The EV/EBIDTA ratio breaks down into two parts:

Enterprise Value (EV): Adding debt to market capitalization, while subtracting cash gives us the enterprise value. This gives us the total value of a company. EBITDA: Earnings before interest, tax, depreciation, and amortization or, EBITDA, provides a popular way to look at earnings. By removing these expenses, we obtain a clearer look at operating performance.

Overall, EV/EBITDA shows the relationship between a company’s total value and its earnings, and is often seen as the price-to-earnings ratio’s sophisticated sibling, used to view companies the way acquirers would. However, the EV component is not necessarily intuitive, so let’s expand a little on it:

Why is Debt Added Back to Enterprise Value?

To acquire a company completely, one must pay out all stakeholders in order to reach the final cost of the acquisition. This includes the stock (equity holders) and the debt holders, subsequently, adding back the market value debt to market cap does just this.

Why is Cash Subtracted from Enterprise Value?

Subtracting cash can also be seen as arriving at net debt. That is, the remaining debt after using the cash and equivalents on a company’s balance sheet to pay it down. In other words, if cash exceeds debt, enterprise value shrinks, and the cost of acquiring the company becomes cheaper. Whereas if debt exceeds cash, the acquirer would have to pay off more debt holders, thus making the acquisition more expensive.

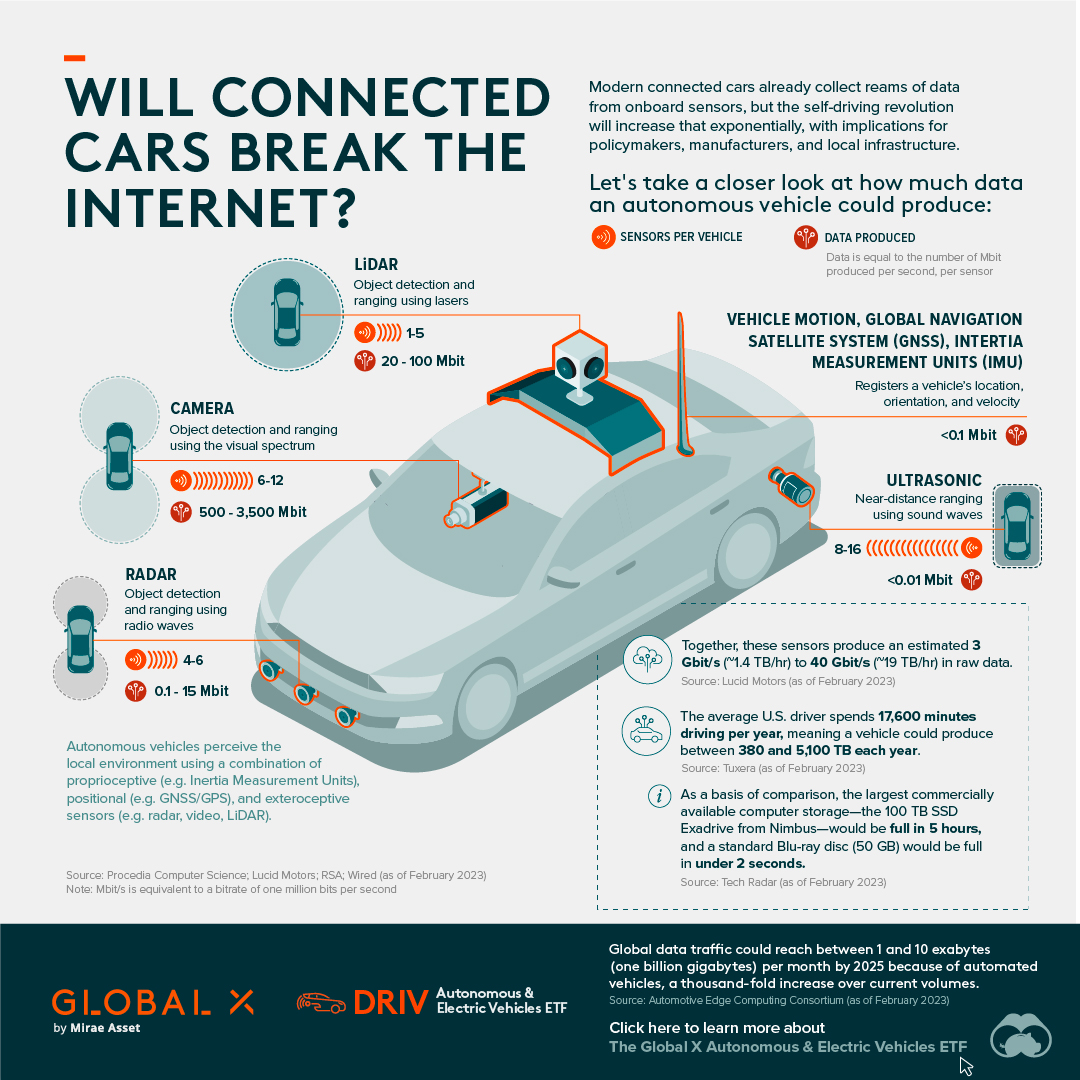

What’s Driving Higher Valuations in Private Equity?

