The situation for the remaining 71% is uncertain, to say the least. A significant portion of the population has lost their jobs due to business shutdowns and mandated lockdown orders. Others employed in “essential services” have continued working as usual, but may face a higher risk of potential exposure to the virus. To that end, today’s infographic leverages data from the Occupational Information Network to determine which occupations face the highest risk of exposure to COVID-19.

Methodology and Results

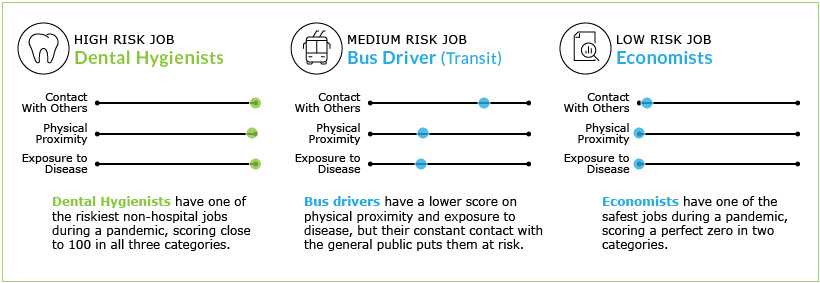

Our score for each occupation is based on evaluating the data on three physical job attributes covered in the occupational database:

We assigned each attribute an equal weight, then aggregated them to arrive at a final COVID-19 Risk Score between 0 and 100, with 100 representing the highest possible risk. Jobs with a risk score below 0.5 were excluded from further analysis. To narrow down the list, we removed most occupations held by fewer than 20,000 people. From the remaining pool, we selected 100 well-known occupations, and included the average annual income and number of workers associated with each based on BLS data. While some of these findings may be obvious—nurses and paramedics have a higher chance of exposure to the virus than lawyers and web developers, for example—these datasets allow us to assign a more quantitative figure to each occupation’s level of risk.

Recognizing Those On the Front Lines

Through the #LightItBlue campaign, communities are recognizing the brave efforts of healthcare workers as they fight the virus firsthand. However, with fewer than a third of Americans being able to work from home, many others are also working on the front lines, and thus deserve our recognition. Two of these occupations are bus drivers (678,260 employed) and cashiers (3,635,559 employed), both of which require workers to be in close physical proximity with others. The services these individuals help to provide are essential, and despite the risks, many have been working throughout the entire pandemic. —John T. Niccollai, President, UFCW Local 464A Data has also shown that working from home is largely reserved for America’s higher earners. Source: Bureau of Labor Statistics At a time when many Americans worry about paying their bills, the effects of this inequality can be particularly harsh on those near the bottom of the income spectrum. If unable to work from home, these individuals will likely face increased health risks on top of their existing financial difficulties.

Looking Out For One Another

The COVID-19 pandemic has impacted everyone differently, especially in terms of the occupational risks faced day-to-day. Individuals on the front lines, whether they’re taking care of patients or stocking grocery shelves, are placing themselves at risk to ensure our communities can continue to run smoothly. Meanwhile, those fortunate enough to work from home can help flatten the curve by continuing to practice safe social distancing, even on weekends.

The Full List

For reference, we’ve also provided the full list of nearly 1,000 occupations, including jobs with fewer than 20,000 workers. The average risk score of the following 966 jobs is 30.2. on Both figures surpassed analyst expectations by a wide margin, and in January, the unemployment rate hit a 53-year low of 3.4%. With the recent release of February’s numbers, unemployment is now reported at a slightly higher 3.6%. A low unemployment rate is a classic sign of a strong economy. However, as this visualization shows, unemployment often reaches a cyclical low point right before a recession materializes.

Reasons for the Trend

In an interview regarding the January jobs data, U.S. Treasury Secretary Janet Yellen made a bold statement: While there’s nothing wrong with this assessment, the trend we’ve highlighted suggests that Yellen may need to backtrack in the near future. So why do recessions tend to begin after unemployment bottoms out?

The Economic Cycle

The economic cycle refers to the economy’s natural tendency to fluctuate between periods of growth and recession. This can be thought of similarly to the four seasons in a year. An economy expands (spring), reaches a peak (summer), begins to contract (fall), then hits a trough (winter). With this in mind, it’s reasonable to assume that a cyclical low in the unemployment rate (peak employment) is simply a sign that the economy has reached a high point.

Monetary Policy

During periods of low unemployment, employers may have a harder time finding workers. This forces them to offer higher wages, which can contribute to inflation. For context, consider the labor shortage that emerged following the COVID-19 pandemic. We can see that U.S. wage growth (represented by a three-month moving average) has climbed substantially, and has held above 6% since March 2022. The Federal Reserve, whose mandate is to ensure price stability, will take measures to prevent inflation from climbing too far. In practice, this involves raising interest rates, which makes borrowing more expensive and dampens economic activity. Companies are less likely to expand, reducing investment and cutting jobs. Consumers, on the other hand, reduce the amount of large purchases they make. Because of these reactions, some believe that aggressive rate hikes by the Fed can either cause a recession, or make them worse. This is supported by recent research, which found that since 1950, central banks have been unable to slow inflation without a recession occurring shortly after.

Politicians Clash With Economists

The Fed has raised interest rates at an unprecedented pace since March 2022 to combat high inflation. More recently, Fed Chairman Jerome Powell warned that interest rates could be raised even higher than originally expected if inflation continues above target. Senator Elizabeth Warren expressed concern that this would cost Americans their jobs, and ultimately, cause a recession. Powell remains committed to bringing down inflation, but with the recent failures of Silicon Valley Bank and Signature Bank, some analysts believe there could be a pause coming in interest rate hikes. Editor’s note: just after publication of this article, it was confirmed that U.S. interest rates were hiked by 25 basis points (bps) by the Federal Reserve.