold. There were several reasons behind the selling, including good macroeconomic conditions and a downward trend in gold prices. Due to strong economic growth, gold’s safe-haven properties were less valuable, and low returns made it unattractive as an investment. Central bank attitudes toward gold started changing following the 1997 Asian financial crisis and then later, the 2007–08 financial crisis. Since 2010, central banks have been net buyers of gold on an annual basis. Here’s a look at the 10 largest official buyers of gold from the end of 1999 to end of 2021: Rank CountryAmount of Gold Bought (tonnes)% of All Buying #1🇷🇺 Russia 1,88828% #2🇨🇳 China 1,55223% #3🇹🇷 Türkiye 5418% #4🇮🇳 India 3956% #5🇰🇿 Kazakhstan 3455% #6🇺🇿 Uzbekistan 3115% #7🇸🇦 Saudi Arabia 1803% #8🇹🇭 Thailand 1682% #9🇵🇱 Poland1282% #10🇲🇽 Mexico 1152% Total5,62384% Source: IMF The top 10 official buyers of gold between end-1999 and end-2021 represent 84% of all the gold bought by central banks during this period. Russia and China—arguably the United States’ top geopolitical rivals—have been the largest gold buyers over the last two decades. Russia, in particular, accelerated its gold purchases after being hit by Western sanctions following its annexation of Crimea in 2014. Interestingly, the majority of nations on the above list are emerging economies. These countries have likely been stockpiling gold to hedge against financial and geopolitical risks affecting currencies, primarily the U.S. dollar. Meanwhile, European nations including Switzerland, France, Netherlands, and the UK were the largest sellers of gold between 1999 and 2021, under the Central Bank Gold Agreement (CBGA) framework. Which Central Banks Bought Gold in 2022? In 2022, central banks bought a record 1,136 tonnes of gold, worth around $70 billion. Country2022 Gold Purchases (tonnes)% of Total 🇹🇷 Türkiye14813% 🇨🇳 China 625% 🇪🇬 Egypt 474% 🇶🇦 Qatar333% 🇮🇶 Iraq 343% 🇮🇳 India 333% 🇦🇪 UAE 252% 🇰🇬 Kyrgyzstan 61% 🇹🇯 Tajikistan 40.4% 🇪🇨 Ecuador 30.3% 🌍 Unreported 74165% Total1,136100% Türkiye, experiencing 86% year-over-year inflation as of October 2022, was the largest buyer, adding 148 tonnes to its reserves. China continued its gold-buying spree with 62 tonnes added in the months of November and December, amid rising geopolitical tensions with the United States. Overall, emerging markets continued the trend that started in the 2000s, accounting for the bulk of gold purchases. Meanwhile, a significant two-thirds, or 741 tonnes of official gold purchases were unreported in 2022. According to analysts, unreported gold purchases are likely to have come from countries like China and Russia, who are looking to de-dollarize global trade to circumvent Western sanctions.

There were several reasons behind the selling, including good macroeconomic conditions and a downward trend in gold prices. Due to strong economic growth, gold’s safe-haven properties were less valuable, and low returns made it unattractive as an investment.

Central bank attitudes toward gold started changing following the 1997 Asian financial crisis and then later, the 2007–08 financial crisis. Since 2010, central banks have been net buyers of gold on an annual basis.

Here’s a look at the 10 largest official buyers of gold from the end of 1999 to end of 2021:

Source: IMF

The top 10 official buyers of gold between end-1999 and end-2021 represent 84% of all the gold bought by central banks during this period.

Russia and China—arguably the United States’ top geopolitical rivals—have been the largest gold buyers over the last two decades. Russia, in particular, accelerated its gold purchases after being hit by Western sanctions following its annexation of Crimea in 2014.

Interestingly, the majority of nations on the above list are emerging economies. These countries have likely been stockpiling gold to hedge against financial and geopolitical risks affecting currencies, primarily the U.S. dollar.

Meanwhile, European nations including Switzerland, France, Netherlands, and the UK were the largest sellers of gold between 1999 and 2021, under the Central Bank Gold Agreement (CBGA) framework.

Which Central Banks Bought Gold in 2022?

In 2022, central banks bought a record 1,136 tonnes of gold, worth around $70 billion. Türkiye, experiencing 86% year-over-year inflation as of October 2022, was the largest buyer, adding 148 tonnes to its reserves. China continued its gold-buying spree with 62 tonnes added in the months of November and December, amid rising geopolitical tensions with the United States. Overall, emerging markets continued the trend that started in the 2000s, accounting for the bulk of gold purchases. Meanwhile, a significant two-thirds, or 741 tonnes of official gold purchases were unreported in 2022. According to analysts, unreported gold purchases are likely to have come from countries like China and Russia, who are looking to de-dollarize global trade to circumvent Western sanctions.