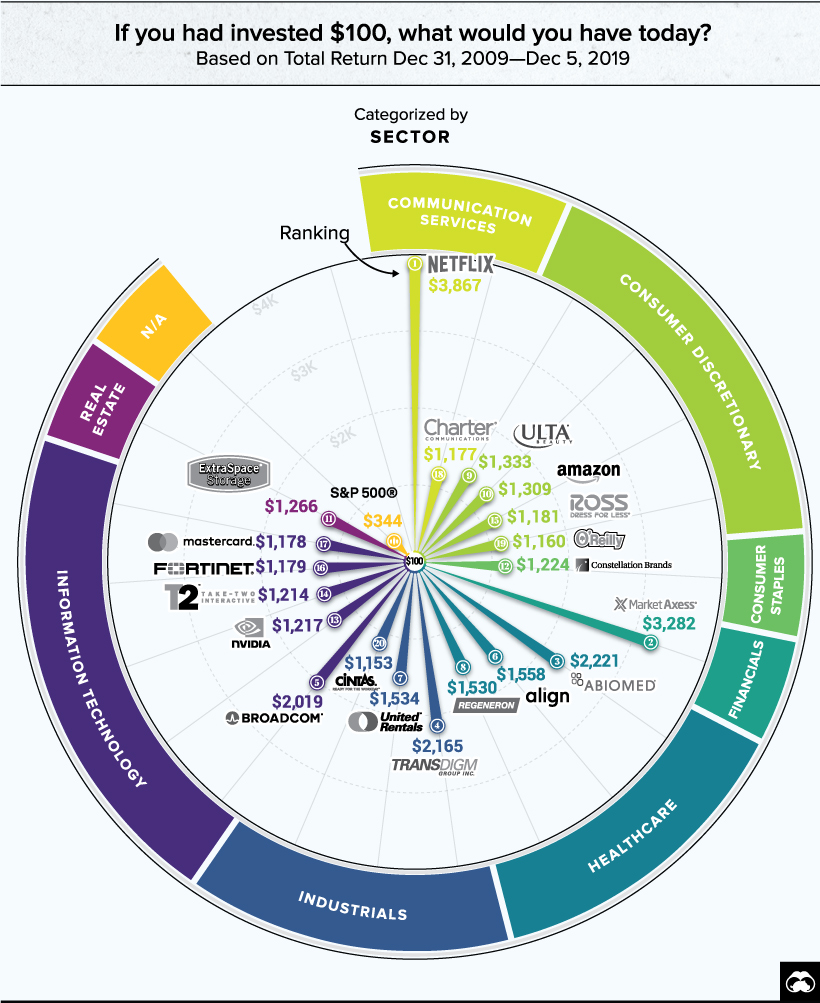

Today’s visualization reveals the best-performing stocks over the last 10 years, and shows how much an initial $100 investment would be worth today.

The Shortlist

To compile the list, MarketWatch reviewed the current S&P 500 constituents and excluded any stocks that have traded in their present form for less than 10 years. The remaining companies were sorted based on their total return, with reinvested dividends, from December 31, 2009 to December 5, 2019. So, which stocks come out on top? Here’s a full list of the top 20, organized by ranking: Note: The final value of a $100 investment is based on the total return, with reinvested dividends, from December 31, 2009 – December 5, 2019. In comparison, $100 in the S&P 500 index overall would have amounted to $344 over the same time period. Let’s take a closer look at these strong performers.

Household Names

Streaming giant Netflix takes the #1 spot. The company earned a staggering 3,767% return over the last ten years, meaning an initial $100 investment would now be worth almost $4,000. However, it remains to be seen whether Netflix’s first mover advantage will remain strong with new competitors entering the space. At #12 on the list, Constellation Brands—owner of several alcohol brands such as Corona—is also no stranger to invention. The company is protecting itself against cannabidiol (CBD) disruption with a $5 billion dollar investment in Canopy Growth, and future plans to create its own CBD-infused beverages. Other well-known names on the top 20 list include discount department store chain Ross Stores (#15) and the credit card company Mastercard (#17), with the latter benefiting from an oligopoly in the industry.

Flying Under the Radar

Apart from the names you’d expect to see, there are also some lesser-known companies that made the list. Well established among institutional investors and broker-dealers, MarketAxess Holdings takes the #2 spot. The fintech company operates a global electronic bond trading platform, vastly improving the process for investors who traditionally traded bonds “over-the-counter”. In third place, healthcare technology company Abiomed develops medical devices that provide circulatory support. The company’s Impella® device—the world’s smallest heart pump— has been used to treat over 50,000 U.S. patients. Fourth place company Transdigm Group gains its stronghold by developing specialized products for the aerospace industry. It has a strong acquisition strategy as well, having acquired over 60 businesses since its formation in 1993.

