In total, there were 492,133 new business applications in January 2021—an increase of over 73% year-over-year (YoY). The region with the highest growth rate was the South at 84% with more than 220,000 new business applications in the region in January of this year. Mississippi had the highest percent increase at 164%, with over 6,000 new applications in January 2021. Here’s a closer look at the number of total applications by state and region:

Notably, new business applications have soared in the last month or so, bouncing back from a dip between July and December 2020. The growth rate from December 2020 to January 2021 stood at 42.6%, with the biggest change happening in the Midwest, where applications have gone up 48.6%. Here’s a look at the biggest changes in applications by region since December 2020: Note: Business applications are measured by collecting data on new applications for Employer Identification Numbers with the U.S. government.

Opportunity Out of Crisis

Prior to the pandemic, new business startups were actually on the decline, but in times of crisis there is often opportunity. People have become wildly innovative during COVID-19, partly because they were forced to do so due to job or income loss. Economists call this ‘creative destruction,’ wherein new innovation springs up because of the failure of particular industries or businesses. Here’s a look at new business applications by industry. Creative destruction has been keenly exemplified in the rise of remote and digital services over traditional brick and mortar stores. In fact, the industry with the highest number of new business applications in January 2021 was retail services, mostly online, with over 101,000 applications.

Feeling the Entrepreneurial Spirit?

As business applications are on the rise, more jobs could potentially be created in the U.S., and competition will likely increase as well. While starting a business during COVID-19 is risky, it could have immense payoffs for the individuals involved and the overall economy. In fact, a piece from the U.S. Chamber of Commerce actually recommends specific business ideas that are ‘pandemic-friendly.’ Among many virtually-based ideas, the list includes:

Digital marketing App development Fitness and wellness services Box subscription services

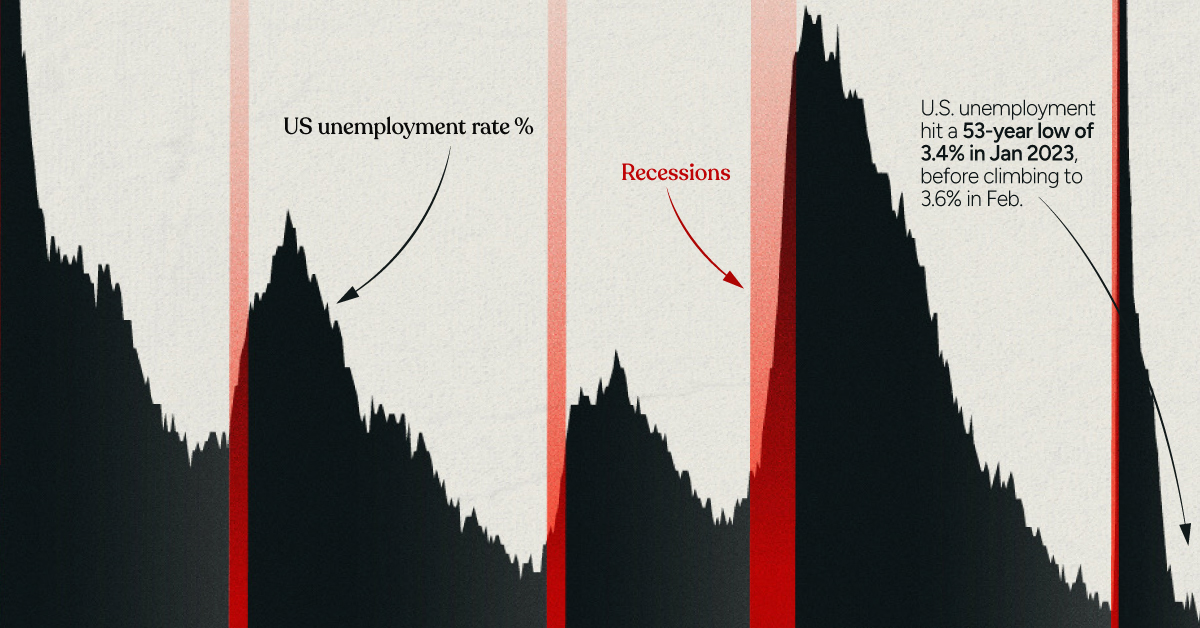

Perhaps, for digitally minded entrepreneurs, there has never been a better time to start a business. on Both figures surpassed analyst expectations by a wide margin, and in January, the unemployment rate hit a 53-year low of 3.4%. With the recent release of February’s numbers, unemployment is now reported at a slightly higher 3.6%. A low unemployment rate is a classic sign of a strong economy. However, as this visualization shows, unemployment often reaches a cyclical low point right before a recession materializes.

Reasons for the Trend

In an interview regarding the January jobs data, U.S. Treasury Secretary Janet Yellen made a bold statement: While there’s nothing wrong with this assessment, the trend we’ve highlighted suggests that Yellen may need to backtrack in the near future. So why do recessions tend to begin after unemployment bottoms out?

The Economic Cycle

The economic cycle refers to the economy’s natural tendency to fluctuate between periods of growth and recession. This can be thought of similarly to the four seasons in a year. An economy expands (spring), reaches a peak (summer), begins to contract (fall), then hits a trough (winter). With this in mind, it’s reasonable to assume that a cyclical low in the unemployment rate (peak employment) is simply a sign that the economy has reached a high point.

Monetary Policy

During periods of low unemployment, employers may have a harder time finding workers. This forces them to offer higher wages, which can contribute to inflation. For context, consider the labor shortage that emerged following the COVID-19 pandemic. We can see that U.S. wage growth (represented by a three-month moving average) has climbed substantially, and has held above 6% since March 2022. The Federal Reserve, whose mandate is to ensure price stability, will take measures to prevent inflation from climbing too far. In practice, this involves raising interest rates, which makes borrowing more expensive and dampens economic activity. Companies are less likely to expand, reducing investment and cutting jobs. Consumers, on the other hand, reduce the amount of large purchases they make. Because of these reactions, some believe that aggressive rate hikes by the Fed can either cause a recession, or make them worse. This is supported by recent research, which found that since 1950, central banks have been unable to slow inflation without a recession occurring shortly after.

Politicians Clash With Economists

The Fed has raised interest rates at an unprecedented pace since March 2022 to combat high inflation. More recently, Fed Chairman Jerome Powell warned that interest rates could be raised even higher than originally expected if inflation continues above target. Senator Elizabeth Warren expressed concern that this would cost Americans their jobs, and ultimately, cause a recession. Powell remains committed to bringing down inflation, but with the recent failures of Silicon Valley Bank and Signature Bank, some analysts believe there could be a pause coming in interest rate hikes. Editor’s note: just after publication of this article, it was confirmed that U.S. interest rates were hiked by 25 basis points (bps) by the Federal Reserve.