1. The Link Between All Equities

First, the public markets are often used as a starting point to derive valuations for deals. Generally, companies with similar business models and operations should be assigned similar valuation multiples. For instance, Lowes and Home Depot, or alternatively, Pepsi and Coca-Cola. Therefore, a company under consideration in private equity often has peers trading publicly. Furthermore, the average multiple assigned to businesses in the stock market fluctuates through peaks and troughs. Today, they’re trading at a premium to historic averages, a result of a rallying prices and elevated investor risk appetite. Naturally, these public valuations spills over into the private equity space.

2. A World of Cheap Money

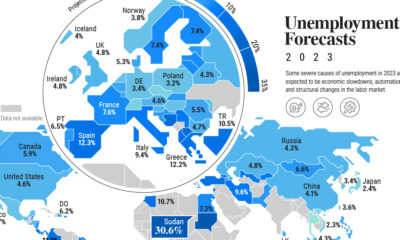

Second, asset markets move based on relativity and opportunity cost. A low interest rate environment pairing with the trillions in money printing is placing debt securities at unattractive levels. Hence, low rates of return on debt is resulting in money moving elsewhere. For private equity though, debt is considered fuel. And in this industry firms use high levels of leverage to acquire companies. For this reason, low rates and cheap debt are a private equity manager’s dream. But what’s true for one private equity firm can be true for all. Because access to cheap debt means more money chasing deals, and this heightened level of competition is reflecting in the higher multiples and expensive deals today. Source: PitchBook Notes: Data is as of November, 2020 on Today’s connected cars come stocked with as many as 200 onboard sensors, tracking everything from engine temperature to seatbelt status. And all those sensors create reams of data, which will increase exponentially as the autonomous driving revolution gathers pace. With carmakers planning on uploading 50-70% of that data, this has serious implications for policymakers, manufacturers, and local network infrastructure. In this visualization from our sponsor Global X ETFs, we ask the question: will connected cars break the internet?

Data is a Plural Noun

Just how much data could it possibly be? There are lots of estimates out there, from as much as 450 TB per day for robotaxis, to as little as 0.383 TB per hour for a minimally connected car. This visualization adds up the outputs from sensors found in a typical connected car of the future, with at least some self-driving capabilities. The focus is on the kinds of sensors that an automated vehicle might use, because these are the data hogs. Sensors like the one that turns on your check-oil-light probably doesn’t produce that much data. But a 4K camera at 30 frames a second, on the other hand, produces 5.4 TB per hour. All together, you could have somewhere between 1.4 TB and 19 TB per hour. Given that U.S. drivers spend 17,600 minutes driving per year, a vehicle could produce between 380 and 5,100 TB every year. To put that upper range into perspective, the largest commercially available computer storage—the 100 TB SSD Exadrive from Nimbus—would be full in 5 hours. A standard Blu-ray disc (50 GB) would be full in under 2 seconds.

Lag is a Drag

The problem is twofold. In the first place, the internet is better at downloading than uploading. And this makes sense when you think about it. How often are you uploading a video, versus downloading or streaming one? Average global mobile download speeds were 30.78 MB/s in July 2022, against 8.55 MB/s for uploads. Fixed broadband is much higher of course, but no one is suggesting that you connect really, really long network cables to moving vehicles.

Ultimately, there isn’t enough bandwidth to go around. Consider the types of data traffic that a connected car could produce:

Vehicle-to-vehicle (V2V) Vehicle-to-grid (V2G) Vehicles-to-people (V2P) Vehicles-to-infrastructure (V2I) Vehicles-to-everything (V2E)

The network just won’t be able to handle it.

Moreover, lag needs to be relatively non-existent for roads to be safe. If a traffic camera detects that another car has run a red light and is about to t-bone you, that message needs to get to you right now, not in a few seconds.

Full to the Gunwales

The second problem is storage. Just where is all this data supposed to go? In 2021, total global data storage capacity was 8 zettabytes (ZB) and is set to double to 16 ZB by 2025.

One study predicted that connected cars could be producing up to 10 exabytes per month, a thousand-fold increase over current data volumes.

At that rate, 8 ZB will be full in 2.2 years, which seems like a long time until you consider that we still need a place to put the rest of our data too.

At the Bleeding Edge

Fortunately, not all of that data needs to be uploaded. As already noted, automakers are only interested in uploading some of that. Also, privacy legislation in some jurisdictions may not allow highly personal data, like a car’s exact location, to be shared with manufacturers.

Uploading could also move to off-peak hours to even out demand on network infrastructure. Plug in your EV at the end of the day to charge, and upload data in the evening, when network traffic is down. This would be good for maintenance logs, but less useful for the kind of real-time data discussed above.

For that, Edge Computing could hold the answer. The Automotive Edge Computing Consortium has a plan for a next generation network based on distributed computing on localized networks. Storage and computing resources stay closer to the data source—the connected car—to improve response times and reduce bandwidth loads.

Invest in the Future of Road Transport

By 2030, 95% of new vehicles sold will be connected vehicles, up from 50% today, and companies are racing to meet the challenge, creating investing opportunities.

Learn more about the Global X Autonomous & Electric Vehicles ETF (DRIV). It provides exposure to companies involved in the development of autonomous vehicles, EVs, and EV components and materials.

And be sure to read about how experiential technologies like Edge Computing are driving change in road transport in Charting Disruption. This joint report by Global X ETFs and the Wall Street Journal is also available as a downloadable PDF.