A Sector View

If we organize the top 20 by sector, information technology stocks appear in the list most frequently with five companies, followed by consumer discretionary (4 companies), and industrials and healthcare (3 companies each).

Sectors with less representation in the top 20 are communication services (2 companies), as well as consumer staples, financials, and real estate (1 company each).

The Bottom Line

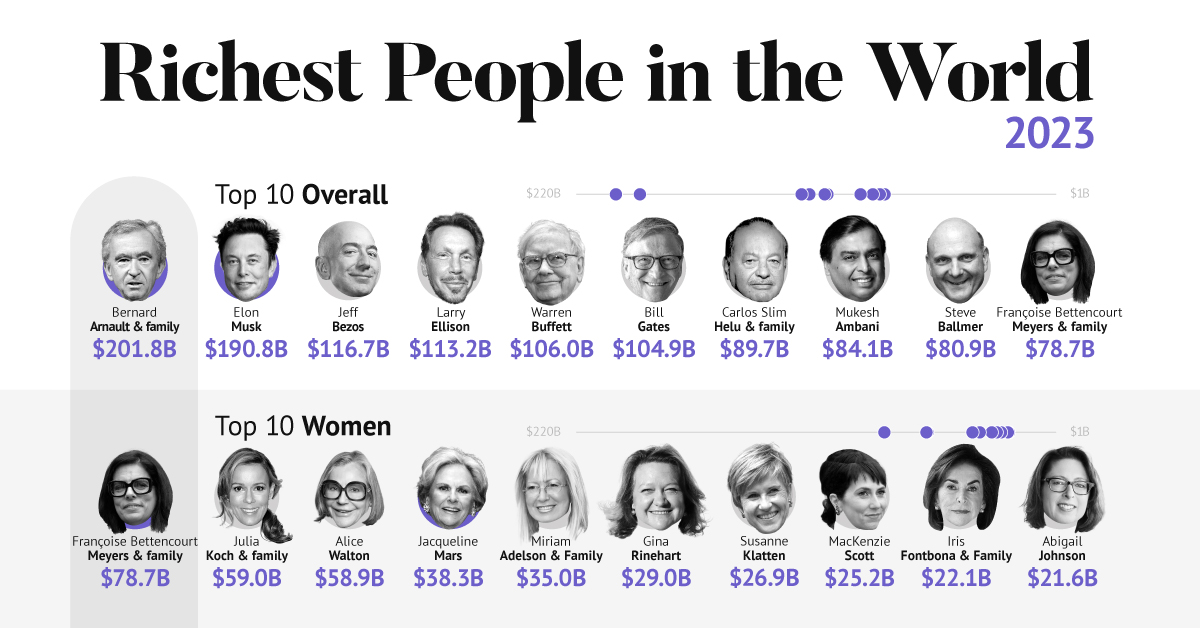

While these stocks have performed extremely well over the last decade, they are not necessarily the best portfolio additions today. Some companies may have become overvalued, or be facing new competition in their industry—as is the case with Netflix. It’s best to consider all current information when building a portfolio. However, the top 20 stocks do demonstrate the power of a buy-and-hold strategy. If you’re lucky enough to identify a winner early on, it’s possible to simply sit back and let your dollars grow. on A lagging stock market dented these fortunes against high interest rates, energy shocks, and economic uncertainty. But some of the world’s billionaires have flourished in this environment, posting sky-high revenues in spite of inflationary pressures. With data from Forbes Real-Time Billionaires List, we feature a snapshot of the richest people in the world in 2023.

Luxury Mogul Takes Top Spot

The world’s richest person is France’s Bernard Arnault, the chief executive of LVMH.

With 75 brands, the luxury conglomerate owns Louis Vuitton, Christian Dior, and Tiffany. LVMH traces back to 1985, when Arnault cut his first major deal with the company by acquiring Christian Dior, a firm that was struggling with bankruptcy.

Fast-forward to today, and the company is seeing record profits despite challenging market conditions. Louis Vuitton, for instance, has doubled its sales in four years.

In the table below, we show the world’s 10 richest people with data as of February 27, 2023:

Elon Musk, the second-wealthiest person in the world has a net worth of $191 billion. In October, Musk took over Twitter in a $44 billion dollar deal, which has drawn criticism from investors. Many say it’s a distraction from Musk’s work with Tesla.

