While public urgency surrounding climate action has been growing, it can be difficult to comprehend the potential extent of economic disruption that environmental risks pose.

Front and Center

Today’s chart uses data from the World Economic Forum’s annual Global Risks Report, which surveyed 800 leaders from business, government, and non-profits to showcase the most prominent economic risks the world faces. According to the data in the report, here are the top five risks to the global economy, in terms of their likelihood and potential impact: With more emphasis being placed on environmental risks, how much do we need to worry? According to the World Economic Forum, more than we can imagine. The report asserts that, among many other things, natural disasters are becoming more intense and more frequent. While it can be difficult to extrapolate precisely how environmental risks could cascade into trouble for the global economy and financial system, here are some interesting examples of how they are already affecting institutional investors and the insurance industry.

The Stranded Assets Dilemma

If the world is to stick to its 2°C global warming threshold, as outlined in the Paris Agreement, a significant amount of oil, gas, and coal reserves would need to be left untouched. These assets would become “stranded”, forfeiting roughly $1-4 trillion from the world economy. Growing awareness of this risk has led to a change in sentiment. Many institutional investors have become wary of their portfolio exposures, and in some cases, have begun divesting from the sector entirely. – Institute for Energy Economics and Financial Analysis The last couple of years have been a game-changer for the industry’s future prospects. For example, 2018 was a milestone year in fossil fuel divestment:

Nearly 1,000 institutional investors representing $6.24 trillion in assets have pledged to divest from fossil fuels, up from just $52 billion four years ago; Ireland became the first country to commit to fossil fuel divestment. At the time of announcement, its sovereign development fund had $10.4 billion in assets; New York City became the largest (but not the first) city to commit to fossil fuel divestment. Its pension funds, totaling $189 billion at the time of announcement, aim to divest over a 5-year period.

A Tough Road Ahead

In a recent survey, actuaries ranked climate change as their top risk for 2019, ahead of damages from cyberattacks, financial instability, and terrorism—drawing strong parallels with the results of this year’s Global Risk Report. These growing concerns are well-founded. 2017 was the costliest year on record for natural disasters, with $344 billion in global economic losses. This daunting figure translated to a record year for insured losses, totalling $140 billion. Although insured losses over 2019 have fallen back in line with the average over the past 10 years, Munich RE believes that long-term environmental effects are already being felt:

Recent studies have shown that over the long term, the environmental conditions for bushfires in Australia have become more favorable; Despite a decrease in U.S. wildfire losses compared to previous years, there is a rising long-term trend for forest area burned in the U.S.; An increase in hailstorms, as a result of climate change, has been shown to contribute to growing losses across the globe.

The Ball Is In Our Court

It’s clear that the environmental issues we face are beginning to have a larger real impact. Despite growing awareness and preliminary actions such as fossil fuel divestment, the Global Risk Report stresses that there is much more work to be done to mitigate risks. How companies and governments choose to respond over the next decade will be a focal point of many discussions to come. on

#1: High Reliability

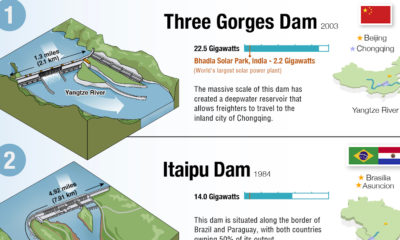

Nuclear power plants run 24/7 and are the most reliable source of sustainable energy. Nuclear electricity generation remains steady around the clock throughout the day, week, and year. Meanwhile, daily solar generation peaks in the afternoon when electricity demand is usually lower, and wind generation depends on wind speeds.As the use of variable solar and wind power increases globally, nuclear offers a stable and reliable backbone for a clean electricity grid.

#2: Clean Electricity

Nuclear reactors use fission to generate electricity without any greenhouse gas (GHG) emissions.Consequently, nuclear power is the cleanest energy source on a lifecycle basis, measured in CO2-equivalent emissions per gigawatt-hour (GWh) of electricity produced by a power plant over its lifetime. The lifecycle emissions from a typical nuclear power plant are 273 times lower than coal and 163 times lower than natural gas. Furthermore, nuclear is relatively less resource-intensive, allowing for lower supply chain emissions than wind and solar plants.

#3: Stable Affordability

Although nuclear plants can be expensive to build, they are cost-competitive in the long run. Most nuclear plants have an initial lifetime of around 40 years, after which they can continue operating with approved lifetime extensions. Nuclear plants with lifetime extensions are the cheapest sources of electricity in the United States, and 88 of the country’s 92 reactors have received approvals for 20-year extensions. Additionally, according to the World Nuclear Association, nuclear plants are relatively less susceptible to fuel price volatility than natural gas plants, allowing for stable costs of electricity generation.

#4: Energy Efficiency

Nuclear’s high energy return on investment (EROI) exemplifies its exceptional efficiency. EROI measures how many units of energy are returned for every unit invested in building and running a power plant, over its lifetime. According to a 2018 study by Weissbach et al., nuclear’s EROI is 75 units, making it the most efficient energy source by some distance, with hydropower ranking second at 35 units.

#5: Sustainable Innovation

New, advanced reactor designs are bypassing many of the difficulties faced by traditional nuclear plants, making nuclear power more accessible.

Small Modular Reactors (SMRs) are much smaller than conventional reactors and are modular—meaning that their components can be transported and assembled in different locations. Microreactors are smaller than SMRs and are designed to provide electricity in remote and small market areas. They can also serve as backup power sources during emergencies.

These reactor designs offer several advantages, including lower initial capital costs, portability, and increased scalability.

A Nuclear-Powered Future

Nuclear power is making a remarkable comeback as countries work to achieve climate goals and ultimately, a state of energy utopia. Besides the 423 reactors in operation worldwide, another 56 reactors are under construction, and at least 69 more are planned for construction. Some nations, like Japan, have also reversed their attitudes toward nuclear power, embracing it as a clean and reliable energy source for the future. CanAlaska is a leading exploration company in the Athabasca Basin, the Earth’s richest uranium depository. Click here to learn more now. In part 3 of the Road to Energy Utopia series, we explore the unique properties of uranium, the fuel that powers nuclear reactors.