Banking is no different. After a decade of expansion, the industry is showing many signs of a late-cycle economy. On top of this, a staggering 60% of banks are destroying value. Today’s infographic from McKinsey & Company explores the steps banks can immediately take to succeed in the next economic cycle.

How is Value Created?

In the banking sector, three main factors contribute to value creation:

The location of the bank The scale of its operations The effectiveness of its business model

Given that geographic reach is mostly out of a bank’s control, and scale takes time to build, banks must focus on their business model. There are three universal business model levers that all banks can immediately act on to change their destiny.

- Risk Management Banks can protect returns in an economic downturn by managing risk. For example, new machine-learning models can predict the riskiest customers with 35 percentage points more accuracy than traditional models.

- Productivity To radically reduce costs, banks can transfer non-differentiating activities to third-party “utilities”, through outsourcing, carve-outs, or partnerships. This has the potential to increase return on equity by as much as 100 basis points.

- Revenue Growth When customers are satisfied, they generate more value for banks—and vice versa. For instance, customers who report low satisfaction with their mortgage experience are almost seven times more likely to refinance with a different bank. By materially improving decisive points in the customer experience, banks can increase revenue and reduce churn rates within 12-18 months.

The Four Banking Archetypes

Beyond these universal performance levers, a bank should prioritize late-cycle economic decisions based on the archetype it falls under.

Market leaders are top-performing financial institutions in attractive markets Resilients are top-performing operators despite challenging market conditions Followers are mid-tier organizations generating returns due to favourable market conditions Challenged banks are poor performers in unattractive markets

Different archetypal levers are available depending on each bank’s unique circumstances. Here’s how banks across the various archetypes can take action: For example, while market leaders’ large capital base is best used for ecosystem and innovation plays, challenged banks need to radically rethink their business model or merge with similar banks.

Reinvent, Scale, or Perish

As the late-cycle economy slows even further, no banks can afford complacency. In fact, history has shown that 35% of market leaders drop to the bottom half of peers in the next cycle. Now is the time for banks to take bold action through universal and archetypal levers—or risk being left behind. For a more detailed breakdown of the actions that banks can take in this market environment, check out the full report by McKinsey & Company. on Last year, stock and bond returns tumbled after the Federal Reserve hiked interest rates at the fastest speed in 40 years. It was the first time in decades that both asset classes posted negative annual investment returns in tandem. Over four decades, this has happened 2.4% of the time across any 12-month rolling period. To look at how various stock and bond asset allocations have performed over history—and their broader correlations—the above graphic charts their best, worst, and average returns, using data from Vanguard.

How Has Asset Allocation Impacted Returns?

Based on data between 1926 and 2019, the table below looks at the spectrum of market returns of different asset allocations:

We can see that a portfolio made entirely of stocks returned 10.3% on average, the highest across all asset allocations. Of course, this came with wider return variance, hitting an annual low of -43% and a high of 54%.

A traditional 60/40 portfolio—which has lost its luster in recent years as low interest rates have led to lower bond returns—saw an average historical return of 8.8%. As interest rates have climbed in recent years, this may widen its appeal once again as bond returns may rise.

Meanwhile, a 100% bond portfolio averaged 5.3% in annual returns over the period. Bonds typically serve as a hedge against portfolio losses thanks to their typically negative historical correlation to stocks.

A Closer Look at Historical Correlations

To understand how 2022 was an outlier in terms of asset correlations we can look at the graphic below:

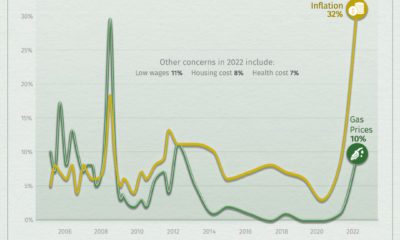

The last time stocks and bonds moved together in a negative direction was in 1969. At the time, inflation was accelerating and the Fed was hiking interest rates to cool rising costs. In fact, historically, when inflation surges, stocks and bonds have often moved in similar directions. Underscoring this divergence is real interest rate volatility. When real interest rates are a driving force in the market, as we have seen in the last year, it hurts both stock and bond returns. This is because higher interest rates can reduce the future cash flows of these investments. Adding another layer is the level of risk appetite among investors. When the economic outlook is uncertain and interest rate volatility is high, investors are more likely to take risk off their portfolios and demand higher returns for taking on higher risk. This can push down equity and bond prices. On the other hand, if the economic outlook is positive, investors may be willing to take on more risk, in turn potentially boosting equity prices.

Current Investment Returns in Context

Today, financial markets are seeing sharp swings as the ripple effects of higher interest rates are sinking in. For investors, historical data provides insight on long-term asset allocation trends. Over the last century, cycles of high interest rates have come and gone. Both equity and bond investment returns have been resilient for investors who stay the course.