While Tesla shares have rebounded—after falling roughly 70% in 2022—Musk’s wealth still sits about 13% lower than in March of last year.

Third on the list is Jeff Bezos, followed by Larry Ellison. The latter of the two, who founded Oracle, owns 98% of the Hawaiian island of Lanai which he bought in 2012 for $300 million.

Fifth on the list is Warren Buffett. In his annual letter to shareholders, he discussed how Berkshire Hathaway reported record operating profits despite economic headwinds. The company outperformed the S&P 500 Index by about 22% in 2022.

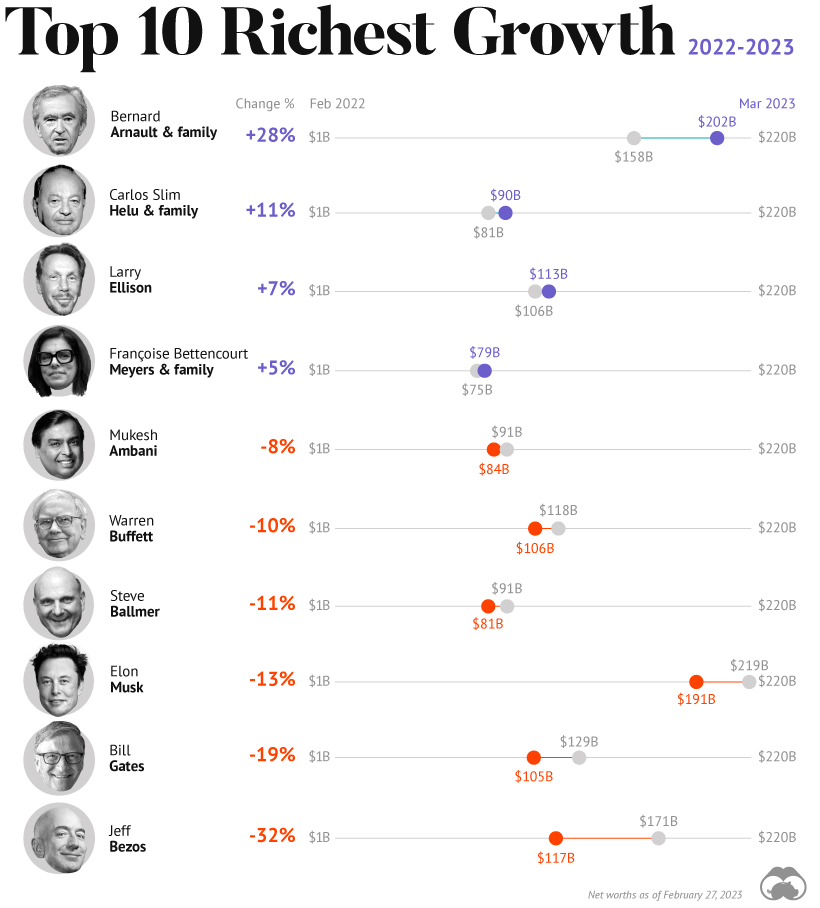

How Fortunes Have Changed

Given multiple economic crosscurrents, billionaire wealth has diverged over the last year. Since March 2022, just four of the top 10 richest in the world have seen their wealth increase. Two of these are European magnates, while Carlos Slim Helu runs the largest telecom firm in Latin America. In fact, a decade ago Slim was the richest person on the planet. Overall, as the tech sector saw dismal returns over the year, the top 10 tech billionaires lost almost $500 billion in combined wealth.

Recent Shakeups in Asia

Perhaps the most striking news for the world’s richest centers around Gautam Adani, formerly the richest person in Asia. In January, Hindenburg Research, a short-selling firm, released a report claiming that the Adani Group engaged in stock manipulation and fraud. Specifically, the alleged the firm used offshore accounts to launder money, artificially boost share prices, and hide losses. The Adani Group, which owns India’s largest ports—along with ports in Australia, Sri Lanka, and Israel—lost $100 billion in value in the span of a few weeks. Interestingly, very few Indian mutual funds hold significant shares in Adani Group, signaling a lack of confidence across India’s market, which was also cited in Hindenburg’s report. As a result, Mukesh Ambani has climbed to Asia’s top spot, controlling a $84 billion empire that spans from oil and gas and renewable energy to telecom. His conglomerate, Reliance Industries is the largest company by market cap in India.